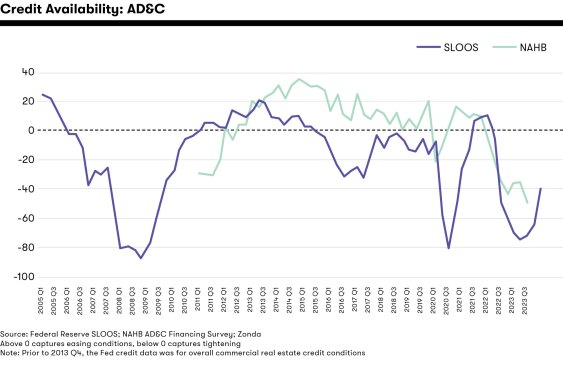

The latest Senior Loan Officer Opinion Survey (SLOOS) was recently released by the Federal Reserve covering the fourth quarter of 2023. As we have noted before, this data provides valuable information on credit conditions across the U.S. economy.

Specifically, we can track credit availability for commercial, construction, and land development loans to see the broader impact of Fed policy on the real estate sector. The NAHB runs a similar survey on Acquisition, Development, and Construction (AD&C) loans, which it updates quarterly.

We can see credit for real estate projects has tightened significantly since the Fed shifted its focus toward restrictive policy. On a positive note, fewer respondents reported tightening credit conditions over the past two quarters, signaling potentially less restrictive lending standards as we get further into 2024.

While the economy continues to grow, one sector that is taking the biggest hit related to access to credit and the value of assets is commercial real estate (CRE). Some recent troubling signs include:

- The sell-off and sharp stock declines of New York Community Bancorp due to large losses in its CRE portfolio (following the series of bank failures and consolidations last year starting with Silicon Valley Bank);

- Record-high CRE office vacancies (19.6%) at the end of 2023; and

- Office delinquencies rising from just 2% to over 6% in a year, per Trepp.

We are monitoring developments in the CRE space, especially as this sector has shown more weakness due to lingering effects from the pandemic due to increases in remote work.

Implications for Builders

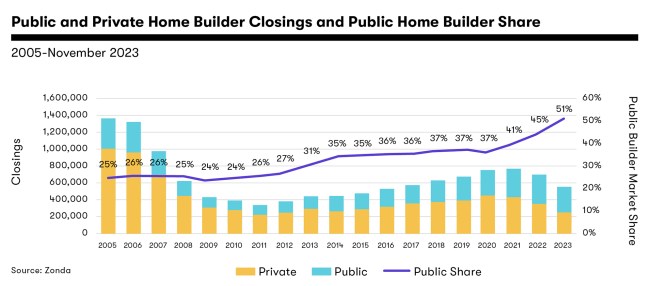

Current conditions have a mixed impact on home builders. Tightening credit conditions have limited growth for some smaller private builders and have played a part in the uptick in M&A activity seen in the market.

Concerns around access to credit are more muted for larger and public builders. In fact, public builder market share grew to over 50% of total sales in 2023, up from 25% in the mid-2000s. While part of the uptick can be attributed to access to credit, 2023 was a continuation of a recent trend. Other reasons for the market share gain include:

- Economies of scale;

- Right of first refusal on some land deals;

- The ability to pay more for land and lots;

- M&A activity of both private and public builders;

- Greater ability to “work” with buyers on affordability; and

- The ability to drive local pricing trends.

Once credit conditions start to loosen notably again, better access to credit can provide a lifeline back to smaller private builders. In the meantime, we will continue to track credit conditions as there is a modest positive correlation between the SLOOS data and single-family starts.

Keep the conversation going—sign up to our newsletter for exclusive content and updates. Sign up for free.