TRI Pointe Group, Inc., Irvine (NYSE:TPH) early Wednesday reported a profit of $72.3 million, or $0.48 per diluted share, for the third quarter ended Sept. 30, up from $34.8 million, or $0.22 per diluted share, for the third quarter of 2016. Analysts were expecting a gain of $0.45 per share.

The increase in net income available to common stockholders was primarily due to an increase in land and lot sales gross margin of $55.4 million due primarily to the sale of a parcel consisting of 69 home building lots located in the Pacific Highlands Ranch community in San Diego, California.

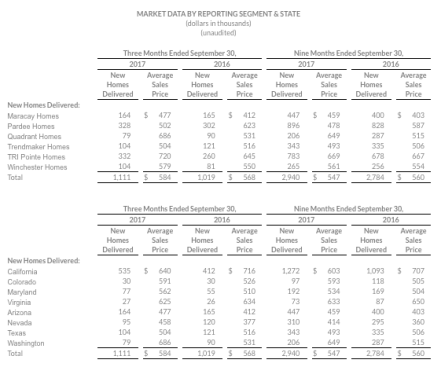

Home sales revenue increased $70.0 million, or 12%, to $648.6 million for quarter, as compared to $578.7 million for the third quarter of 2016. The increase was primarily attributable to a 9% increase in new home deliveries to 1,111, and a 3% increase in the average sales price of homes delivered to $584,000, compared to $568,000 in the third quarter of 2016.

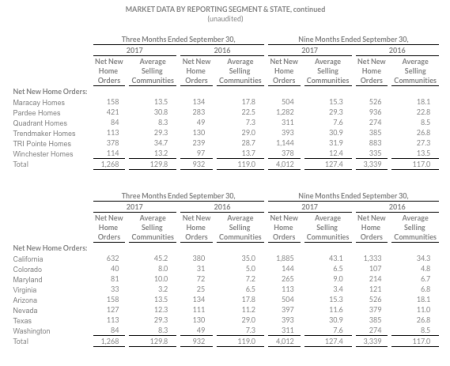

New home orders increased 36% to 1,268 homes for the third quarter of 2017, as compared to 932 homes for the same period in 2016. Average selling communities increased 9% to 129.8 for the third quarter of 2017 compared to 119.0 for the third quarter of 2016. The company’s overall absorption rate per average selling community increased 27% for the third quarter of 2017 to 9.8 orders (3.3 monthly) compared to 7.8 orders (2.6 monthly) during the third quarter of 2016. The cancellation rate fell to 15% from 17% in the prior-year quarter.

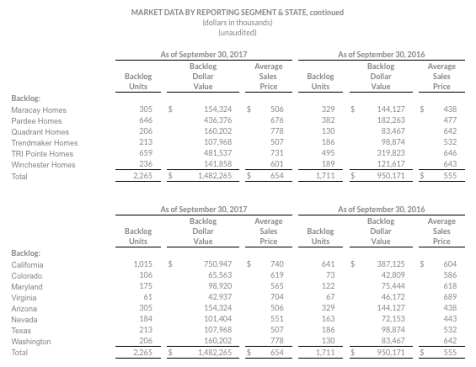

TriPointe ended the quarter with 2,265 homes in backlog, representing approximately $1.5 billion in value. The average sales price of homes in backlog as of September 30, 2017 increased $99,000, or 18%, to $654,000, compared to $555,000 as of September 30, 2016.

Home building gross margin percentage for the third quarter of 2017 decreased to 19.5%, compared to 20.1% for the third quarter of 2016. Excluding interest and impairments and lot option abandonments in cost of home sales, adjusted home building gross margin percentage was 22.0%* for the third quarter of 2017, compared to 22.7%* for the third quarter of 2016. The decrease in home building gross margin percentage was largely due to the mix of homes delivered and increased labor and material cost.

Selling, general and administrative (“SG&A”) expense for the third quarter of 2017 decreased to 10.2% of home sales revenue as compared to 10.9% for the third quarter of 2016 primarily due to increased leverage as a result of a 12% increase in home sales revenue.

“We believe this order growth is a strong indicator of the strength in the housing market and the quality of our home offerings, said TRI Pointe Group Chief Executive Officer Doug Bauer. “The positive trends we saw for the quarter were broad-based, with our operations in California continuing to produce excellent results and operations in our other markets making improvements with respect to order growth and/or profitability. These trends, coupled with the significant increase to our quarter-ending backlog, put us in a great position to end the year on a high note and carry that momentum into 2018.”

“Our home building teams did an excellent job of executing this quarter, as we once again met or exceeded our quarterly guidance for deliveries, average sales prices and home building gross margin,” said TRI Pointe Group President and Chief Operating Officer Tom Mitchell. “In addition, we continue to be encouraged by the quality of our land pipeline and the improvement in both our operations and product. I would especially like to thank and applaud our team in Houston for displaying such dedication, perseverance and compassion for the community in the wake of Hurricane Harvey and its aftermath. Our team members really came together to help one another and to make sure our communities were safe and back open for business.”

The company said it expects to open 14 new communities in the fourth quarter, and close out of 10, resulting in 131 active selling communities as of December 31, 2017. In addition, the Company anticipates delivering approximately 75% to 80% of its 2,265 units in backlog as of September 30, 2017 at an average sales price of $630,000 to $640,000. It expects home building gross margin percentage to be in a range of 21.0% to 22.0% for the fourth quarter resulting in a range of 20.0% to 21.0% for the full year. SG&A expense as a percentage of home sales revenue is projected to be in the range of 7.6% to 7.8% for the fourth quarter and 10.2% to 10.4% for the full year.