M/I Homes, Inc., Columbus (NYSE:MHO) on Wednesday reported net income of $22.3 million, or $0.64 per diluted share for the third quarter ended Sept. 30, up from $10.9 million, or $0.35 per diluted share, for the third quarter of 2016. Analysts, however, were looking for a gain of $0.75 per share.

The current quarter diluted earnings per share was reduced by a $2.3 million after-tax fair value equity adjustment ($0.07 per diluted share) related to the previously announced redemption of outstanding preferred shares, which was completed on October 16, 2017. The third quarter of 2016 included a $14.5 million pre-tax charge ($0.30 per diluted share) for stucco-related repair costs in certain of our Florida communities.

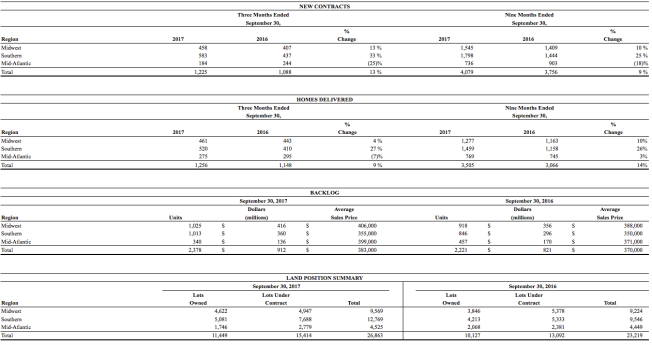

Homes delivered in 2017’s third quarter were 1,256 compared to 1,148 deliveries in 2016’s third quarter, a 9% increase. New contracts for 2017’s third quarter were 1,225, an increase of 13% over 2016’s third quarter. M/I Homes had 179 active communities at September 30, 2017 compared to 174 at September 30, 2016, a 3% increase. The company’s cancellation rate was 15% in the third quarter of 2017 and 2016. Homes in backlog increased 7% at September 30, 2017 to 2,378 units, with a sales value of $912 million (an 11% increase over last year’s third quarter), and an average sales price of $383,000. At September 30, 2016, the sales value of homes in backlog was $821 million, with an average sales price of $370,000 and backlog units of 2,221.

Robert H. Schottenstein, CEO and president, commented, “We are very pleased with our third quarter results highlighted by record revenue, record new contracts and record homes delivered. We reached our highest third quarter backlog level in more than 10 years, with a sales value of $912 million – an 11% increase over 2016’s third quarter. Gross margins improved 30 basis points to 21.4% and net income improved 12% over 2016’s third quarter, excluding the impact of 2016’s stucco-related charges. We achieved this strong performance despite the impact of hurricanes in our Florida and Houston markets, which delayed approximately 20 third quarter deliveries, slowed down sales and resulted in approximately $700,000 of community and model home repair costs.”

Schottenstein continued, “Our financial condition remains strong. During the quarter, we issued $250 million of 8-year senior notes, converted $58 million of our convertible notes into equity and completed the redemption of $50 million of our preferred shares in October. These steps both strengthened and simplified our balance sheet. We ended the quarter with $104 million of cash, no outstanding borrowings under our $475 million unsecured credit facility, shareholders’ equity of $723 million and a healthy home building debt to capital ratio of 47%. As we begin the final quarter of 2017, we are well positioned for another solid year. We have a strong backlog and housing market conditions remain favorable throughout most of our markets. We will continue to focus on increasing profitability while growing our market share and investing in well-located attractive land opportunities.”