Hovnanian Enterprises (NYSE:HOV), Matawan, N.J. late Tuesday disclosed in an SEC filing that it will be reorganizing its structure, shedding employees and gradually pulling out of the Chicago market due to the economic impact of COVID 19. It’s COO, Lucian T. Smith III, also announced his November retirement.

In the filing, Hovnanian stated, “Given the uncertain economic environment, and consistent with many national home builders, the company took measures to preserve cash by delaying certain land purchases and land development activity and beginning work on unsold homes. In light of recent record unemployment levels and other indicators of a potential recession, the company is taking difficult measures to right size its organization to prepare for a further potential economic slowdown. This strategy comprises several components. First, it is streamlining its organizational structure by transitioning from three home-building operational groups to two. Additionally, Hovnanian is consolidating several business units, resulting in the reduction of three divisional offices. Additionally, given the challenging conditions of the Chicago market for several years, the company has decided to gradually phase out of that market as it sells through its existing Chicago communities.”

It continued, “In light of the challenging economic environment arising from the COVID-19 pandemic and in connection with the strategic decisions described above, the company will be taking measures to reduce its overhead expenses through a combination of furloughs, layoffs and other cost reduction measures. Hovnanian expects these steps to reduce its annualized overhead expense by approximately $20 million. The company expects to take a charge of approximately $3 million for severance and other related expenses in the third quarter of fiscal 2020.”

“As the market rebounds from the pandemic, the company believes that this new organizational alignment should allow it to be even more cost-efficient in pursuing its growth plans and should result in a more rapid repair of its balance sheet.”

The company said new home sales began to slow substantially starting in mid-March. Since then, the company’s weekly consolidated sales pace has rebounded from the low in mid-April of approximately 42 homes (minus joint ventures) to a pace of approximately 145 homes over the most recent two weeks, and May month-to-date contracts are ahead of the same period last year.

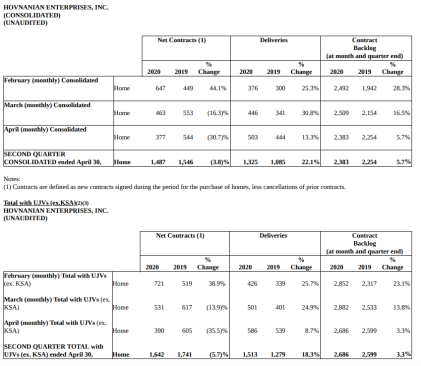

“While COVID-19 had an adverse impact on the company’s operations for the fiscal second quarter, deliveries were still up significantly, both for the quarter and for the month of April, as compared to the prior year periods,” the companys stated.

Hovnanian’s total liquidity as of April 30, 2020 was $247 million, which is comprised of $233 million of cash and cash equivalents and $14 million of restricted cash required to collateralize letters of credit.

On May 15, 2020, Lucian T. Smith III, chief operating officer of the company, notified the company that he intends to retire effective November 30, 2020. The company said it does not intend to appoint a successor.

In the 8K filing, Hovnanian provided the following operational metrics: