D.R. Horton complicated matters for the board of directors of Forestar Group yesterday, as it offered to buy 75% of the company for $16.25 per share, or roughly $520 million–effectively a 14% better deal than the one set for a July 7 vote, a 100% sale to Starwood for $605 million.

The Forestar board may stick with the Starwood deal it already accepted on April 13, for a number of reasons, not the least being a $20 million kill fee owed to Starwood if the board goes with a “superior offer.”

Weighing in the balance, however, is not only the 14% premium to the Starwood bid, but a future value to shareholders represented in the scenario D.R. Horton is proposing. In this scenario, Forestar remains a public company in its own right, but with a gigantic big brother who’ll be a constant, and very profitable customer in the years ahead for what it is Forestar does, which is to develop, bank, and market residential lots.

Setting aside the complexities of the proposed deal for a moment, let’s take a look at what it means, especially at this moment in the housing cycle.

First, basics on Forestar. Here’s the way the company whose key stakeholders believe it will merge with Starwood describes itself:

Forestar is a residential and mixed-use real estate development company. At first quarter-end 2017, we own directly or through ventures interests in 49 residential and mixed-use projects comprised of approximately 4,400 acres of real estate located in 10 states and 14 markets. In addition, we own interests in various other assets that have been identified as non-core that the company is divesting opportunistically over time. At first quarter-end 2017, our remaining non-core assets principally include, 19,000 acres of timberland and undeveloped land (including mitigation banking), four multifamily assets and approximately 20,000 acres of groundwater leases in central Texas. Forestar operates in three business segments: real estate, mineral resources and other.

One may reasonably surmise that as a Starwood acquisition, overhead costs and many people would come out and, before long, Forestar would become a small percentage contributor in the Starwood empire.

The D.R. Horton scenario is quite different.

If Horton can pull off the deal, it has dibs on a potent breeder-reactor of lots funneling into a best-of-breed turner of inventory.

JP Morgan Chase home building and building products analyst Michael Rehaut describes the strategy like this:

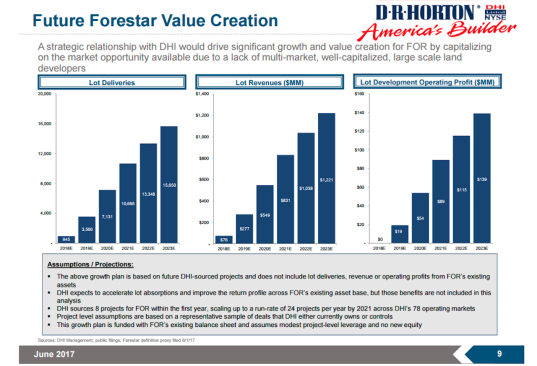

Strategic rationale. DHI expects this relationship to allow it to improve inventory turns and return on assets while maintaining its strategy of owning a 2-3 year lot supply and controlling remaining land through option agreements with land developers. DHI expects FOR’s lot closings and revenue sourced from DHI to grow to over 10,000 units and roughly $830 million by 2021 (along with roughly $90 million of operating profit), funded by FOR’s existing balance sheet with modest project-level debt and no new equity. By 2023, this could increase to over 15K of lot sales generating $1.2 billion in revenue and roughly $140 million of operating profit.

New land deals would be sourced through FOR’s existing land team, as well as in partnership with DHI under terms of a proposed Master Supply Agreement. Based on DHI’s proposed Master Supply Agreement, FOR would acquire, develop and sell lots to DHI and other builders. FOR and DHI’s teams would each source and present potential lot development opportunities. If deals are sourced by FOR, 50% of the lots would be offered to DHI on market terms and if DHI declines the offer, FOR could market and sell lots to other builders. For deals sourced by DHI, up to 100% of the lots would be sold to DHI and if an agreement cannot be reached, DHI would retain the opportunity.

D.R. Horton’s favored-nation relationship with Forestar would begin in markets where Horton has already established No. 1 to No. 3 ranking in marketshare–Texas, Colorado, Georgia, North Carolina, South Carolina, Tennessee, Wisconsin, Arizona, California, Montana, and Utah, and would secure immediate access to lot pipelines that would enable it to build on strength and clout. Forestar owns or has joint venture interests in 49 residential and mixed-use projects consisting of 4,600 acres in 10 states and 14 markets.

We’ve written this month on the value and benefits to deep market dominance here, and this move would be consistent with D.R. Horton’s playbook, which calls–unequivocally–for No. 1 market share in all of its operating markets, sooner or later.

Analysts are quick to note that the structure of the deal reflects best practice discipline around land acquisition, particularly in a stage of the housing cycle that many observers believe is winding into its latter “innings” of recovery, and could inflect toward a downturn in the next 24 to 36 months.

One particularly incisive comment came from Susquehanna Financial Group analyst Jack Micenko, who drew comparisons in D.R. Horton’s bid for Forestar to the Lennar-Five Point relationship, as separately operating publics with highly symbiotic interests. Micenko writes:

This announcement following on the heels of the successful Five Points IPO may be coincidental, but it shows smart builders remain disciplined and committed to a more “land-light” strategy coming out of the last downturn. While it’s unclear whether the company will be successful in their pursuit, it’s another tangible piece of evidence the US homebuilding industry is maintaining their discipline in the current housing recovery, with smart builders looking to own considerable stakes in land development companies with their own access to capital. Timing wise, what’s changed for DHI since prior conversations is that FOR has made material progress divesting much of its non-housing related assets, making them more of a pure play land developer. While the deal is small relative to DHI today (current lot position is less than 25% of annual DHI home deliveries), it’s the future platform that holds value in management’s view. Specifically, it allows DHI a “captive” land development arm that insulates the company from incremental land risk in a future economic downturn. Leveraged land positions put many builders out of business in the downturn, and this transaction would help insulate DHI from outsized risk while providing the company a pipeline for future development, as FOR will remain a public company with its own debt and equity capitalization. For this very reason, it makes sense that DHI remains a controlling shareholder, not an outright acquirer.

What remains to be seen is whether Forestar’s board will experience a change of heart as they see a night-and-day different future ahead of the company should they warm to the Horton proposal.

Among other threads of encouraging news, it’s good to see that former D.R. Horton ceo Don Tomnitz is still feeling his oats. If this opportunity does not materialize as Horton hopes, we don’t doubt that the strategy itself will reemerge in other options.