It’s a question every big home building company began to ask themselves the moment the big tax cut came through just before this past Christmas.

What to do with the windfall? Of course, many of America’s publicly-traded companies may opt to supercharge share repurchase programs with the one-time gain, bolstering their share prices. Few business sectors, however, match up to the level of urge for deals that home builders and residential developers unapologetically have racing through their veins.

Suddenly, weekly land committee meetings at the high-volume home building enterprises would have to have taken on a new, pulse-quickened tone, as a backhoe bucket-full of cash just got dumped into businesses that had been doing just fine operating off their own balance sheets, trying to meet a crescendo of demand in an inventory-starved mid-to-lower level price band of would-be homeowners.

The role that this “fun money”–billions of dollars in instant corporate wherewithal captured from the difference between prevailing 35% tax rates and the new 21% corporate level–has already been playing and will continue to play in land acquisition and mergers and acquisitions activity through 2018 can only be the subject of speculation at this point. Suffice to say that some of the “nice to have” deals buyers might have had their eyes on could well become “go-gets” thanks to the Trump tax bump.

Moreover, if you’re on the selling side of the land or entity equation, knowing there are a bunch of potential bidders out trolling for everything from portfolio management opportunities, to market share scale-ability, to incremental volume, to increased exposure to specific customer segments, to evolving jobs-driven economics, to you name it, … it has to be an exciting moment.

Growth plans, succession plans, and value optimization plans each become part of a new calculus, even as the current recovery–like an infinity pool illusion–looks like it can run at its current rate for some indefinite, far-off future distance. But that’s not usually what happens.

So home building operators who might be looking at their five-year plans and estimating that sometime during that period they might be interested in a sale have to be looking at the next 24 months–the cyclical inverse of the “falling knife”–to call it.

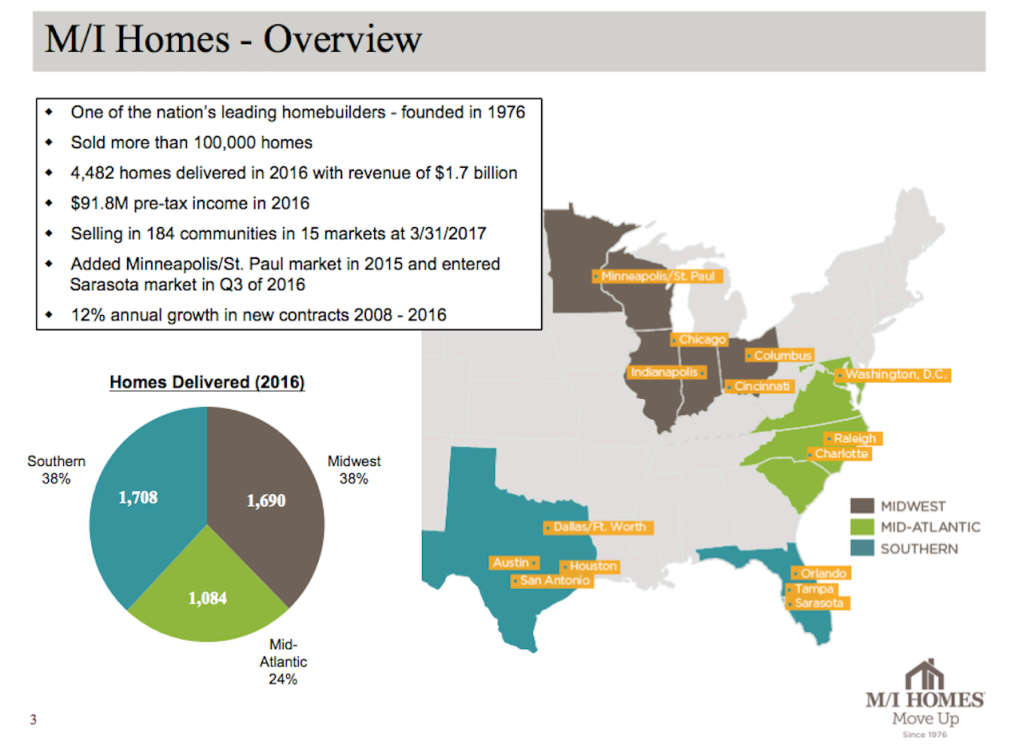

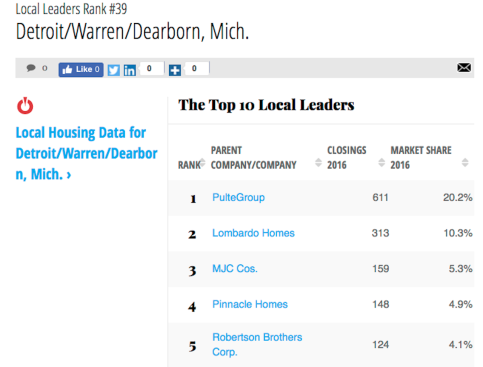

In Bloomfield Hills, MI-based Pinnacle Homes, M/I Homes has landed a trusted, adversity-tested, fast-growing Detroit-area operator, a top-5 market share, and a 1,000-lot pipeline with a 4-year-or-so horizon of sites in the hopper. Too, the deal brings 25-year vet and Pinnacle co-founder Howard Fingeroot, who supplies local intel and particular knowledge of the 55-plus, move-down customer segment that’s growing fast in the Southeastern Michigan marketplace.

Crain’s Detroit Business staffer Tyler Clifford reports:

“The housing market and new-home construction business has really been taking off,” Fingeroot said in a Monday afternoon interview. “It’s been a really rock-solid business. I think the larger builders see that. Builders like M/I Homes want to grow and see the opportunity in southeast Michigan, and for us, it’s fabulous.”

Fingeroot said Pinnacle had been approached by six homebuilders about a potential sale since the second quarter last year, when it hired [Zelman Partners LLC] for a recapitalization effort.

“In 2017, we closed (sales on) over 200 homes. We’ve grown (sales) every year since 2009, when after the financial meltdown, ever since then, every year we have grown larger and built out a larger and larger portfolio,” Fingeroot said.

“The Pinnacle team loves to come to work and I saw that same culture when talking to the M/I guys. It was a perfect fit in terms of the employees and for them to help them grow and develop in their careers. It was a really, really great fit.”

Pinnacle Homes last year detailed to Crain’s a strategy to target the growing “active adult” demographic with subdivisions targeting empty-nesters age 50 and over who are looking to downsize. The company built more than 210 homes in 2017, the release said, and controls more than 1,000 home sites.

When it looked, for the first half of 2017, as if Japan-based organizations and Clayton Homes might be the ones dominating the m&a dancefloor, Lennar, CalAtlantic, Century, William Lyon, and Taylor Morrison stepped up their game as acquirers.

Now that all of these players, including Clayton, are running around with a few tens of millions of dollars in tax cut windfalls, the m&a game gets really interesting at about this point in the cycle.