As a Japan-headquartered trio of venerable, diversified housing, materials, and, manufacturing giants–Sumitomo Forestry, Sekisui House, and Daiwa House–make inroads in U.S. home building as formidable and growing strategic acquirers and long-term operators, it appears they’re not alone among powerful Asia-based organizations in pursuit of growth in the safer-haven of North American residential real estate.

At least two mainland China home building players are courting large-scale strategic acquisitions that would diversify their geographical exposure, open up markets to growth, keep pace with Chinese home buyers’ interest in U.S. properties, and leverage finance advantages while the getting is good for them.

It’s rare that big news breaks during a panel conversation in a conference, but just such an event occurred this past week during our session, “The Rising Power of non-U.S. Owners,” led by Margaret Whelan, founder and CEO of Whelan Advisory, LLC.

Participants in the session included Don Dykstra, president of Dallas-based Bloomfield Homes, which Sumitomo has taken a stake in; Robert Crowley, managing director of Moelis Group, which participated in both the Daiwa House acquisition of Stanley Martin Homes, and this past February’s North American Sekisui House acquisition of Woodside Homes; Tom McKay, senior VP and chief development officer at NASH Advisory Serivces; Michael Forsum, coo of China-based Landsea, which has made a splash in both single- and mixed-use/multifamily development starting in 2014; and Molly Huang, managing partner at SeaZen Capital Partners, which is another Chinese company on the prowl for U.S. residential real estate strategic partners.

The session spotlighted the diligence, care, strategic culture match-making, and decades-long commitment each of the Japanese companies have prioritized in their pursuit of U.S. partners and acquisition targets. Since many U.S. private home builders have been more accustomed to a buy-and-steamroll acquisition model typical of many of the public home builder consolidations that have occurred, Japan’s three “longer-view” players have emerged as an intriguing and in some ways preferable option for private home builders.

Not to discount the fact that, due to both international tax and corporate policy and to the disproportionately lower cost of financing and rates in Japan and China, these players can tend to value U.S. home builders higher in relation to their book values than domestic public builders would.

This amounts to a win for both the seller–who whether for demographic reasons of their principal management teams ages or tight capital constraints in a time of need to fight fiercely for land positions that will vie for locational advantages as the housing market tips into its next, more competitive phase of growth and eventual slowing–and the buyer.

Among the three Japanese players, about 10 private home builders, whose unit volume totaled more than 7,000 homes, and revenues of more than $5 billion have become part of the three respective portfolios, and there are plans to add more in the next 24 to 36 months for all three.

Still, the news value of the session came as U.S.-based officials speaking for the two Chinese organizations–Landsea and SeaZen (Futureland)–spoke of equally vaunted plans to establish “meaningful” contribution from U.S. home building operations via planned acquisition.

Landsea chief operating officer Mike Forsum notes that his sponsor company’s bar of ambition is both high and urgent, setting as one of the potential goals one of the mini-me public home builders, along the lines of both WCI and UCP which recently sold to Lennar and Century Communities, respectively.

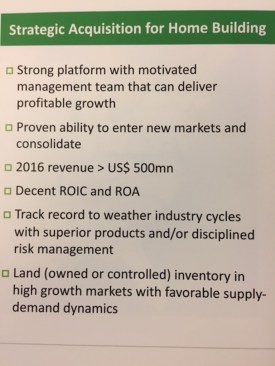

SeaZen Capital’s Molly Huang asserts that Futureland’s intentions are to spend up to a half-billion to land one or more significant U.S. partners in the single-family space, having already invested in a number of multifamily and mixed-use development deals, primarily in Texas.

Recent policy shifts in China under a new finance minister have added to the complexity for organizations who want to make investment outside of China, given that officials there want to constrain the movement of money beyond its borders.

This tends to present an impediment to closing U.S. acquisition deals, as it adds contingencies–amounting to a greater lag-time on freeing up capital to close on an acquisition–into the deal process. Public companies in particular have difficulty engaging in conversations with potential buyers who have contingencies because of the amount of time such transactions take and the need to disclose such material conversations shareholders.

Still, says Huang, Futureland has established corporate presence and investment infrastructure in Hong Kong that would allow the organization to pull the trigger on U.S. acquisitions in a timely, streamlined, and confidence-inducing manner.

So, before long, China-based companies could rank alongside Japanese organizations as a significant acquisition force in what is shaping up to be an inflection point in consolidation of the home building landscape over the next few years.