Housing, and its varied ecosystem of private, public, and community enterprises have always followed a cyclical path, and the current cycle may be shifting. That doesn’t mean individual organizations and people don’t continually try to free themselves from ties to the cycle.

Now may be the moment we see a few such organizations and people go into action to counter at least the timing and trajectory of a cyclical shift.

As interest rates on mortgage loans go up, home builders realize they may lose the last of three important levers they’ve had available to shift the housing recovery into a higher gear.

The three levers–cheap dirt, cheap labor, or cheap money–tend to work cyclically. One or more of them typically gives new home builders an opportunity to push their pricing closer to what it takes for a family household to buy a resale. One or more of them also tends to confer competitive advantage, for builders who can generate the highest return from the lowest amount invested in lots–and do it repeatedly and sustainably–are normally winners.

Interest rates–the “dirt cheap money” relatively recently available to a more expansive universe of borrowers as post-Recession regulatory barriers fell–have been masking off the facts that land costs, labor costs, and materials costs have been inflating faster than household wages and incomes.

Evidence of that gap and its impact on momentum in the market is growing.

Here, from the end of last week, National Association of Home Builders assistant VP for survey research Rose Quint, notes:

Rising home prices and interest rates pushed housing affordability to a 10-year low in the second quarter of 2018, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI).

In all, 57.1 percent of new and existing homes sold between the beginning of April and end of June were affordable to families earning the U.S. median income of $71,900. This is down from the 61.6 percent of homes sold in the first quarter that were affordable to median-income earners and the lowest reading since mid-2008.

Clearly, although new-home builders in many markets continue to drive sales growth and can expect to record year-on-year increases in sales volume, revenue, and profits, the interest rate wild card is at least showing signs of raining on our builders’ parade.

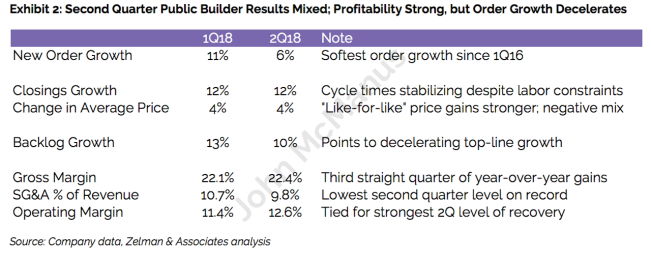

In fact, Ivy Zelman and her team at Zelman & Associates call out a statistically important inflection point in the latest issue of The Z Report, a recap of second quarter 2018 earnings among 14 public home builders who booked revenue of $20 billion on 51,500 closings–about 37% of high volume builders sales in the nation. Here’s a link for a free trial of The Z Report.

They note that the Zelman home builder basket had a great quarter from a business operating margin and profitability standpoint, but appear to have reached a pivotal moment in terms of the sustainability of their sales volumes and margins. The report takes particular note of new order growth of 6% across the 14 companies analyzed, a 500-basis point quarter-to-quarter decrease in sales volume growth from the first quarter of 2018:

“To put this quarter’s 500 basis point deceleration in order growth into perspective, over the last 28 years spanning 113 quarters, order growth has decelerated at least 500 basis points in 32 other quarters, or 28% of the time. In 69% of these instances, order growth decelerated further in the subsequent quarter, by an average of 1,000 basis points. In other words, periods of large deceleration in order growth more times than not are followed by additional periods of weakness.”

Remember, now, we’re talking about the second derivative here–or slowing growth–versus an outright decline in sales volume.

Zelman data shows that, while in seven out of 10 occasions, a big decline in growth was followed by an even bigger decline in growth, the other 31% of the time, a big growth decline was followed by a “robust” re-acceleration in growth rates.

So, what will it be this time?

That may depend at some essential level on an organization’s ability to break from its use of those three constant cyclical levers–cheap dirt, cheap labor, and cheap money–to continue to make value beyond the force and gravity of the cycle.

This is where innovation comes in. Companies that have made names and empires for themselves as shrewd and well-resourced “cycle-timers” self-disrupt, and learn a new business and operations model that makes them resilient in the face of a downward shift in the cycle. BTIG home building and building products analyst Carl Reichardt has been looking over the past couple of years at a new, structurally evolved trend among leading home builders that shows an increasing operational focus on “vertical vs. horizontal” value creation. That is, the best companies are de-emphasizing the role of “cheap dirt” and cycle-timing in their business models, and giving obsessive attention to what it takes to make and sell a house’s structure and systems profitably.

Innovation–which would give builders a lever they need to counteract the fact that they can no longer count on cheap dirt, cheap labor, or cheap money to grow their businesses–is rare.

That’s why we celebrate it, share it, and open up its discovery process at Hive, which will return this year in a new location, at Austin’s JW Marriott, on Nov. 28-29, and why this year our laser focus will be on what it takes to break through barriers to building more affordably for more people. Register now by clicking here.

That’s also why we’re particularly gratified to call attention here to a unique new program of action that will, no doubt, catalyze a multiplier effect series of actions among home builders and their partners in the housing ecosystem, all toward addressing a U.S. housing crisis that makes it almost impossible to finance, develop, and build more attainable homes and communities for America’s working households.

Clark Ivory and his team at Utah’s No. 1 builder Ivory Homes are raising the ante of innovation challenge in the business community in a powerful, potentially game-changing way.

This fall, the Clark and his team will be launching the Ivory Prize for Housing Affordability a new national challenge designed to advance projects and reward innovators for their efforts to impact adoptable solutions to tackle housing affordability. The prize has the support of an advisory board made up of some of our nation’s brightest mind in housing, a $200,000 purse and now a direct partnership with Hanley Wood.

The Prize will officially launch this September and will be looking for nominations of existing efforts and new ideas that address the focus areas: construction/design, especially rehabilitation of housing; public policy with an emphasis on regulatory reform, and; improving housing finance. You can learn more at www.ivory-innovations.org.

Hanley Wood is excited to partner with the Ivory Prize for Housing Affordability and lend our voice to this critical issue and the innovative concepts and entrepreneurs that step forward during the nomination process.

Here are more details on the criteria for the prize.

Ivory Prize for Housing Affordability Discussion Points Key Award Components:

- Construction/Design: Innovative construction and design approaches that bring down the cost of housing and improve performance in building more affordable housing for the average household. The award will focus on construction/design approaches both for new construction and for rehabilitation.

- Regulatory Reform: Overcoming regulatory and political obstacles in order to produce more affordable housing for the average household. (For example, achieving innovative approaches to work with public entities related to zoning, land-use planning, building codes, the approval process for permitting, and meeting environmental requirements at the local, state, and federal level.)

- Finance: Encouraging and recognizing innovative and successful housing finance approaches to achieve more affordable housing for the average household. (Some of the greatest barriers to affordability are financial, such as qualifying for a mortgage or meeting down payment and monthly payment requirements.)

Note: In evaluating these three areas, special consideration will be given to ideas that can be adopted around the country and innovative/non-traditional approaches.

Who is eligible?

Private sector organizations, non-profit organizations, and public-private partnerships; either organizations or individuals are eligible.

Role and Composition of the Advisory Board

Role: To provide advice and counsel in designing and developing the award, and to serve on the selection committee/Jury for the award.

Members of the Advisory Board: (Six members serve on the Advisory Board)

- Clark Ivory, Founder of the Ivory Prize for Housing Affordability, and Chief Executive Office, Ivory Homes, Salt Lake City, Utah;

- Carol Galante, I. Donald Terner Distinguished Professor and Faculty Director of the Terner Center for Housing Innovation, University of California, Berkeley;

- Natalie Gochnour, Associate Dean in the David Eccles School of Business and Director of the Kem C. Gardner Policy Institute at the University of Utah;

- LaurieGoodman,Director,HousingFinancePolicyCenterandVicePresidentfor Policy, Urban Institute, Washington, D.C.;

- Chris Herbert, Managing Director of the Joint Center for Housing Studies of Harvard University;

- Kent Colton, President, Colton Housing Group and Senior Research Fellow in Housing Studies, Joint Center for Housing Studies of Harvard University (Advisory Board Chair).