Home building acquisition deals make for one of the more important business trends in the residential development and construction space right now, for three reasons.

- One, what the transactions say and mean about buyer and seller motivations as the current housing recovery enters its stress-test stage, measuring duration versus amplitude;

- Two, what they reflect about an ongoing big-builder business strategy shift away from making money on horizontal development toward greater focus on pumping value into vertical execution;

- And three, further business model innovation opportunity accruing to larger, more scale-able, more just-in-time operations that drive price-and-value benefits directly to home buying consumers with less complexity, lower overheads, and greater profitability.

For the second time in two weeks, a national home building enterprise that had been almost totally absent from the last couple of years of accelerated mergers and acquisitions activity scored on a meaningful, local market transaction.

Then, it was No. 13-ranked Builder 100 company Beazer Homes picking up Atlanta private home builder Venture Homes for $65 million, improving Beazer’s penetration and volume among the fast-growing market’s entry-level buyers in the Northwest Quadrant of Atlanta suburbs.

Now, it’s KB Home–like Beazer, recently having emancipated themselves from some of the more cumbersome constraints of over-leverage–that signals that it too is back in the hunt for volume growth via acquisition. Recently, in early June, as Taylor Morrison announced it would acquire AV Homes, KB got a strong challenger for its coveted top-five position in the Builder 100. KB’s signaling here that it’s back out there on the acquisition dance-floor–and, given its low-spec, build-to-order business model–it means to protect its strategy by upping the ante in order to retain top-five market share rights and privileges in its operating arenas.

Landon Homes' Amber model rendering.

Deeper local scale, entry-level market exposure, and a firmer, “favored-nation” tie with a land developer–three motivators that have fueled the buyer-side of combinations and alignments large and small over the past 24 months–underlie KB Home’s quiet acquisition of most of Jacksonville, Fla.-based Landon Homes assets and operations last week.

The deal, reported Friday in the Jacksonville Daily Record, notes that 14 of Landon Homes’ communities will almost double the KB Home store count in the Jacksonville market, stretching south of downtown Jacksonville, including the Sawgrass-Palm Valley area, St. Augustine, Palm Coast, to Daytona Beach. Prices range from the $160s to the $600s.

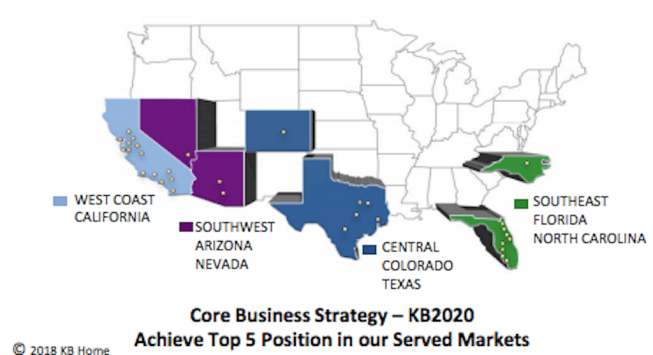

KB Home footprint, Q2 quarterly presentation.

According to BUILDER sibling Metrostudy, the combined volume of KB’s current Jacksonville operations and Landon Homes–the No. 15 ranked operator in a market whose 2nd quarter 2018 closings of 8,041 are running 15.5% ahead of the same period last year on an annualized basis–would boost KB Home’s top five position in the market from No. 5 to No. 4, with last-12-month total volume of 689 closings, just shy of Dream Finders Homes, one of the fastest-growing private home builders coming out of the Great Recession. Roughly half of KB Home’s deliveries over the past five years have been to first-time buyers, and now the “first-time buyer” marketplace includes both young adults and downsizing 55-plus near retirees.

“KB is looking to expand in strong entry level markets,” an executive familiar with the transaction told us. “Jax–and particularly St John’s county–is one of the best markets in Florida.”

Importantly, too, the transaction firms KB’s Jacksonville connection to further lot development, a microcosmic example of what we’ve seen on a much larger scale in D.R. Horton’s acquisition of Forestar, North American Sekisui House’s deeper bonding with Woodside Homes, Sumitomo’s acquisition of Crescent Communities, and Lennar’s spin-off and IPO of California land and development giant Five Point Communities.

The KB deal with Landon suggests a win-win that results in KB’s being able to quickly put inventory turns at a price range that fits its book into the within 24-month horizon, while Landon principals, including co-owner Jesse Killebrew, can take chips off the table.

“It was the right time,” Killebrew said when asked why they decided to sell. “The market’s good and things are good. I don’t want to sell when things are bad. I went through the whole recession … and my gut said it was time to go.”

A cash infusion–and the promise of more demand in the months ahead–from KB gives Killebrew great customer visibility for his Alsop Companies development firm–allowing him to operate within a safer zone with lenders in the event of a market turn in the two to three years ahead.

These moves, of course, are text-book cycle-timing best practice, aimed at securing access to a reliable pipeline of lots (options), while reducing the balance sheet risk of future land asset impairments should the market lose steam in the period 24 months from now and beyond.

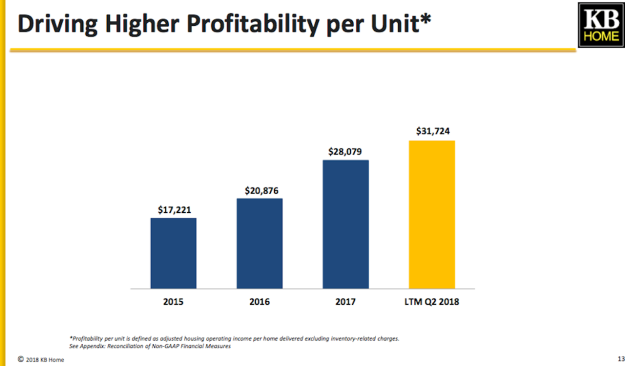

Slide from KB Home second-quarter 2018 quarterly presentation.

Moreover, given that both the big challenge and equally large opportunity of the current moment is about 1) tugging young adults into homeownership, and 2) pulling retirees out of their existing homes into new “forever communities,” most home builders’ skills must shift from land spec proficiency to design, build, data, and marketing wizardry. Per home profitability–irrespective of the noise of materials and labor cost increases and variability, and minus calculations and escalators for land appreciation–essentially means home builders have to learn to get out of their own way from a productivity and value standpoint, as NVR, Horton, and Lennar have made strides in doing.

So, the strategic shift on sustainable profitability from the “land” side of the business to the “house” side of it puts many builders more fully into the marketing, data, and intellectual property business they never had to embrace before as they do now.

Thing is, the luxury of innovation goes first to those who are able to reduce risk best and hit paydirt fast on good ideas that work in the field. They enjoy the ability to scale, clout with those who sell items and services and land assets to them, and mastery at closing the gap between themselves and a buyer with data and technology.

As this recent piece in the Wall Street Journal notes, “The Problem with Innovation: The Biggest Companies are Hogging All the Gains.”

Smaller, nimbler, more customer-centric players have to be very quick on the uptake of the good ideas, and shrewd about not getting drawn into the bad ones.

More builder M&A to come.