Seven days from now, Federal Housing Administration mortgage insurance premiums that borrowers pay on FHA-backed loans are scheduled for a small cut.

The reduction–intended as a well-earned, parting “gift” of the Obama administration–would trim premiums for Mutual Mortgage Insurance Funds on FHA loans by one-quarter of a percentage point for most borrowers.

Whether or not the cut will happen next Friday, given a brand new administration’s outlook on the soundness of judgment on policies–including housing finance–of the outgoing one, is reported to be in question.

The argument stems from interpretations as to the relative health and solidity of the FHA’s reserve funds, and whether a reduction in MMI premiums would put those reserve funds at risk. It seems that the lenses of judgment and evaluation of the move may bear a strong correlation to partisan politics.

So, some believe that a 25 basis point reduction in MMI for FHA borrowers may imperil the FHA risk reserve funds while others believe those funds are sound and growing, and that working Americans have earned a shot at homeownership with a slight nudge from housing finance policy.

The slight nudge, when it comes down to it, is really slight on a loan-by-loan basis, but it could add up.

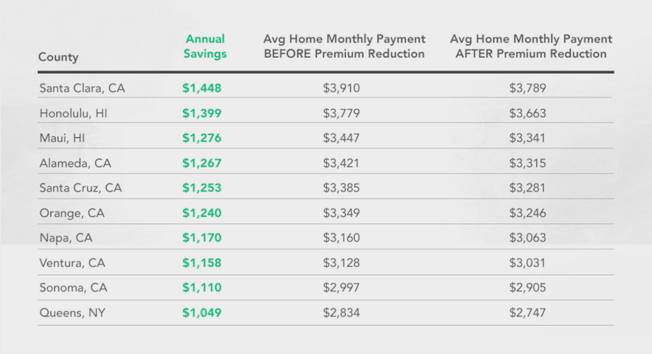

ATTOM Data Solutions vp Daren Blomquist looked at the math and found that borrowers across the country could potentially save an average of $446 a year under the new mortgage insurance premium reduction. That’s about $37 a month. That’s material, in monthly payment terms, to some buyers. In some–i.e. expensive–markets, the savings is noteworthy, and could easily impact whether prospective buyers buy or not.

Blomquist carries out the calculation as follows:

Over five years the average savings would add up to $2,232, and over 10 years the average savings would add up to $4,463.

Blomquist also notes that historically, an FHA premium cut comes with a boost in FHA loan activity–effectively opening up the credit box for would-be borrowers.

What this all gets down to, given that home builders may have already modeled their budgets, sales volume forecasts, pace per week per community, and perhaps even some new community openings aimed to attract FHA buyers, etc. for 2017, factoring in the FHA premium reduction, now, they’ve got two choices in light of word that the FHA cut may be rescinded before it even happens next week.

One is to re-forecast–clipping projected sales volumes, re-looking at starts-per-store in FHA-range pricing tiers, and re-shifting emphasis to higher ticket product and communities.

The other, perhaps tougher and more counter-intuitive tack might be to double-down on that lower price tier product, especially when it’s likely that other builders might ease off on their focus on those FHA buyers in light of the housing finance policy 180.

What does that mean? It means that if it takes cutting monthly payments by between $40 and $50 to stimulate more sales among potential FHA buyers, how are you going to accomplish that without the benefit of a housing finance policy gift?

If a $446 per year gift is enough to stimulate some buyers to come off the sidelines vs. staying on them, some builders will find a way to keep that incentive in place even if there’s not FHA premium reduction next Friday as currently scheduled.

And, the thing is, you probably already know who those builders are in your market. They’re already mining the FHA borrower universe while most peers are still constrained by local land regulation and their own product programs and operational processes to compete there.

The Wall Street Journal reports that FHA lending by non-bank finance sources has once-again reverted to red-flag status when it comes to risk. What we don’t need now is another destabilizing event to wipe out the hard-gained recovery of the past four or five years or so.

We think that progress in housing’s recovery has more to do with operational excellence, solid locations, good prices, and compelling designs in new homes and communities, than any national policy or housing finance changes’ impact. The good news is, there are already signs and examples of this occurring in some markets among some builders.

No pressure, but it’s all on you.