Affordability is a key issue in the housing market, along with record home price appreciation and higher mortgage rates. Increasing loan limits is one lever that can be pulled to help reenergize home buyers and make financing easier in today’s market. Over 99% of counties across the United States will start 2023 with higher Federal Housing Finance Agency (FHFA) and Federal Housing Administration (FHA) loan limits than 2022.

FHFA and FHA are two popular loan providers for those purchasing a home with a mortgage. These loans have different rates, insurers, credit standards, and loan limits.

- Conforming loans. The FHFA, which was created as a part of the Housing and Economic Recovery Act of 2008, shows the dollar amount of mortgages that can be acquired by Fannie Mae and Freddie Mac. These loans are commonly called “conforming” as they need to meet specific requirements laid out by Fannie Mae and Freddie Mac. These loans, for example, require a higher credit score, a larger down payment, and lower debt-to-income ratios to qualify than other loan options available.

- FHA loans. FHA loans are primarily utilized by home buyers who may not have otherwise been able to receive a mortgage in the conventional market for one reason or another. These loans are guaranteed by the FHA, and they allow buyers who have a lesser down payment or lower credit scores to qualify.

Conventional loans make up the vast majority of financing in the new-home market, representing 77.6% of activity. Conventional loans include conforming loans, but also other types like jumbo loans in which the amount exceeds conforming loan limits set by the FHFA. FHA loans represent just 7.5% of activity.

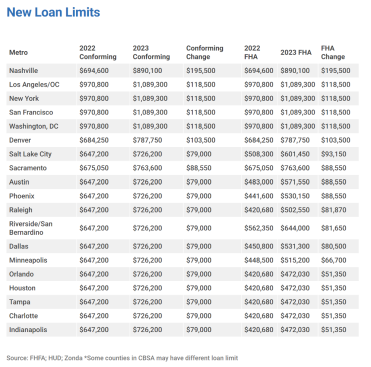

The FHFA established the national conforming limit at $726,200 for 2023, adjusting the floor by the 12% price appreciation seen year over year. For high-cost areas, locations in which 115% of the local median home value exceeds the baseline conforming loan limit, the applicable loan limit will be higher than the baseline loan limit. The conforming ceiling for 2023 is now $1,089,300, a record high.

The FHA also sets a ceiling and floor each year for the loan limits based on median home prices. Like conforming loans, the new ceiling of $1,089,300 is 12% higher than the $970,800 from last year. Loans in traditionally expensive metros like Los Angeles, New York, and San Francisco are subject to the revised ceiling.

The new floor of $472,030 is seen in housing markets like Orlando, Florida; Charlotte, North Carolina; and Houston. Over 87% of all counties received the minimum limit, in line with last year.

Among major markets, the new loan limits increased the most in counties comprising Nashville, Tennessee, and Atlanta, up 28% and 26%, respectively. Other notable increases include select counties in Nebraska, Idaho, and Utah. In some markets, though, the dramatic increase still lags the run-up in prices seen over the past several years.

Below you’ll find the revised FHFA and FHA loan limits for select markets across the country.

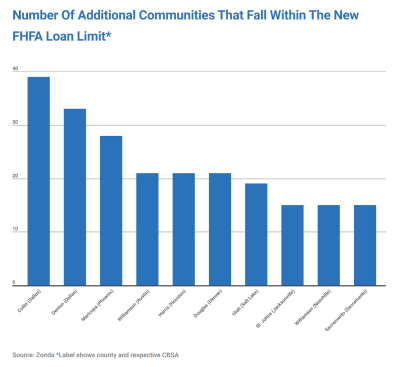

The impact on the new-home market varies by metro, but most will see a net benefit.

- Under the new conforming loans, Portland, Oregon; Sacramento, California; and Dallas were the major metros benefiting the most, with projects falling under the FHFA loans all rising at least 20%. Collin County in Dallas was the biggest increase on the county level, adding 39 projects.

- Given the higher floor, more projects naturally fall under the conforming limit. More than 80% of Zonda’s actively selling projects have minimum asking prices below the FHFA floor, totaling over 12,000 projects.

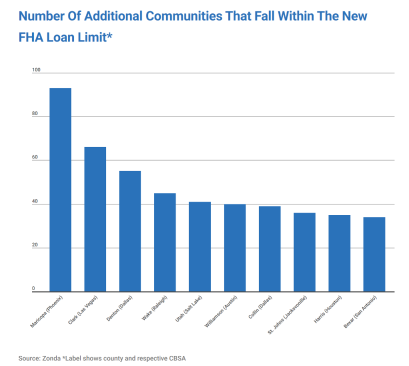

The change in the FHA loan limits could have an even more pronounced impact on the new-home market, depending on location.

- For the fourth straight year, new-home communities in Maricopa County in Phoenix are the biggest winners under the new 2023 criteria, 93 additionally active communities that list a minimum price under the updated $530,150 limit. The increase may provide a much-needed boost in the market.

- Looking on a CBSA level, Dallas gained the most volume of new-home communities that now fall within the new limits, adding210 active projects that contain a minimum price under the limit.

- Among major metros, Las Vegas gained the most on a percentage basis, increasing the market’s under FHA count by 83%. Other major metros with large percent gains were Salt Lake City, Miami, Phoenix, and Minneapolis.