Over the past decade, there has been dramatic growth in the number of rental housing units, and much of that expansion has been realized for single-family homes. The question for those in the home building industry is what do these changes imply for construction going forward?

It has always been true that a large share of the U.S. rental housing stock consisted of single-family homes. For example, in 2005 there were 11.3 million single-family rental homes. In contrast, there were only 4.2 million rental units in apartment buildings with 50 units or more.

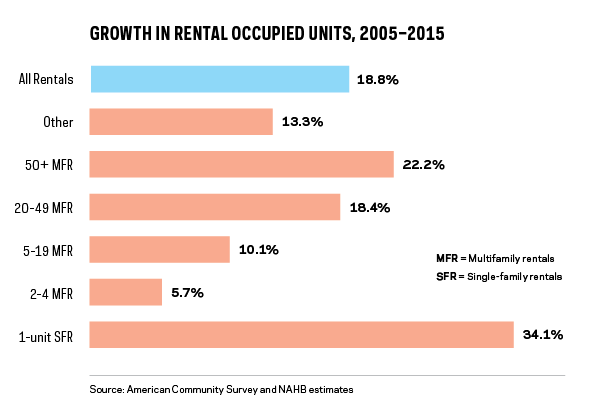

From 2005 to 2015, according to Census data and NAHB estimates, the single-family rental housing stock grew by 34% to a total of 15.2 million units. This was the largest growth rate experienced by any rental housing class. The second fastest was the 50-plus unit class, which expanded by 22%. Thus, much of the growth in rentership, and decline in homeownership, took shape in single-family homes. By 2015, almost 35% of all rental residences were single-family homes.

It’s also important to note that the vast majority of the nearly 4 million single-family homes that, on a net basis, moved from being owner-occupied to being part of the rental housing stock were existing homes. The single-family built-for-rent market, while elevated by historical standards, remains a small part of the industry.

NAHB analysis of Census data indicates that for 2016, just slightly more than 4% of single-family starts were built for rental purposes (constructed and held for the rental market), a total of just 34,000 homes. Over the past few decades, the average for this market has been just under 3% of starts, so the market is stronger compared with historic norms but still a limited share.

Similarly, while media attention has been paid to institutional ownership of single-family rental homes, such homes are mostly owned by individuals. According to economist Laurie Goodman of the Urban Institute, institutional ownership of single-family rental homes only make up less than 2% of the total market (less than 300,000 homes). The industry remains dominated by “mom and pop” owners.

There is some concern in the industry that the growth in this market acts as check against homeownership, that in effect supply creates its own demand. I think this concern is somewhat exaggerated. The growth in single-family rental units reflects demand trends of recent years, particularly declines in homeownership for members of Generation X.

What does this mean for builders? NAHB’s forecast is for continued growth in single-family construction as the industry over the next few years grows back to 1.3 million annual single-family starts. Our modeling indicates that some builders, in some markets, will be able to benefit from elevated levels of single-family rental construction. But on the whole, the market will remain a small part of the home building industry. The for-sale model will continue to dominate in the years ahead.