For Wall Street’s stakeholders, timelines matter most.

The shape of things to come, a V, a W, an L, even the jagged “swoosh” our own sibling company Meyers Research’s chief economist Ali Wolf scooped her peers on in an April 22nd outlook as to how COVID-19’s collateral economic damage plays out, looks at duration in 90-day increments. Fiscal quarters.

In life and in the hearts and minds and wherewithal of consumers, it’s milestones, not timelines, that matter most.

Duration’s Latin root conveys the time it takes to harden, to become steadfast, or solid. That’s not simply the passage of seconds, or minutes, or days, or fiscal quarters. In duration, some action continues, some phenomenon progresses to its resolved and completed form.

For home builders, why quibble over the difference between Wall Street’s take on whether the worst of consequences of COVID-19 has occurred already, and others’ alarm that we have yet to see the full extent of impact?

Home builders and their partners–capital investors and lenders, land developers, manufacturers, building trades, and distributors–work, by nature, as a bridge that spans Wall Street and Main Street, by way of local, regional, and national government.

Duration means all the world to home builders, because in what they do, currency time-releases its value. Dollars are either worth more earlier on in the building lifecycle, or less. It’s one or the other.

A real-world, real economy chasm–the magnitude of which even the smartest, most technologically-enabled, most studied economists can only throw blindfolded darts at guessing–lies ahead.

A strategic-level lending company executive we spoke with yesterday echoed the sense of humility in the face of such a grand unknown, acknowledging, though, a few instinctive suppositions from which to derive hopefulness.

“We had a big fall-off in 2018 going into 2019, and several dips and chops in traffic and momentum during the year last year before the big surge at the end of the year,” he said. “That choppiness and the volatility raised red flags for a lot of the builders, so many of them were already playing cautiously before all of this occurred. Those periods of softness and warnings may have readied them for some of what they’re going through now.”

That may be the case.

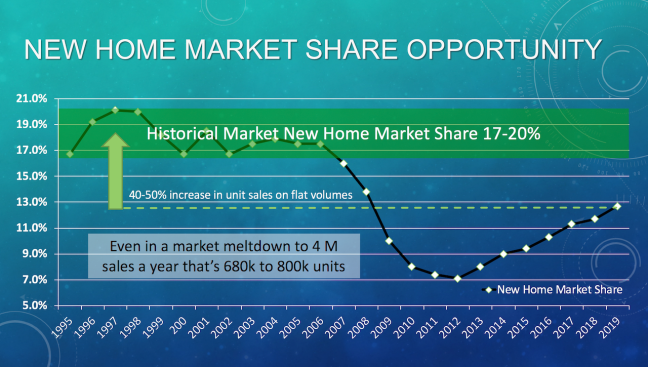

What also may be the case is that, as Builder Homesite chairman and CEO Tim Costello focused on in our #BuildersAreEssential web leadership training program yesterday, a long-overdue pivot in market share, from resales to new-home sales may buffer the harshest collateral blows for home builders and developers.

Source: Builder Homesite/BDX

New at a time where “used” or “existing” or “resale” convey a meaningful sense of risk, to health, to well-being, to the feeling of being able to prosper for the time ahead, potentially takes on value it could never have achieved in a “normal” housing recovery.

Will that shift work as a milestone in the real economy that sets itself apart from the timelines of a Wall Street economy that pegs this current 2nd quarter–from April 1 to June 30–as the worst of what we’ll encounter for business?

Main Streets–a FiveThirtyEight chart from 2014 noted that there are 10,902 of them in cities and towns and hamlets across the U.S.–will decide. Not, Wall Street.

We know this week that leaders of home building’s best, and brightest, and most caring, and, ultimately, most important organizations are taking action–eliminating costs and laying off team members–to try to get across a real-world, real economy chasm.

This is because, although many on Wall Street invest capital as though the worst is over, many, many more who reside on or near those 10,000-plus Main Streets, know the worst is far from having fully pronounced itself.

We can say to every leader in the position now to have to decide, to communicate, and to act on telling associates they no longer have a job, we know the feeling, and we’re right there with you. It’s a humbling moment, and being crystal clear that it’s the right thing to do to ensure that an organization can weather the chasm ahead, doesn’t somehow feel like any kind of consolation.

This piece–“How To Find And Practice Courage”–may offer some help.

It speaks of what leaders are called on to do at times like now, some of which is natural-born gift, and some of which comes from learning.

“Perhaps the best way to think of courage is to treat it as a muscle. Some people are born with better muscles than others, but everyone can improve their muscles through training and practice. ”

For what it takes, now, as a home building organization leader who has to reduce his or her workforce in order to size and configure the business for really rough times ahead, a Chinese proverb may be appropriate.

Question: “What is the best time to plant a tree?”

Answer: “30 years ago.”

Question: “What is the next best time to plant a tree?”

Answer: “Today.”