Three times a year, the Harvard Joint Center for Housing Studies Policy Advisory Board (PAB) meets, typically, once in Washington, D.C.; once in Cambridge, Mass.; and once in a third, floating location. The PAB is a who’s who of 50 or so housing business leaders, developers, builders, manufacturers, distributors, and the like. It’s dynamic. Extremely so.

PAB proceedings as a rule include a roundtable session that calls on each participant to offer up—briefly—a bullet point or two of high-level, material insight, straight from the trenches. Apart from brevity, the rule is that what you divulge cannot violate federal antitrust, securities, or other laws. You’re among competitors responsible for about one out of three for-sale or for-rent new homes in America, after all, and any whiff of complicity in the meeting would be a no-no.

What’s not against the rules is to listen to what the other speakers say. Chances are, you like what a few of the people in the session impart, while what others say when they take their turn—or the way they say it—can be a turn-off. The phrasing that one strategic executive may use to describe what he or she sees going on in the market may strike a chord of some sort. Next thing you know, two people may choose seats next to one another during the following meeting, based on the mysteries of what causes people to make such decisions.

What exactly it was that drew two chief executives—Larry Nicholson, who stepped up as Ryland CEO in May 2009, in the throes of the housing depression, and Scott Stowell, whose ascent to CEO of Standard Pacific took place Jan. 1, 2012—into one another’s immediate sphere at the Harvard PAB and other high-level industry meetings was hardly a mystery. They were, amid such company, the relative “new guys” among veterans at the helm; people whose average tenure was a decade or more. Also, observers might say that in such company they were two “normal guys” among mostly towering egos.

“We started sitting together at industry meetings, and the relationship grew over time as we discovered that we had quite a bit in common, in our careers and in our lives,” says Stowell, recalling the first traces of a casual camaraderie with Nicholson that sparked up in gatherings with home building CEO peers, shortly after Stowell became Standard Pacific CEO. “Our history at our respective companies stretched back aways, and our paths through the ranks were similar.”

Cut of a Cloth

Why did Scott Stowell and Larry Nicholson gravitate to one another as home building enterprise leaders?

It’s almost too obvious for words. Both are athletes. Both have working-class backgrounds. Both are family men. Both worked their way, literally, from the ground up to the top in building, under the tutelage of strong mentors.

As an undergrad at Brigham Young University through 1982, Stowell put in time on home building jobsites for summer income he needed to continue his studies in organizational communications. He worked on crews through his graduate studies at UC Irvine, and mapped directly from his MBA there to a job in product development and market analysis at Orange County–based Irvine Co.

Nicholson, a Cleveland Heights, Ohio, native, similarly worked his way through Ohio University doing manual labor. He even did a short turn as a draftee of the Pittsburgh Pirates, from farm teams to Double-A ball. He also wound up at construction sites as his first real job.

Land, and operations, came naturally to them both. Both emphasize “doing the right thing for the right reasons.”

That’s how it all started, and it’s why builder is celebrating CalAtlantic as its 2016 Builder of the Year. Take that camaraderie away and that sense of being the less-experienced, fresh faces among wizened powers that be, and you probably wouldn’t have the friendly basis that led to first conversations a year ago this past March, and the deal, announced in June 2015, that became one of home building’s most compelling mergers-and-acquisitions narratives ever—the $5.7 billion coupling of equals between Standard Pacific and Ryland, two companies born in the mid-1960s in, respectively, California and Maryland.

Take away the trust that kindled and began to marinate over a few years between Stowell and Nicholson, and who knows? Take away the trust that deepened beyond mirrorlike executive biographies to kindred interests and values, and what may someday prove to have been what they call “a shared vision and focus,” and you probably wouldn’t have a deal that has a shot of working.

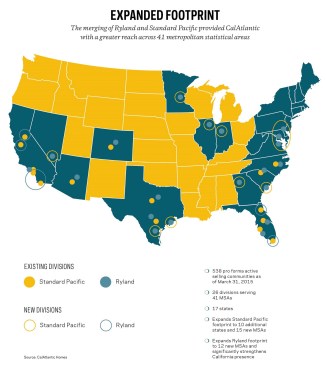

That’s despite how much sense the combination makes on paper. The Standard Pacific–Ryland merger into CalAtlantic Homes pairs two multi-regional firms—whose re-sculpted footprint now covers 41 total metropolitan statistical areas in 538 active communities in 17 states, including 20 of the top 25 MSAs for new-home construction—and a top-five Local Leaders position in 15 of those 20 markets.

Combined, the two giants own or control just over 70,000 lots, a six-year supply mapped to a wide diversity of community and product price points and positions from entry-level to luxury. Their equity market capitalization of about

$5.4 billion equated, at deal time, to an enterprise value of approximately $8.4 billion.

In the 12 months ended June 30, 2015, the pro forma combined company delivered more than 12,786 homes in aggregate, with combined pro forma revenues of approximately $5.2 billion, which jettisoned the combo to a No. 5 ranking on the Builder 100.

Yin, Meet Yang

The two entities—with some puts and takes—essentially complete each other, with relatively little geographical overlap and relatively abundant complementary proficiencies and market positions. Ryland got Standard Pacific’s access to higher-end clientele, placemaking, design prowess, and real estate land-strategy savvy. In turn, Standard Pacific got a clear, unimpeded return-on-invested-capital channel to Ryland’s sales and operations skills, and a fire hose of lot positions ready for the eventual sluice gate opening of entry-level millennial home buyers. What’s more, the timing looked right.

“This is the right move for our respective shareholders, as the combination will create value by strengthening our liquidity and improving operational efficiencies across the two enterprises,” said Nicholson last June as the deal was announced. “In the recent conversations, we decided that this was the right move and that the moment had come; the time was right.”

For Stowell, the timing issue had an added urgency to it: the risk that, by waiting, one or the other of these “best-suited” partners could be removed from the menu of merger options, especially where a “sloppy seconds” option could materially challenge a successful integration outcome.

“We wanted to make sure we controlled the ‘best fit’ and ‘best combination,’ ” Stowell says. “And there aren’t many ‘best fits’ in this industry.”

What makes opportune timing for a consolidation move of this magnitude in an industry whose DNA typically has emphasized local economies over scalable national ones? To some extent, it’s a belief the market is entering a middle-innings, or midcycle, stretch in the recovery, which changes companies’ investment and operational focus from lot-pipeline expansion to an obsessive emphasis on monetization, inventory turns, pace, and profitable volume.

“Move too early, and you underestimate the downside risk of deals like this,” says Stowell, who notes that the primary timing impetus for the first conversations with Nicholson regarding a deal were about an “early-mover” advantage combined with a “right-fit” strategic partner. Stowell adds that moving “too late doesn’t allow you to capture the full value of a recovery–land buying, ROI, value creation. Doing the combination at midcycle allows a ramp way to complete the integration, stabilize the company, and take full advantage of an improved balance sheet and [the] remainder of [the] recovery.”

“We started sitting together at industry meetings, and the relationship grew over time as we discovered that we had quite a bit in common, in our careers and in our lives.” — Scott Stowell

Stepping back even farther from the fray and looking from the standpoint of how Federal Reserve policy and global financial investment capital flow were working, there may have been no more advantageous time to access and put to use merger money.

Reasons to make the deal in the first place, and reasons to make it work, go on and on. A stronger balance sheet; a hybridized, richer talent pool at all levels; a more balanced, less concentrated geographical operating footprint; a better product segmentation mix; improved operational scale to absorb overheads; more efficient access to investment capital; “synergy efficiencies” on the cost side; and, for Standard Pacific, an important psychological and financial watershed wind-down and exit plan for hedge fund MatlinPatterson. The litany of why CalAtlantic made, and makes, sense is long, and with nary a structural flaw.

Structured as planned, Standard Pacific’s shareholders now own 59% of CalAtlantic, and Ryland’s own 41%. Each group picked five members for the new company’s 10-member board. Standard Pacific’s Stowell is executive chairman, while Ryland’s Nicholson serves as CEO and president, with day-to-day responsibility.

As many reasons that anyone—a board member, a loyal employee, a Wall Street analyst, an outside industry observer, or vested leaders of the two companies—could use to justify both the motivation and the logic of the deal from a rational analysis standpoint, one push-back sits there as the gorilla in the room of every discussion about mergers and acquisitions: Deals like this don’t work.

Especially bold ones, such as this deal, with two venerable, currently successful home building brands with more than 110 years and hundreds of thousands of homes sold between them, with established brand DNAs and thousands upon thousands of “this-is-the-way-we-do-things” processes and workflows and practices. What’s more, from the time the deal is announced, the clock is ticking.

Suddenly there is $70 million in cost-efficiencies to identify and extract; IT systems galore to migrate and sync up; a race to close and normalize, and painful choices about whom to keep in certain operations and whom to let go; back offices to combine; and organizational charts to make and remake, and remake again. And that’s only the start.

Deals that make sense on paper don’t work in real life if the two merging organizations can’t, or won’t, integrate. And, in this case, it had to be fast, or else it would risk foundering on the shoals of complexity, Wall Street impatience, a talent pool that could tolerate just so much disruption, and a housing recovery cycle that provides only so much fairway before the course gets tight and unforgiving. Plain and simple, CalAtlantic was as risky as it was rewarding.

For all the “whys” in favor of and the stars aligning around the Ryland–Standard Pacific merger into a single, top–ranked home building powerhouse, one or two “why nots” might have derailed the agreement at any stage, or clouded what, to all appearances, has been a case study in public-to-public merger strategy execution.

1965

Arthur Svendsen combines his financial talents with the home building expertise of Ronald Foell to create Standard Pacific Corp.

1967

James P. Ryan forms the James P. Ryan Co., which will become Ryland Homes. The company becomes the first builder in the nation’s first master planned community in Columbia, Md.; 48 homes are built in the company’s first year.

1973

A visionary collaboration with The Irvine Co. produces the prototype for what would become “The Irvine Lifestyle” and establishes a relationship lasting over 30 years.

1978

Ryland Mortgage Co. is created after Ryland acquires Great Financial Services.

1992

Ryland builds its 100,000th home 25 years after opening in 1967.

1999

Revenues reach $1.2 billion and Standard Pacific operates 12 divisions, including its newest in California’s Inland Empire.

2004

BIA of Southern California names Standard Pacific its Builder of the Year.

2005

Fortune names Standard Pacific among America’s 100 Best Companies to Work For.

2007

Ryland Homes celebrates its 40th anniversary and the construction of more than 275,000 homes since its founding.

2012

Company spends more than $500 million in land acquisition and site development; opens divisions in Raleigh and Phoenix.

2014

BUILDER gives Ryland Homes an A+ on its Big Builder 2014 Public Builder Report Card.

2015

The company celebrates its 50th anniversary of continuous operation.

Merger Sans Egos Equals Success

This is where a four-year friendship, hatched at events like the Joint Center for Housing Studies’ PAB meetings and incubated across the first few years of housing’s early recovery, comes into profound play. Nicholson and Stowell wouldn’t have made it past “hello” if their heads were as swelled as those of some of their strategic, larger-than-life peers. And, they couldn’t expect to lead a true integration of their respective 58- and 60-year-old companies without right-sizing their own egos.

“The reason this deal has worked much better than home builder public-to-public acquisitions have worked in the past is that the egos weren’t so large as to kill this thing,” says Stephen East, partner at Evercore ISI investment research. “[Scott and Larry] are evolving the leadership mode, and they’re working very hard with each other to make the model work.”

Ego. It’s such a tiny word but comes packed with so much power, and home building leadership born of the common practice of affixing a family surname to the company’s brand is famous for it. Ego accounts in good part for why there are 21 public home building companies today, and hundreds upon hundreds of companies that make up new residential construction’s still largely unconsolidated arena.

Were it up to capital investors, greater productivity and fewer, larger, more geographically distributed companies would—and will someday—capture more and more of new-home development and construction, well beyond the current 50% share, and would make for more straightforward investment analysis—fewer black-box real estate shenanigans and more transparent opportunity versus risk.

But egos, more often than not, prevent even the near occasion of merger discussion among home building’s public company leaders, let alone serious consideration of the values and benefits gained for stakeholders, customers, and so on. Rather, it tends to be unusual constraint, abnormal duress, and, ultimately, desperation that spark and spur the concession, which, evidently, is to stand down as CEO of one’s own home building company and hand over control to somebody else.

Clearly, a CalAtlantic versus a separate Standard Pacific and Ryland makes a lot of sense from an investor’s vantage point. The combination has “improved our cost synergies, and has been accretive to earnings,” Stowell notes, adding that the new entity’s heft derives “benefit from large-cap multiples” versus small-cap. Plus, by doubling up on revenue into the $5 billion–plus sphere, the company competes in an investment universe entirely new and distinct from the cluster of $1 billion to $3 billion firms with which it was formerly grouped.

Penciling out “cash and prizes” benefits on an envelope, napkin, or even an iPad Pro is one thing; engaging the respective boards of directors in the conversation was a pivotal step for both Nicholson and Stowell, taking place between early March and mid-April of 2015. It was during this discovery period that they each recognized that, as many benefits as there may have been inducing them to continue exploring, two issues were the hardest to confront.

“This [combination] needs to be not about Scott and me but about our whole, newly organized team of 2,800 people.” —Larry Nicholson

Also, one challenge wouldn’t have a prayer of being solved unless the other one was addressed—and clearly, concretely, sustainably resolved. That is: How would two CEOs—both of whom broke in and earned their stripes and became passionate as hands-on operational exemplars—split up the leadership of the new organization?

“The Standard Pacific board asked point blank, ‘Are you and Larry able to get along, each continuing to generate value for the company, and, at the same time, redefine the roles so that there’d be a clear division of responsibilities and accountability?’” says Stowell.

Nicholson adds, “Clearly, we agreed early on that there couldn’t be two CEOs, or co-CEOs, and everybody was in alignment on the need for clear role definition, an absolute partnership that leverages our respective strengths and sets up collaboration at every turn.”

Egos get checked at the door or the second challenge of integration—which continues to this day—is a moot point. “This needs to be not about Scott and me but about our whole, newly organized team of 2,800 people,” Nicholson explains. An integration initiative got underway with a gut-check across three stark understandings of the challenge.

First, integrations are highly complex undertakings, involving several simultaneous changes in current company business processes, organizational structures, and top leadership and management personnel.

Second, time is money. The speed of the integration is important and will be closely watched. Longer durations likely will lead to distractions, unrealized synergies, and potential loss of key talent.

Third, and perhaps most important, says Stowell, “integration is not a core competency for us, especially a merger of equals of this magnitude. While each of us has integrated bolt-on acquisitions into our systems, this type and magnitude of change is different given the goal of taking the ‘best of both companies’ and creating a new, more powerful company. This type of integration will vary depending on the strategic rational and specific imperatives of the merger and circumstances of both companies.”

The simple reckoning of “we don’t know what we don’t know” led Nicholson and Stowell to a level-set on the integration—systems integration, 300 initiatives around 1,200 discrete activities or practices, with 150 fully loaded people under a steering committee led by executive vice president/chief operating officer Peter Skelly and executive vice president/chief financial officer Jeff McCall.

“It’s an amazing way that we’re looking at every single one of our processes and practices,” Nicholson says. “We’re scrutinizing every one of them, mapping each to whether the Ryland practice is better or the Standard Pacific one is better, or third, maybe we need a brand-new practice to replace the old way at both places.”

“It’s far easier to set clear expectations and develop a strong culture at the beginning of the newly formed entity, than to try to recover or steer it later in the process,” says Stowell, who’s created his own, rather ambitious checklist of the results he’s shooting for, first of all by checking his own ego at the CalAtlantic door and working as Nicholson’s partner.

They’ll know if they were successful when:

- The synergies announced are achieved or exceeded;

- The new company is off and running without having lost key talent;

- The integration process has been perceived as fair and objective;

- The combined company is operating efficiently;

- There are no major problems with stakeholders: employees, customers, trades, investors, and so on;

- The integration process hasn’t lasted longer than expected;

- There are no substantial issues still pending;

- The motivation of employees is higher than before the merger; and

- The combined company can accomplish things the separate companies could not do by themselves.

That’s what can come of getting past ego.

It’s not on Stowell’s checklist, but affirmation that Nicholson and Stowell’s “one-team, one-focus” strategy was gaining traction among the troops came in a series of town hall visits to offices and outposts among the new empire’s 26 divisions in 41 metropolitan statistical areas across 17 states.

“Larry took me to Baltimore, one of the stronghold, old-school Ryland offices, with a long Ryland pedigree and people who’ve been making that division work for decades,” says Stowell, who stood by and watched as executives, associates, even clerical folks queued up to give Nicholson and COO Skelly greetings with a hug.

“I noticed two things,” says Stowell. “One was the immense amount of collegial spirit and emotional bond coming out in the team’s welcome of their leaders. The other,” he quips, “is that I got a little jealous, being a ‘hugger’ myself. So, I was happy that some of the team stopped to give me a hug as well.”

Now, hugs may sound trite in the context of a $5.7 billion merger. For Wall Street investors and analysts, scores upon scores of financial data points that populate spreadsheet fields may say enough about the combination to sustain or increase investment in the company. But their jobsite experience, community profit-and-loss track records, divisional tactics and strategy planning, and regional and national operations accountability give them a slightly different skew on the kind of performance transformation they’re currently overseeing.

“Three basic messages are these,” says Nicholson, who, although he may have repeated them dozens of times, speaks of them as though it’s his first mention of them. “One is, ‘Do the right thing,’ and the second is, ‘You’ve got to go out there each day with a will to win.’ The third is this: ‘We’re one team, one brand, period.’ ”

Subsuming two big-time home builder nameplates—whose brand equity combined amounts to 110 years of recognition and trust—into a single, unified, new trust mark takes guts. It takes recognition that, for something to be gained from the combination, something, too, must be given up. But customers—home buyer customers—trust people, and people, after all, are what make up every great home building company.

So, those hugs in the Baltimore regional offices—and in every other town hall meeting Nicholson, Stowell, and their brain trust held during their road show—counted. And that’s why Wall Street, whether it knows it or not, had best look at the CalAtlantic model for a public-to-public merger as one of true equals.

Economic rules and the history of other secular business communities suggest that—sooner or later—home building will consolidate further. Global finance, production capacity, building codes, and the evolving geography of jobs point to fewer large residential development and building enterprises. CalAtlantic got a head start on how to do it and why.