Toll Brothers Inc., Horsham, Pa. (NYSE:TOL) early Tuesday reported net income of $148.6 million, or $0.87 per share diluted, for its fiscal third quarter ended July 31. The gain compared to net income of $105.5 million, or $0.61 per share diluted, in FY 2016’s third quarter. Wall Street was expecting a gain of $0.69 per share.

Third-quarter results included inventory write-downs of $2.4 million, compared to $3.7 million in FY 2016’s third quarter. The third-quarter tax expense was positively affected by a net $27.9 million benefit associated primarily with the reversal of a state deferred tax asset valuation allowance.

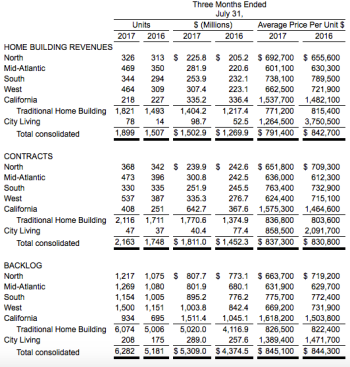

Revenues of $1.50 billion and home building deliveries of 1,899 units increased 18% in dollars and 26% in units, compared to FY 2016’s third quarter. The average price of homes delivered was $791,400, compared to $842,700 one year ago. The drop in average price was due to a change in mix, as was expected.

Net signed contracts of $1.81 billion and 2,163 units rose 25% in dollars and 24% in units, compared to FY 2016’s third quarter. The average price of net signed contracts was $837,300, compared to $830,800 one year ago. On a per-community basis, FY 2017’s third-quarter net signed contracts were 6.89 units per community, compared to a third-quarter total of 5.85 in FY 2016.

Backlog of $5.31 billion and 6,282 units rose 21% in dollars and units, compared to FY 2016’s third-quarter-end backlog. The average price of homes in backlog was $845,100, compared to $844,300 one year ago.

Gross margin was 21.7% of revenues in FY 2017’s third quarter, compared to 21.9% in FY 2016’s third quarter. Adjusted gross margin, which excludes interest and inventory write-downs (“Adjusted Gross Margin”), was 25.0% of revenues, compared to 25.3% in FY 2016’s third quarter.

SG&A, as a percentage of revenues, was 10.3% in FY 2017’s third quarter, compared to 10.6% in FY 2016’s third quarter.

Other income and Income from unconsolidated entities totaled $31.9 million, compared to $20.1 million one year ago.

The company ended its third quarter with 312 selling communities, compared to 316 at FY 2017’s second-quarter end and 297 at FY 2016’s third-quarter end.

Toll estimates it will deliver between 7,000 and 7,300 homes in fiscal 2017, compared to previous guidance of 6,950 to 7,450 units, at an average delivered price for FY 2017’s full year of between $800,000 and $825,000 per home. This translates to projected revenues of between $5.6 billion and $6.0 billion in FY 2017, compared to $5.17 billion in FY 2016. The fourth-quarter delivery projections reflect approximately 150 homes that were to be delivered in fiscal 2017 but will instead be delivered in fiscal 2018 due to the floor joist recall by a major lumber manufacturer.

Said Douglas C. Yearley, Jr., Toll CEO, “The unemployment rate is at a 15-year low, the economy is growing, the stock market is strong, and home prices continue to rise, putting equity in the pockets of those who may want to sell their existing home and move to a new one. New home prices are significantly outpacing existing home prices. Many buyers want new and they want it their way: That’s exactly what we provide. This bodes well for Toll Brothers over the coming years.”

Robert I. Toll, executive chairman, stated: “We believe our industry has room to run. Single-family housing starts, at 811,000, are still well below the 50-year industry average of 1.02 million units. The home ownership rate is on the rise but also still below historic norms. Interest rates remain low, unemployment is low, and more and more buyers are entering the upscale market. Based on these trends, we believe Toll Brothers is well positioned for future growth.”