Beazer Homes USA, Atlanta (NYSE:BZH) late Tuesday reported a net profit of $33.7 million, or $1.03 per diluted share, for its fiscal fourth quarter ended Sept. 30. The gain compares to a loss of $0.9 million in the 2016 quarter, Analysts were looking for a gain of $0.54. Shares were up more than 3% in after market trading Tuesday.

For the full fiscal year, net profit was $31.8 million.

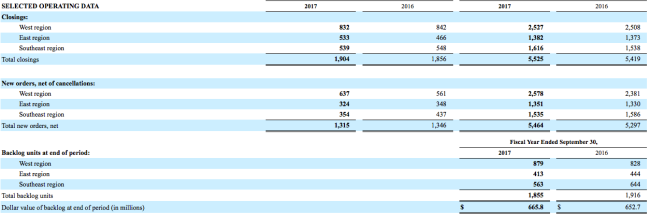

Home building revenue for the fourth quarter increased 7.3% over the prior year to $665.5 million, as the average selling price rose 4.6% to $349.500. Despite temporary delays caused by the recent storms, fourth quarter closings of 1,904 homes were 2.6% above the level achieved in the same period last year.

Net new orders for the fourth quarter decreased 2.3% versus the prior year. This slight decline was anticipated, as several markets were negatively impacted by Hurricanes Harvey and Irma during the closing weeks of the fiscal year. Even with the impact from these storms, the Company generated an absorption rate of 2.85 sales per community per month, up 2.8% from the previous year. This partially offset a 4.9% year over year decline in the average community count to 154 communities. The cancellation rate was 20.6%, relatively flat compared to the fourth quarter of last year and in line with historical levels.

The dollar value of homes in backlog as of September 30, 2017 increased 2.0% to $665.8 million, or 1,855 homes, which compared to $652.7 million, or 1,916 homes, for the same period last year. The decrease in backlog units was more than offset by a 5.4% increase in the average selling price of homes in backlog to $358.9 thousand.

Home building gross margin for the fourth quarter was 17.0%. Excluding impairments, abandonments and amortized interest, home building gross margin was 22.0%, up 120 basis points versus the prior year. The fourth quarter gross margin benefited from a number of one-time items, which added approximately 70 basis points to our overall margin improvement.

Selling, general and administrative expenses, as a percentage of total revenue, were 10.5%, down 10 basis points versus the prior year. The improvement in operating leverage was attributable to both the strong top line growth achieved and a continued focus on overhead cost management. For the full year, SG&A as a percentage of total revenue was 12.2%. This excludes a $2.7 million charge related to the write-off of a legacy investment in the first quarter. Including this charge, SG&A as a percentage of total revenue would have been 12.4%.

The company ended the quarter with approximately $437.4 million of available liquidity, including $292.1 million of unrestricted cash and $145.3 million available on its secured revolving credit facility. Subsequent to its fiscal year-end, the company announced it had increased the capacity of its secured revolving credit facility to $200 million from $180 million and extended the maturity by one year to February 2020.

On September 25, 2017, the Company announced it would issue $400 million of 5.875% unsecured Senior Notes due 2027. The transaction closed in early October and the proceeds, combined with cash on the balance sheet, were used to retire $225 million of its 5.750% Senior Notes due 2019 and $175 million of its 7.250% Senior Notes due 2023 in a leverage-neutral refinancing transaction.

“Our fourth quarter results contributed to an exceptionally productive year for the Company,” said Allan Merrill, president and CEO of Beazer Homes. “We generated improvements in virtually every operational metric – including ASP, sales pace, gross margin and overhead leverage – which led to substantially higher profitability, and we launched our Gatherings business in multiple markets. We also increased our balance sheet flexibility and reduced cash interest expense – highlighted by a major capital markets transaction that was announced in the last week of the fiscal year. Looking into Fiscal 2018, we expect additional growth in profitability, likely culminating in the achievement of our ‘2B-10’ goals, further expansion of our Gatherings business, and the completion of our multi-year debt reduction program.”