The squeeze on smaller builders these days comes in many forms, from all directions.

They may have two advantages in a business environment that tilts in favor of bigger, more financially powerful, higher volume home builders: more loyal associates and a better relationship with their customers.

If that’s the case, small subdivision and custom builders are going to need to make that competitive edge mean more and more in the days ahead.

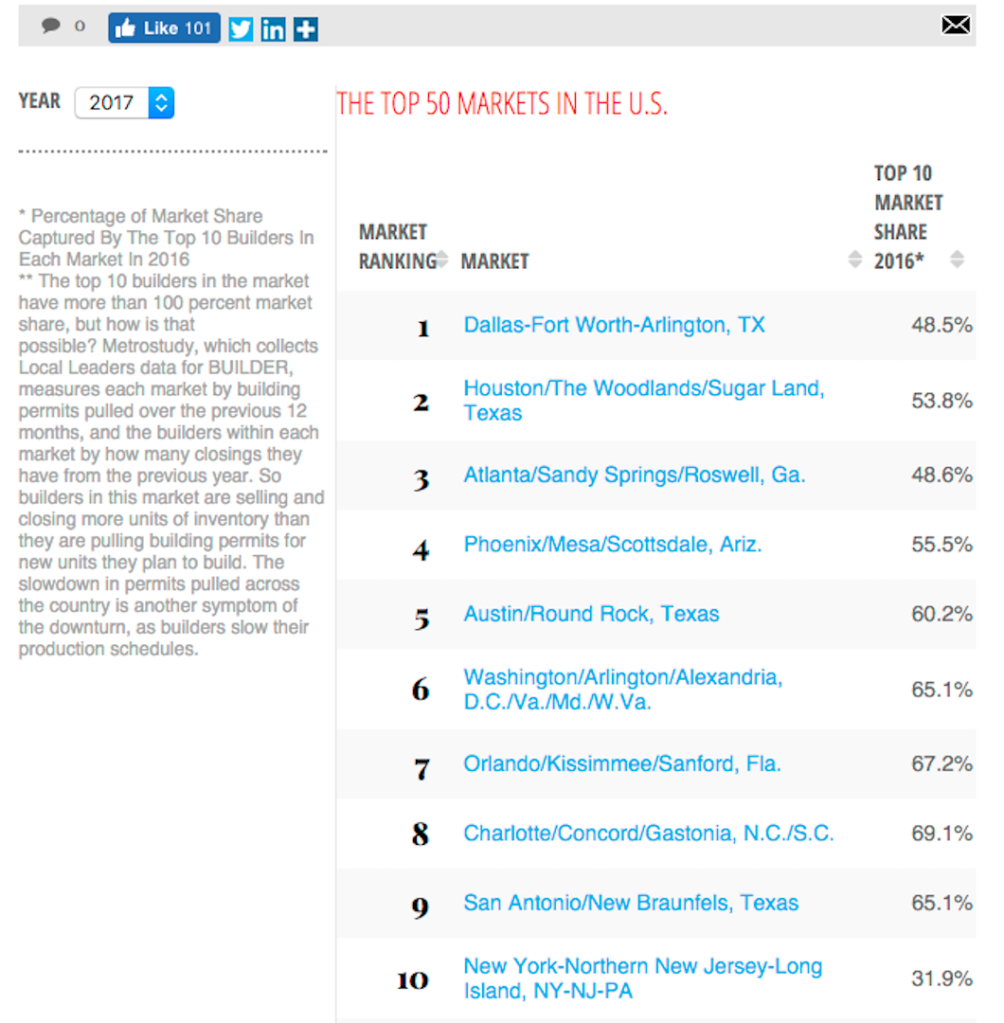

This analysis of BUILDER/Metrostudy Local Leaders data by National Association of Home Builders economist Paul Emrath paints a picture of the growing clout of national and large regional builders. They’ve risen from about 30% market share across a set of 36 highly active home building metro areas to just under 40% in the past 8 years coming out of The Great Recession.

Emrath notes that the dynamic of greater concentration differs in individual markets, but that directionally the trend is that the largest builders are taking market share away from smaller ones. Looking at the latest year’s data, 2016, he writes:

The average market share for builders with 500+ closings increased only slightly from 47.9 to 48.0 percent. The average share for builders with 1,000+ closings increased from 42.6 to 42.9 percent. The average share for national builders (with 3,000+ closings) posted the largest gain, going from 36.3 to 37.2 percent.

The explanation for this one might simplify and say that the bigger the builder, the more capital they have to draw on, therefore it’s understandable how and why they’re taking marketshare out of the hides of smaller, less well-heeled players.

However, the real reasons go deeper, and they tie all four of builders pain points together, not just the access to lending for land acquisition and development, but to the lots themselves, the availability of labor, and the critical role local government land-use approval processes play as a business factor.

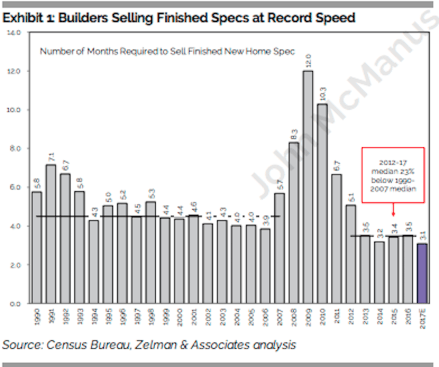

For instance, look here at data the Zelman & Associates team analyzed in the latest issue of its twice-monthly The Z Report (click here for a a free trial), in a piece entitled “If You (Can) Build It, They Will Come: Updated Single-Family Starts Forecasts.”

The broad premise of the Zelman team’s analysis is that disruption in materially significant markets in Florida and Texas due to Hurricanes Harvey and Irma will impact 2017 starts and deliveries. At the same time, the dislocation is geography. In other words, what won’t get to happen in 2017 will both push supply into 2018, and pull demand into 2018, making next year a potential break-out period in the recovery.

One of the underlying observations here stands out in our minds as a critical competitive separator of big, high-volume builders from the rest, especially as regards access to both labor and lots in the months ahead. Zelman’s team notes:

“[…] new construction homes that have been built on a speculative basis are selling at the fastest pace in over 40 years of data. Specifically, thus far in 2017, 32% of new home sales have been contracted before the builder broke ground, 35% were started without a buyer in hand but sold before the home was completed and the remaining 33% were sold after construction was finished. These completed specs were sold in 3.3 months, 12% faster than the prior-year period. If that pace held through year end, it would result in a new record speed at just 3.1 months. (Exhibit 1).

Fact is, specs not only sell and deliver faster, specs are also one of the most important baseline values builders can provide for their trade partners in an effort to become “builder of choice” among those skilled trades.

Evenflow spec programs, with the same number of starts and completions every four to six weeks, allow contractors visibility and a smoothed operational model for their workflows, their cashflow, their resource allocations, and their opportunities for growth, etc.

When builders can cadence their starts across time and guarantee that numbers won’t fluctuate sporadically, trade partners see that as a plus.

The point is, smaller builders don’t have that luxury. The way they take down lots, and subdivisions, it’s a much closer time horizon thanks to the way their financing and operations models work. What’s more, a local municipality’s planning, zoning approvals and permitting process can also impact–to a much more profound, and viability-shaking degree–a smaller builder’s ability to provide that forward visibility and consistency that local skilled labor crews regard as a must.

“We might want to give our trades a look at what’s out ahead across the months, but if we’re waiting for local approvals to come through to zone and entitle our next tract, we can’t do provide that forward look at the business,” the director of operations for a regional home building company tells me.

That relationship between local regulatory delays and securing consistent access to labor is a point that often gets lost in the mix of pain points builders struggle with these days. The way that relationship weighs more heavily on smaller, less well-capitalized, more project-to-project oriented builders, is another strengthening force favoring consolidation among fewer, larger, more concentrated builders as we go forward.