As the clocked ticked down to the end of 2017, 11th-ranked Builder 100 firm Beazer Homes USA emerged as a buyer in 2017, although not at the entity-level other public companies, like Lennar, CalAtlantic, AV Homes, and Century Communities did with their respective mergers and acquisition activity.

Beazer anted up $29 million to Carolina-area family-run private powerhouse Bill Clark Homes, for an asset portfolio of seven open-and-marketed communities, four in the Raliegh, NC, market and three in Myrtle Beach, SC, for a total of 450 sellable lots. San Francisco-based Builder Advisor Group represented Bill Clark Homes on the deal, which netted a cash warchest for the family-run company at a moment competing for lots in the Carolinas has reached a fever pitch.

“This acquisition is a win win for both companies,” says Builder Advisor Group ceo Tony Avila. “Bill Clark is able to focus on their core markets and Beazer increases its market share in two key markets of Myrtle Beach and Raleigh.”

Prior to the deal, Beazer ranked No. 9 in the Raleigh-Durham market according to BUILDER sibling Metrostudy through the 3rd quarter of 2017, with a reported 268 closings through the first nine months, and a market share of 2.5%. Beazer’s currently marketing homes out of 11 active communities (not including the four new Bill Clark neighborhoods there) in the Raleigh-Durham market, and seven in Myrtle Beach, with prices ranging from the $150s to the mid-$400s.

The $64,000 average per home site in the seven active Bill Clark communities suggests minimum average selling prices for Beazer from the high $250s and up. Here’s the statement from Beazer CEO Allen Merrill on the deal.

“This acquisition allows us to accelerate our growth in two existing markets, with an immediate contribution to both profitability and return on assets and no increase in leverage,” said Allan Merrill, President and CEO of Beazer Homes. “In addition to adding the new communities, we are pleased to welcome a number of new sales and construction colleagues who will enable us to pursue additional growth in Raleigh and Myrtle Beach in the years ahead.”

In its fiscal year ended Sept. 30, 2017, Beazer reported across-the-board modest performance improvement over the prior year:

- Net income from continuing operations of $32.0 million

- Adjusted EBITDA of $178.8 million, up 14.4%

- Homebuilding revenue of $1.9 billion, up 6.2% 5,525 new home deliveries, up 2.0%

- Average selling price of $343.1 thousand, up 4.2% Homebuilding gross margin was 16.5%. Excluding impairments, abandonments, amortized interest, unexpected warranty costs and additional insurance recoveries, homebuilding gross margin was 21.2%, up 60 basis points

- SG&A as a percentage of total revenue was 12.2%, down 10 basis points. This excludes a $2.7 million charge related to the write-off of a legacy investment in the first quarter of Fiscal 2017

- Unit orders of 5,464, up 3.2%. Average community count was 155, down 6.7% Dollar value of backlog of $665.8 million, up 2.0%

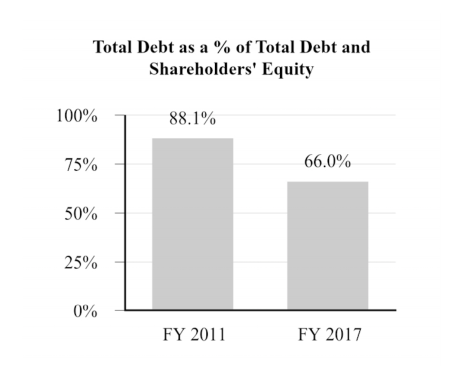

Noteworthy, in the earnings release, Beazer reported that its community count–155 active neighborhoods nationally–was down 6.7% vs. 2016. As one of executive management’s highest priorities since 2011 has been to reduce the company’s debt-load, spending on lot acquisition and land development has been heavily constrained. This year, as part of its full-year earnings reporting, management under CEO Allan Merrill was able to report to shareholders a strong case for improvement, contrasting this year’s results with the year he took over as CEO, 2011, both in revenue and profitability growth and reduced debt.

Source: Beazer Homes proxy

Significant Improvement in Total Revenue, Net Income from Continuing Operations and Adjusted EBITDA. Since fiscal year 2011, the Company grew revenue by 158.2%. During the same period, Net Income from Continuing Operations grew from a loss of $200.2 million for fiscal year 2011 to net income of $32 million for fiscal year 2017. Adjusted EBITDA (1) for fiscal year 2017 of $178.8 million reflects an improvement of $203.7 million, as compared to a loss of $24.9 million for fiscal year 2011. Since the fourth quarter of fiscal year 2011, Adjusted EBITDA over the trailing twelve month period has increased in 23 out of 24 quarters.

The Beazer team, under Merrill, has worked assiduously to dig out from an extraordinary financial and reputational handicap coming out of the Great Recession, and could be said to be one of the better come-back narratives of the the mid-to-latter recovery, thanks to financial discipline, deft management of debt maturities, and improved executional discipline. Compared with Hovnanian, which has struggled under the weight of its leverage, Beazer and KB Home seem to have found a sounder footing, although they’re not entirely out of the woods as the market has begun to hint of the first-signs of a downturn in the cycle in the next 24 to 36 months.

This is why Beazer’s move to capture market share improvement in several of its best-run market arenas is important, because with deeper scale and share, it can widen its profitability deltas using purchasing, trade-crew, and marketing resources more efficiently, with less windshield time for work crews and supervisors, etc.

We see more tactical moves such as this one now that Beazer’s been able to increase its revolver and re-term some of its debt, and, particularly, if it strikes a strong mark with its fledgling Gatherings 55-plus condo-community brand, Beazer could find its way back into the top 10 national builders once again.