Over 50 leading housing industry executives gathered for our second annual ‘Retooling Boot Camp’ two weeks ago in Scottsdale Arizona. I use this annual meeting to sustain the collaboration, learning, and commitment to action that begins at Retooling Workshops for housing industry executives. To begin things off I had each attendee answer the question, what change have they have observed over the past five years that has had the greatest impact on the housing industry? Before reading further, stop and ask yourself that question and see how your perception compares with that of our distinguished participants.

Okay, time’s up. Here’s how the responses from Boot Camp sorted out. Nearly 60 significant changes were identified that can be grouped into six key categories:

- Business Practices

- Home Performance

- Healthy Homes

- Design

- Quality Construction

- Sales and Marketing

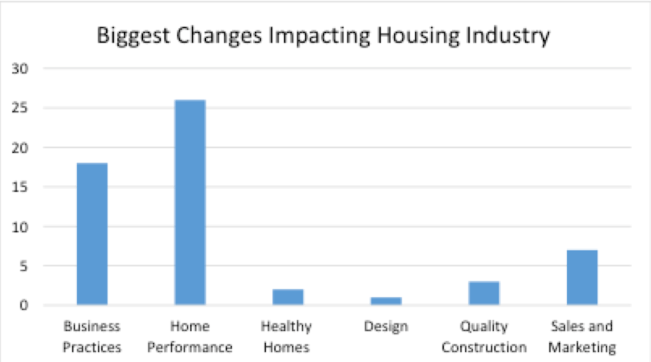

The number of changes identified in each of these categories is shown in the chart below. Based on this feedback, the biggest changes in the U.S. housing industry relate to Business Practices and Home Performance.

Figure 1: Biggest changes impacting the U.S. housing industry from input at 2016 Retooling the U.S. Housing Industry Boot Camp

The specific changes for all categories are shown in the table provided at the end of this article. Based on the greater detail provided in this table, the key changes cited for the Business Practices category include more informed home buyers (change forecasted to have even greater future impact in BuilderOnline article, It’s All App to You from October 17, 2016), labor shortages/price increases, and younger home buyers, and the key changes cited for Home Performance category include higher expectations for integrated building science and more rigorous codes.

This is a great look backward and appears consistent with feedback I have heard from extensive travels and networking with industry leaders. So what is the big key take-away? Without question what is most remarkable is how few big changes were cited in the Healthy Homes, Design, Quality Construction, and Sales and Marketing categories. That’s because these are critical components to the ‘housing-as-a-product’ business strategy we address in Retooling Executive Workshops. In fact, they are the key drivers to a superior homeowner experience (see BuilderOnline article, If it Can be Done, it Will from March 23, 2015). Yet the completely open and unbiased solicitation of input about changes supports the theory there is substantial lack of innovation in these critical areas. Thus, with confidence I will continue to keep focusing on them as the themes of this column and our workshops. There’s just too much profit being left on the table with consumers willing to pay for a better product experience.

Biggest Changes Impacting the Housing Industry Past 5 Years

Retooling the U.S. Housing Industry Executive Boot Camp #2

November 3-4, 2016 • Scottsdale, AZ

Business

- Off-site componentization

- Millennials

- Millennial buyers

- More informed consumers

- Home buyers using the internet make it an imperative to use effectively

- Informed buyers

- Educated consumer as a resource….not the same sticks and bricks

- Client’s ability to educate themselves on new products/costs via the internet

- Demographics of home buyer resulting in more multi-family

- How people buy and information available to them

- Consumer access to information

- Price appreciation

- Substantial increase in cost for custom construction

- Increase in construction cost per square foot

- Loss of labor force driving cost up

- Labor shortage and increased labor cost and effect on prices balance of affordability relative to buyer wants

- Exit of labor from industry faster than entering

- Lack of inventory driving costs sky high, but doesn’t translate to quality homes

Performance

- Diagnostic testing

- Ventilation

- Shift from just energy efficiency to energy efficiency + health + durability

- More rigorous Building code adoption

- Customer demand for higher efficient, better air quality, & managed comfort

- Single family production home builder participation in LEED for Homes in my market

- The growing specter of code mandated zero net-energy

- Consumer now desire energy efficiency

- Increased interest in resilience

- Increased air tightness standards

- Green building codes

- Buyers expectations for energy efficiency and health

- Interest in sustainability

- More stringent energy code requirements require trades to improve quality

- Integration of building science into codes

- Air barriers integrated with framing

- California 2020 new zero energy home regulation

- Consumer appreciation for energy efficient and healthy homes

- Better building materials available to make more efficient homes resulting in better living conditions for homeowners

- Improved energy codes and need for building science

- The increased appreciation of building science

- Impact of energy efficiency and code implementation

- Builder education on code compliance options and assembly cost

- Difficulty with ‘green washing’

- ENERGY STAR and efficient home brand recognition

- Regulatory changes how we design and install HVAC systems

Health

- Balanced ventilation to improve IAQ

- Healthy homes

Design

- Smaller homes

Quality

- Quality plus efficiency

- Lack of skilled labor pushing builders to simple packages and component based construction practices

- Increased interest in quality management (quality, cost, cycle time, waste)

Sales/Marketing

- Attention to energy savings and consumption

- Increased requirements and desire for energy efficiency

- Consumers’ knowledge of high performance homes – media, Internet, etc.

- Increasing awareness of True Cost

- Client definition of luxury (to include what’s behind the drywall)

- Idea of comfort is more important than energy efficiency

- HGTV creating distorted consumer expectations (cost and time)

This article is part of a series on housing innovation based on the author’s book, ‘Retooling the U.S. Housing Industry: How It Got Here, Why It’s Broken, and How to Fix It.’ This book examines opportunities to transform five key home buyer experiences: 1) Community, 2) Design, 3) Performance, 4) Quality, and 5) Sales. Each article features one innovation or business principle covered in workshops with builder executives. Find out how to participate in one of these workshops at www.SamRashkin.com.