Timing is everything. In February 2020, two top 100 U.S. home building companies—Reston, Virginia–based Stanley Martin Homes and Columbia, South Carolina–based Essex Homes—were pushing hard to close the deal that brought Essex’s operations and all of its employees under the Stanley Martin umbrella.

“We closed on Feb. 25 and had big plans for how to wildly succeed with the integration of over 200 new team members,” recalls Steve Alloy, president and CEO at Stanley Martin Homes, about the acquisition. Those plans—while still a success—shifted significantly when, within weeks, COVID-19 shut down all travel and closed the company’s offices. “If [the deal closing] had been three weeks later, it wouldn’t have happened,” says Alloy, later noting that, thanks to the pandemic-induced housing boom and the cultural fit of the two firms, “it turned out to be the greatest deal ever.”

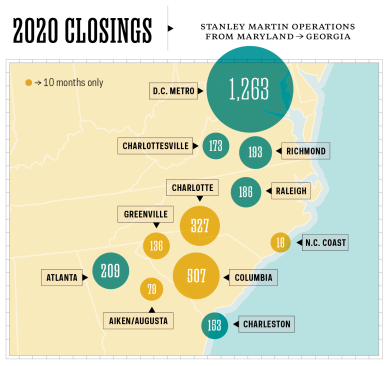

Despite the uncertainty many home builders felt in March and April last year, 2020 turned out to be good for business but fairly quiet in terms of mergers and acquisitions within the industry. But the Stanley Martin and Essex deal was a notable one: The combination of the two companies added more than 1,000 closings to Stanley Martin’s numbers for 2020, resulting in an impressive 11-spot jump to No. 21 on the Builder 100 list with 3,436 closings.

Mutually Beneficial Partnership

Karl Haslinger, founder of Essex Homes and current regional president at Stanley Martin, jokes that in hindsight had he known how good of a year 2020 would be for home builders, he might have delayed selling. But just over a year later, he has zero regrets with where he and his company landed with Stanley Martin.

“When you get to a certain age, and it’s time to sell your company, you start realizing you only have so many windows to do things in,” he says. “At the time I was 64, and I’m 66 now. It was time to do something. I didn’t want to be 70 and risk going into another downturn.”

In looking for a buyer, Haslinger says taking care of his people—225 of them at the time—was a top priority. As soon as talks started with the team at Stanley Martin, he felt at ease. In fact, he never considered any other offers.

“With a big builder, like a Lennar or D.R. Horton, I’m not saying anything bad about them, but there are multiple overlaps in markets, which usually means people are displaced,” Haslinger says. “Steve and several of his top managers flew into Columbia, I believe it was December 2018, and literally the meeting and the conversation started out with, ‘If we buy Essex, we’re going to need all of your people. Do you have management and do you have people that will move over in the acquisition?’ Which was exactly what I wanted to hear, I wanted to hear somebody that wanted all of my people and had places for them and needed to have them. So the conversation really started about people and about corporate culture.”

According to Alloy, that kind of fit is exactly what Stanley Martin is looking for and is how it plans to grow its market presence via acquisition going forward. “Karl was really trying to figure out, one day as he retires, what will that look like? He wanted to protect everybody,” Alloy notes. “And because of the beautiful fit with us, there was no overlap. And because we were growing so fast, we needed all the corporate people he had. We wanted everybody. [His team members] recognized, ‘Wow, Karl really took care of us,’ so they had buy-in.”

For Alloy, his take on M&A is that “who the company is is more important than the geography.” That being said, the Essex deal was a home run in both areas as Essex was operating in five Southeast markets that were surrounded by Stanley Martin’s existing markets.

“They already had offices in Raleigh, Charleston, and Atlanta,” Haslinger says of Stanley Martin. “They started to look at where we’re at and immediately made the comment that ‘this fits like the hole in the doughnut.’ We covered the central missing piece of geography they were surrounding.”

Source: Stanley Martin Homes

Path to Growth

Despite the fact Stanley Martin was founded by Alloy’s father, Martin Alloy, and Stanley Halle in 1966, Steve Alloy never intended to work there. While Steve Alloy was studying at The Wharton School of the University of Pennsylvania, it was “during a time when there was a buying wave of real estate investment from Japan into the U.S., and Japan at the time was the new economy to take over the world,” he says. “So I studied some Japanese and went that direction, I thought my career was global. I never thought I’d be at a D.C.-based home building company that my father had founded. The only reason it changed is because the Japanese economy collapsed in 1990-91.”

In 1991, Alloy returned to the U.S. and became the land acquisition manager for Stanley Martin. Roughly six months later, the company realized it didn’t have the money to buy new land. “It was the best thing that ever happened to me because instead of getting laid off, I moved into a sales training role and sold houses on the floor.”

From there, he held other positions in departments throughout the company, which proved beneficial to prepare him for when his father stepped down in 1998. That’s when, at just 33 years old, Steve Alloy took over as president.

“I don’t know how many top 25 CEOs were shoveling curb, taking a fire hose into drainage pipes, and hauling refrigerators, but that’s what I used to do,” laughs Alloy, reflecting on his varied former jobs. “I’ve been in almost every role in the company. It’s incredibly helpful. Lots of people come up through the industry, but often they’re recruited into a management-level role. I have a lot of non-management roles on my resume in our industry.”

Alloy has an older brother and a younger sister, but neither of them have current involvement with the company. “None of us were really coming into the home building business,” he says. “It just happened that I shifted there, and it’s been fantastic.”

Positioned for Success

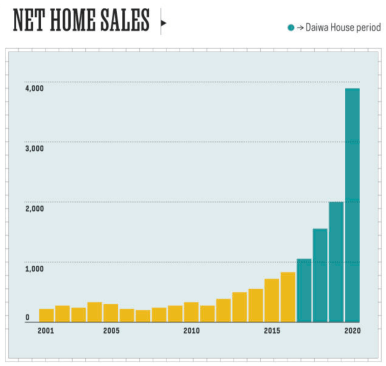

From its start in the ’60s until 2009, Stanley Martin Homes operated as a single-market family business, building in the Washington, D.C., area. Following that, it joined up with private equity in December 2009 to grow the company coming out of the downturn. While 50% private equity owned, Stanley Martin expanded into Richmond and Charlottesville, Virginia, and Raleigh, North Carolina, and it grew from 302 sales in 2009 to 862 sales in 2016. With a six-year time horizon, however, the private equity funds needed to be replaced come 2016.

In another bout of good timing, Stanley Martin joined Daiwa House Group, one of Japan’s largest home builders, in February 2017. The expiration of Stanley Martin’s private equity funds nicely coincided with the Daiwa House goal to expand into the U.S. single-family home business.

“We had hired a financial adviser to find a replacement for the private equity funds, and the adviser reached out to Daiwa House,” Alloy recalls. “In the early meetings, it became evident that they were the absolute best match.”

Alloy’s work experience and time spent in Japan—and what he calls a conversational grasp of the language—certainly didn’t hurt, but again, the deal came down to people.

People: ‘The Secret Sauce’

At Stanley Martin Homes, the people—more specifically, its team members—are the most important thing.

“When I took over the business I was 33 years old. I had some experience in the business and outside the business, but it took some years for me to figure out the secret sauce,” reflects Steve Alloy, Stanley Martin Homes president and CEO. “That secret sauce around people came years later. The tinkering to get the culture and the structure right, and to get the right people in the various seats, it took time.”

Less than two years ago, the company shifted away from a traditional human resources department toward more of a focus on team and culture. “Knowing we were going to be an acquisition company, it was important that there was a vision to take HR recruiting, learning, and development under this bigger-picture department,” says Debra Fletcher, vice president of team and culture. “My role was created to bring that together strategically.”

With the Essex Homes deal, Stanley Martin experienced about 30% growth for its company size. “We were close to doubling in size with one company acquisition,” Fletcher says. “What is exciting now as we get bigger are the growth opportunities. Now we are finally getting to a scale where people can move around. People can get to the next role within the company that was previously hard to do.”

Stanley Martin conducts various team member surveys, most notably an annual one around Labor Day—and Alloy reads every comment. “In 2020, in the middle of a pandemic, massive growing pains, material shortages, and government approval delays, we had the highest team member survey results in our history,” Alloy says.

The main survey, according to Fletcher, covers everything from “broad overall engagement and satisfaction—would you refer someone to work here?—to how are we doing operationally? Are you receiving career development to be successful?”

When new members join the company, Alloy puts in face time with each of them—currently via Zoom because of the pandemic. “They all spend an hour with Steve,” Fletcher says. “They introduce themselves and say why they joined the company, and then they get a Q&A with the CEO.”

Alloy looks forward to those new-hire meetings, which are just one part of how the company promotes and fosters a positive culture.

“If we keep taking care of our team, everything else will work,” Alloy says.

“If I think about where Daiwa House was, they weren’t looking to pick a Washington, D.C.–based home builder,” Alloy says, noting that Daiwa House had spent five years looking for the right partner. “You think coming from Japan to find a U.S. partner, you’re probably looking at California or Texas. Maybe Florida. And they picked Washington, and I think the reason was that it wasn’t about the geography, because it was longer term than that. It was about the who. And I think it served them really well, and that’s our approach to [M&A] as well, we’ve kind of mirrored it.”

From the start, Daiwa House was explicit about not wanting to change Stanley Martin’s operations, and Alloy attributes that to the partnership being a success. “Where there were synergies, they wanted to apply them,” he says, “and where there weren’t synergies, they said, ‘Do it your way.’”

Since joining Daiwa House, Stanley Martin acquired the assets of FrontDoor Communities in February 2018 to enter the Atlanta and Charleston, South Carolina, markets, in addition to completing the Essex Homes acquisition in February 2020 to enter markets in Georgia, North Carolina, and South Carolina.

Tech Transition

While Stanley Martin plans to do and is budgeting for one acquisition per year—“the reason we don’t do more is it takes so much work to integrate,” says Alloy—there was no transaction in 2019 because the company took the time to update its technology platform.

“One of the impediments to the industry is that most large companies are on dated systems,” Alloy explains, noting that almost all of the software in the home building space was developed before the iPhone was invented. “It’s a huge lift to change. It’s enormous. But we went through that and changed it, and it’s great. We think it’s a big advantage for us.”

The company replaced its existing enterprise software system and launched HomebuilderONE, and it upgraded everything to the cloud. It needed to focus on that instead of an acquisition because “it is really hard to do that kind of technology upgrade while growing at the pace we have been growing,” Alloy says.

Yet again, timing worked in the company’s favor. “Because we had gone through that massive enterprise process to abandon all of our servers and everything is in the cloud, you can work from anywhere,” Alloy says. “Well, as soon as COVID hit, nobody missed a beat. You could sell houses from your iPhone. It doesn’t matter what device you’re on or where you are—everything works. It became really easy that we weren’t reliant on anything technologically happening locally.”

In mid-March, mere weeks following the close of the Essex deal, Alloy became symptomatic with what he calls a “really bad case” of COVID-19. He had a fever for 15 days and considers the timing of his symptoms coming on the heels of the shutdown of the company’s offices to be lucky. “I think one of the things that helped us is that I was one of the first people in the area to get COVID,” says Alloy. “We mandated closed offices. We took it very seriously. The investment in people alongside the investment of technology made a huge difference for us.”

Love of Land

Alloy remembers being in bed with a COVID fever, worrying about occupancy permits and cash flow. One thing that reassured him is the fact the company has Daiwa House standing behind it. Another was the lack of hesitancy his firm had regarding land opportunities.

“Our philosophy in every downturn, it’s always keep selling,” Alloy says. “Nothing good happens when we stop selling. We kept selling, and it kept working. Another thing we did during COVID, very early, we said all of the public builders will likely hesitate on land—now is the time to go sign up land contracts. That was in April. So in April, our land team started saying, ‘Hey, we’re in, we’re ready.’ We signed so many land contracts in April and May that are now really paying off for us.”

Land is precisely how Stanley Martin, the No. 2 builder in the D.C. area, has competed with NVR, the No. 1 builder in D.C. and No. 4 on the Builder 100, for the past 30-plus years. Not only are the firms operating in the same market, but also within the same office park in Reston.

“Our towers are next to each other,” Alloy says. “We have always had this thing because NVR is land light, and how would we compete by the No. 1 market-share builder? One of the ways we compete is our approach to land is land heavy. We do lots of complicated land transactions. NVR made us better at the land business, because we had to be. We love land. Land is how we thrive. Fortunately, we’re capitalized to be able to do that.”

Courtesy Stanley Martin Homes

The Springfield at Grantham in Charlotte, North Carolina.

The Long Game

The best part about Stanley Martin’s growth story is that it’s just beginning. Alloy says things are “very long term” with Daiwa House, noting that during his first meeting with its team members, they shared their 100th anniversary target, and “at the time I think they had 30, 40 years to go?” Stanley Martin itself has a published plan through 2030.

Ultimately, the long-term goal is for the firm to be a top five builder operating in every major U.S. market. Part of the plan is to hit 10,000 sales by 2030. While Alloy says the company is ahead of schedule, he knows it will need to be larger to break into the top five. (As reference, this year’s No. 5 firm, Taylor Morrison, closed 12,524 homes in 2020.)

“I don’t think we make top five in the next 10 years, but I do think we could get there in the next 15,” he says. “There’s no reason to think that if we’re not in Seattle today that we wouldn’t be in Seattle one day. As we’re building a national company, we should be in every major market. It just takes a lot of years. We think about it over decades, not quarters.”

There’s no wish list of markets where Stanley Martin wants to be next, although Alloy does point out that it “makes no sense” that the firm isn’t in Florida given its significant presence in the Southeast.

“What we really want to do is find the right team that we want to have join the company,” he explains. “We don’t actually care where they are, because we’ll eventually find the team in every market.”

As the company continues to expand, Alloy admits growing pains are a definite issue. “We were just trying to figure out how to be a 1,000-home builder for the first time in 2017 when we hit 2,000 sales in 2019, and then the next year we did almost 4,000 sales,” he says.

Source: Stanley Martin Homes

At some point, Stanley Martin hopes to adopt and find efficiencies in some of the building solutions used by Daiwa House in Japan, but they’re not quite there yet. “They have extraordinary technology and robotics,” Alloy says about Daiwa House. “Their manufacturing plants are like walking into an automotive plant. We’ve been talking for the past few years about how we adopt off-site solutions in the U.S. and what they can help contribute through that. It’s something our team is studying now. We don’t have the answer, but we may be able to benefit from some Daiwa House synergies around manufacturing.”

Stanley Martin’s path forward to a nationwide presence includes a mix of growing existing markets and adding new markets through mergers and acquisitions.

“It’s a very forward-looking company,” Haslinger says. “If I were to look at the top 50 or 25 [home builders] right now and place a bet, I would bet on Stanley Martin. Daiwa House is a powerhouse. You look at the physical size of that company compared with the largest companies in America and you see just how much financial muscle is behind Stanley Martin right now, and that’s huge.”

Currently, 75% of Stanley Martin’s business is entry-level or first move-up, and that percentage is growing not shrinking. So while the company is striving toward ambitious growth in the coming years, it’s also determined to stay true to its mission, vision, and values.

“Seven years ago we did a huge shift to go affordable with the belief system that affordability will be one of the most important factors in the housing industry in the future,” Alloy says. “That has really served us well with our land positions. How we do great houses that people can afford is a really important part of who we are—it’s what drives us to pursue greater efficiencies. We’re very mission focused to design and build homes at a price that people can afford. That just really simply states what we’re all about.”