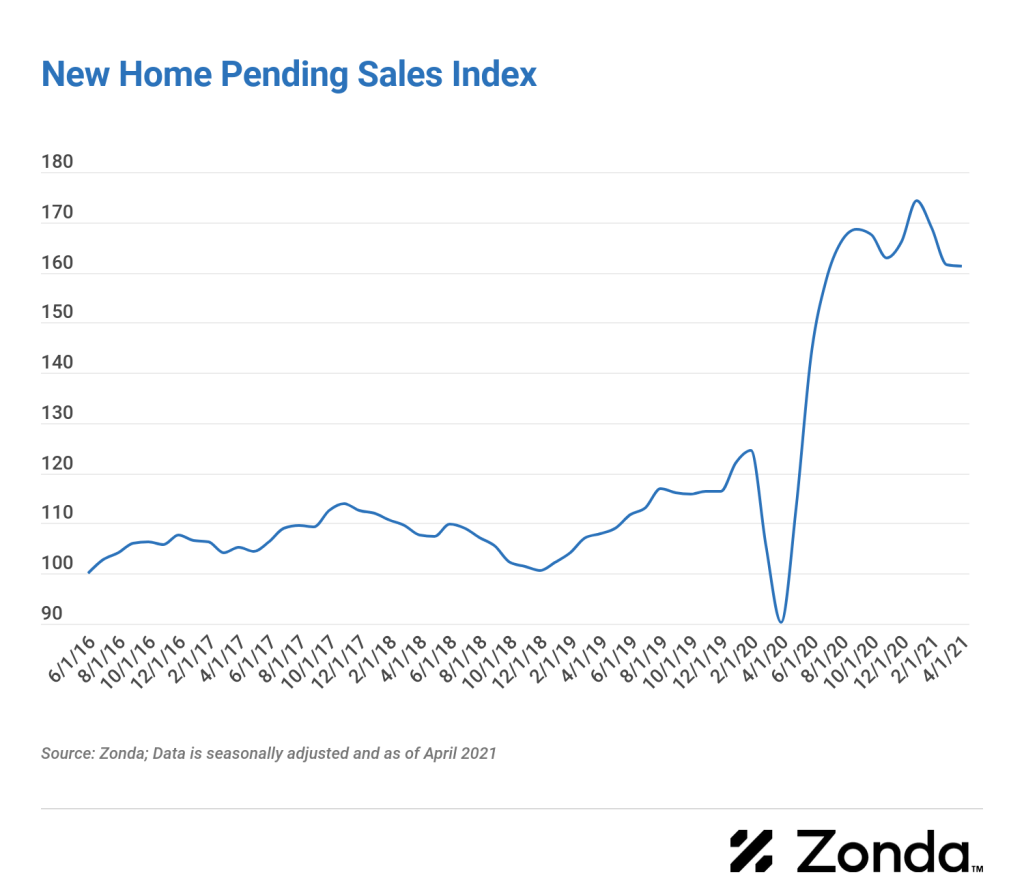

The latest Zonda New Home Pending Sales Index came in at 161.3 for April. This marks a 78.6% year-over-year increase in pending home sales from the height of the pandemic housing crash in April 2020 and a 49.5% increase over April 2019.

Month-over-month pending home sales remained relatively steady, falling only -0.1% from March to April.

“The year-over-year trends remind us how far the housing market has come over the past year,” says Ali Wolf, Zonda’s chief economist. “Sales plummeted for four to eight weeks last March and April before Americans realized one thing: Home had become more important than ever to them. Housing has been a big driver of economic growth ever since.”

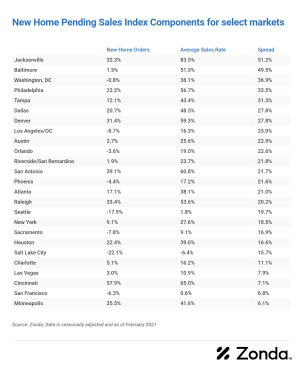

The New Home PSI is calculated based on two components—new-home orders, which look at total sales and will be affected by low supply, and average sales rate per community, which captures how well builders are selling the homes they have and does not consider supply. The new-home orders component rose 40% YOY in the latest report, while the average sales rate per community rose 80%.

At the market level, pending new-home sales trend above April 2020 levels YOY in top markets. The top performing markets on a YOY basis were the ones hit hardest by the housing slowdown one year ago—Las Vegas (up 290.7% YOY), San Francisco (up 221.8% YOY), and Riverside/San Bernardino, California (up 146.2% YOY). Month-over-month, the best performing top markets include Seattle (up 11.5%), Austin, Texas, (up 10.9%), and Cincinnati (up 6.5%).

The spread between the average sales rate and new-home orders is highest in Riverside/San Bernardino, Los Angeles/Orange County, Baltimore, Las Vegas, and Tampa, Florida. This, according to Zonda, suggests a huge imbalance in supply and demand for a given market.

“Affordability is and will remain the top risk for the housing market,” says Wolf. “Buyers are eager to jump into today’s markets, but, with limited inventory, prices are skyrocketing, and competition is fierce. We are anticipating a bottom in inventory in the coming months, which should help normalize the market.”