Beazer Homes, the No. 13 firm in this year’s Builder 100 rankings, has–with the exception of a late December 2017, $29 million land asset purchase from Bill Clark Homes in the Carolinas–remained mostly a spectator during a surge of mergers and acquisition-fueled growth and deepening local scale among the nation’s biggest home builders over the past 36 months.

But no more.

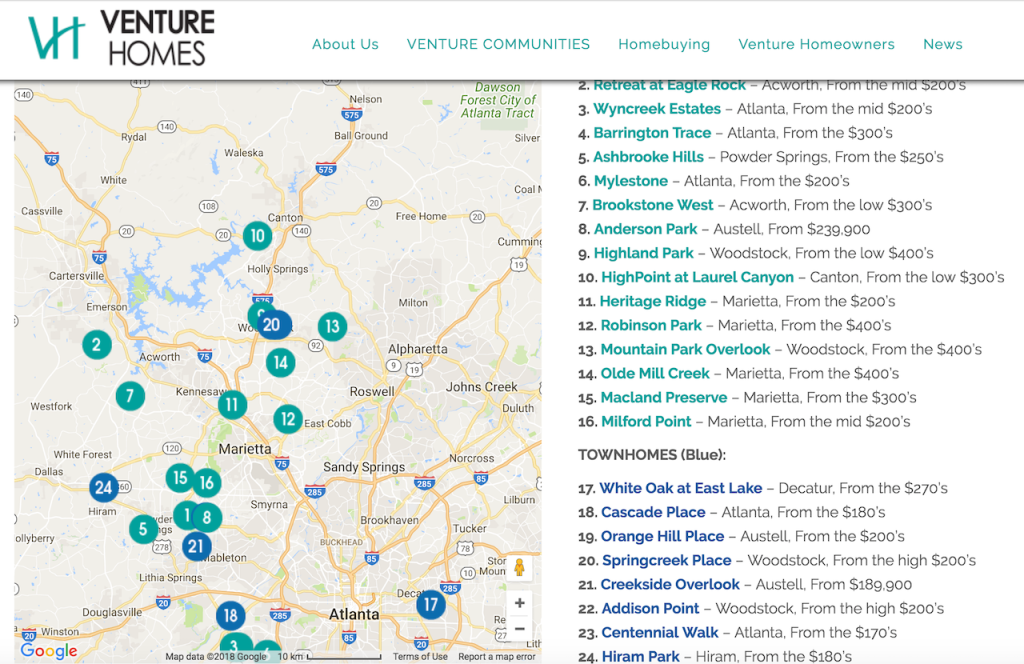

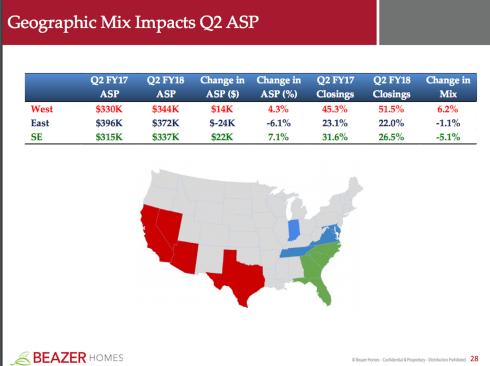

Beazer forays as a strategic buyer into what may go down as one of the most active 12-month periods for builder M&A transactions and consolidation ever, with a $65 million deal for Venture Homes, a Marietta, Ga.-based, 34-year-old privately held builder of single family homes and townhomes in the metro-Atlanta’s Marietta, Austell, Atlanta, Smyrna, Canton, and Acworth urban and suburban areas. Listing prices ranging from the high $100,000s to the $400,000s, Venture Homes’ average selling prices appear give Beazer’s Southeastern markets ASP of about $337,000 a new baseline capability of up to $100,000 less than the Beazer average, a clear path to a swelling universe of would-be young adult entry-level home buyers.

According to the press statement:

Over the last 12 months, Venture Homes generated $69.9 million of homebuilding revenue from 277 closings with an average selling price of $252.2 thousand.

The Venture assets to be acquired by Beazer include more than 1,000 lots located in 9 active communities and 18 future communities principally serving first time and first move-up homebuyers. The transaction also includes substantial construction work in process as well as 51 homes in backlog.

The combination sling-shots Beazer from the 25th position in Atlanta’s juggernaut market into the top 10, where local market scale advantages–with land sellers and developers, building trades, manufacturers and distributors, as well as real estate agents–go more and more to those with market share muscle to flex in their business operations and community development. Atlanta has been the single-most active metro area in a binge of strategic and tactical M&A activity, the motivations, drivers, and business conditions of which seem to be only gaining momentum.

Beazer’s acquisition of Venture–which was represented in the deal by San Francisco-based Builder Advisor Group–shares key commonalities with several other strategic home builder transactions in the last year to 18 months. Underarching Beazer’s moves are a strategic focus on a goal of $2 billion in revenue and 10% EBITDA, from which one might infer that it will need to become more aggressive on the M&A front to reach community count assumptions increasing from the low 150s to 175 or so.

- Venture’s 25 or so actively-selling communities, clustered mostly in North Atlanta’s 9 pm-to-Noon sector, giving Beazer increased exposure to the entry-level buyer market in an increasingly robust Atlanta economy.

- Too, in addition to more than tripling its community count in the market and vastly extending its lot pipeline in a highly competitive market, Beazer acquires an operation–led by Venture Homes founder Robert C. [Bob] White Sr.–whose signature business and operations model focus is on total quality management even at the lower price ranges of the market. This proficiency, and operational excellence best practices approach is eminently portable into other geographies, divisions, and developments, an opportunity for Beazer.

- Three, the deal gives Beazer a new window of opportunity quickly to go to school on acquisition, integration, and optimization skill-sets in its own headquarters market, where it can capture efficiencies, swiftly operationalize systems, and learn the M&A game, perhaps to play it again in a Southeastern U.S. home building market that’s on a tear.

Here’s the four-point low-down on the “benefits” of the transaction, per Beazer’s statement this morning.

- Similar customer focus. Venture’s customer positioning is well-aligned with Beazer’s commitment to provide extraordinary value at an affordable price to homebuyers. The Company will be able to provide its Mortgage Choice, Choice Plan and Energy Efficiency advantages to a larger group of home buyers

- Increased scale in an existing market. On a combined basis, Beazer and Venture have closed nearly 500 homes in Atlanta over the last 12 months, which ranks among the top 10 builders in the market. This added scale will create opportunities with, and for, trade partners, current and prospective employees and land sellers

- Compelling land acquisition leading to earnings and ROA growth. The transaction represents a rare opportunity to acquire a portfolio of performing communities and future land assets at an attractive price. This results in a faster improvement in both earnings and return on assets than would be possible solely from land purchases

- No increase in debt from transaction. The transaction was funded from available cash and resulted in no increase in debt.

More will come.

The holy grail of the current recovery, which has eluded all but a handful of outliers in the current new residential real estate and construction marketplace, are homes in the right location, for the right price, and the right features and functionality for people who would get out of renting their homes if they could tomorrow.

Given the past several years of rent increases in all classes of apartments and single-family homes for rent, homeownership–especially in new homes with low operating costs and manageable monthly payments–has intensified in its appeal as a force-field. But builders are fighting labor and materials cost volatility and price pressure even as they try to ratchet down their new home selling prices to meet this new, strengthening tide of demand.

The ability to build profitably–consistently–at lower price ranges is that rarest of phenomena in a business sector where price elasticity, housing finance practices, and volatile direct costs are a fact of today’s business environment. Pursuit of this proficiency as a business model, one that proves to be resilient in up and down cycles, has been the motivator of deals ranging from Clayton Homes recent acquisition of Indianapolis-based Arbor Homes, to Century Communities’ move to take full ownership of Wade Jurney Homes, to Taylor Morrison’s combination with multi-regional out-performer AV Homes.

Beazer has worked admirably through a complex mire of financial challenges, largely a hangover from a near-death experience during the Great Recession, and has deftly managed both its capital structure and operations into an organization with a future, rather than one fighting its past.

Here’s what’s going on in the Atlanta market from an economic and housing activity standpoint, per BUILDER sibling Metrostudy’s regional director for Atlanta, Eugene James.

“The metro Atlanta economy expanded by 1.7% annually in March, versus 1.5% nationally, and net job growth is expected to continue through 2018,” said Eugene James, Senior Regional Director for Metrostudy. “Housing supply is low for both new and resale homes. Total vacant lot inventory (VDL’S) months supply remains skewed at 40.7 due to many in less desirable locations but several submarkets have a months supply less than 18 months. These areas have a lot shortage.”