KB Home, Los Angeles (NYSE:KBH) after market close Thursday reported net income of $50.2 million, or $.51 per diluted share, for fiscal third quarter ended August 31. It marked a 28% increase in net from the same period last year and beat analyst estimates of a profit of $0.46 per share.

The company reported:

- Total revenues grew 25% to $1.14 billion.

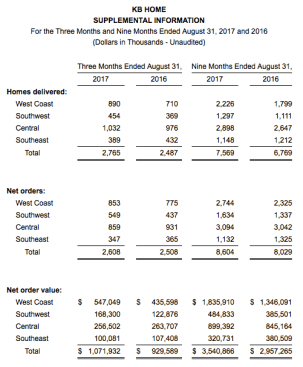

- Deliveries rose 11% to 2,765 homes.

- Average selling price increased 12% to $411,400.

- Home building operating income rose 49% to $76.7 million. This included inventory-related charges of $8.1 million, compared to $3.1 million.

- Home building operating income margin increased 100 basis points to 6.7%. Excluding inventory-related charges, the improvement was 140 basis points to 7.4%.

- Housing gross profits increased 23% to $184.0 million, and the related margin was 16.2%.

- Housing gross profit margin excluding inventory-related charges rose 10 basis points to 16.9%.

- Adjusted housing gross profit margin, a metric that excludes the amortization of previously capitalized interest and inventory-related charges, increased 50 basis points to 21.7%.

- Selling, general and administrative expenses improved 120 basis points to 9.6% of housing revenues, a third-quarter record for the company.

- Net order value grew 15% to $1.07 billion on a 4% increase in net orders to 2,608, with double-digit growth in the Company’s West Coast and Southwest regions.

- Company-wide, net orders per community averaged 3.7 per month.

- Ending backlog value grew 14% to $2.12 billion, with homes in backlog up 4% to 5,455 and the average selling price of those homes rising 10%.

- The cancellation rate as a percentage of gross orders improved to 25% from 29%.

- Average community count for the quarter was essentially flat at 234. Ending community count was up 2% to 231.

- The company had total liquidity of $961.0 million, including cash and cash equivalents of $494.1 million and availability under its unsecured revolving credit facility.

- On July 27, 2017, the company entered into an amended and restated revolving loan agreement with a syndicate of financial institutions that increased the commitment under its unsecured revolving credit facility from $275.0 million to $500.0 million and extended the maturity from August 7, 2019 to July 27, 2021.

- There were no cash borrowings outstanding under the company’s unsecured revolving credit facility.

- Inventories increased to $3.51 billion, with investments in land acquisition and development totaling $1.12 billion for the first nine months of 2017.

- Lots owned or controlled aggregated to 45,624, with 78% owned.

- Notes payable decreased to $2.50 billion from $2.64 billion, primarily due to the early redemption of $100.0 million of senior notes in the 2017 first quarter using internally generated cash.

- Subsequent to the end of the third quarter, the company repaid the remaining $165.0 million in aggregate principal amount of its 9.10% Senior Notes due 2017 at their maturity on September 15 using internally generated cash.

- The ratio of debt to capital improved to 57.6%, and the ratio of net debt to capital improved to 52.2%.

Financial services pretax income rose to $3.0 million, up from $2.4 million, mainly due to income from KBHS Home Loans, LLC, the Company’s recently formed mortgage banking joint venture that is operating in all of the company’s served markets as of June.

“We continued to make considerable progress on our three-year returns-focused growth plan with outstanding results in our 2017 third quarter,” said Jeffrey Mezger, chairman, president and CEO. “We posted double-digit increases in revenues and earnings, and generated measurable improvement across our key financial metrics. Significantly, we increased our housing gross profit margin on a year-over-year basis, excluding inventory-related charges, and we expect to sustain this favorable comparison on a quarterly basis going into 2018. In addition, with the expansion in our gross margin and a record-low third quarter SG&A ratio, we improved our operating income margin by 100 basis points, extending the upward trend in this important profitability measure.”