When there are 10 or so significant public home builder mergers and acquisitions deals in the home builder space in a 12-month period–as there were last year, it’s considered a pretty normal year in terms of such transactions.

Estimates for 2017 from pretty authoritative sources suggest that, by the time the end of December rolls around, we’ll have seen 15 or more transactions valuing in at $50 million or more. Right now, geographical markets we’re hearing are most active for m&a are in the Southeast and the Northwest, but no region is off the radar–not even Pittsburgh–when it comes to opportunity and need converging.

We’ve looked at three principle kinds of buyer-side players currently trolling for deals, and touched on their motivations. But over the next week or so, we’ll take a deeper dive into what’s motivating each.

First up, we’ll take a look at strategic buyers, the big publics, and what’s behind their continued hunger for operators and their land assets in selective markets.

For starters, let’s examine National Association of Home Builders economist Stephen Melman’s take on Top 10 Publicly-Traded Builder Share of the single-family for-sale new-home market for some helpful context.

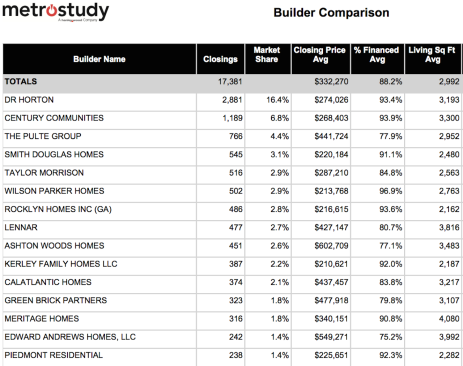

Melman notes that of 559,000 new, single-family, for-sale units sold in 2016, a top 10 public builder captured almost one in three of them (27.4%). D.R. Horton alone accounted for 7.2% of new single-family for-sale units, and in one of America’s hottest markets, Atlanta, for instance, Horton built up market share of 16.4%, according to BUILDER sibling company Metrostudy.

Metrostudy analysis for Atlanta MSA, for 2016

Melman reaches a conclusion as he looks at the national data that is certainly arguable. He writes:

“The often held small builder concern that the large national companies will take share away has not occurred. The residential construction industry remains primarily a sector dominated by a large number of small entrepreneurs.”

Melman supports this conclusion with a logical assertion that public company advantages are their balance sheets, economies of scale in what they buy, and their marketing clout and deeper lot pipelines. Private companies, he counters, have better local intel on all levels–from land sellers to home buyers–which gives them a more nimble, service oriented advantage over publics.

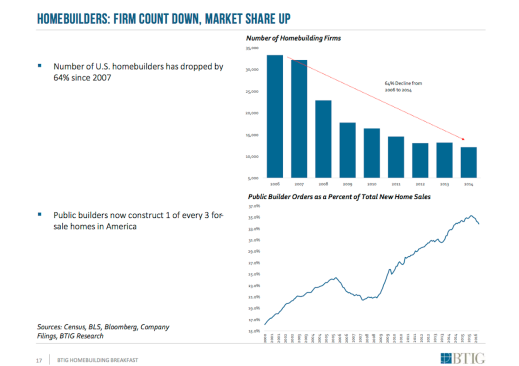

Still, if you take a look at either Wells Fargo analyst Stephen East’s analysis of his “Builder Composite,” a cobbling of permit data from 31 markets that represent 45% of all residential permits, or you look at BTIG analyst Carl Reichardt’s take on the “top 50 metros” for home building, you may reach a conclusion different than NAHB economist Melman does.

At least where big public builders operate, big public builders are showing signs of dominance. Here’s a Reichardt chart that shows how the balances tip when you look at the parts of the country where public builders have their operations.

Now, private home builders may be nimble and they may be quick, and they may jump through hoops to make their names stick in these markets, but, when it comes down to it, competing in them, except for the very strongest, is going to get harder and harder.

So, the biggest of the big builders have grown in market share, and, for some time now, the realization has been setting in that the “low hanging fruit” era of the recovery, consisting of the ability to fix many of the broken deals and add value to many of the distressed deals of the Great Recession, is over and done with. So the quick, quantum-leap volume increase days are out, and the hard-working, more complex and tricky deals come into play.

This is the kind of moment when a deal that pencils for one builder doesn’t necessarily make sense as a fit for many or all of the others. The urgency or motivation on one side creates an internal rate of return model on the other that works, or at least seems to, but wouldn’t meet some of the others’ hurdle rates.

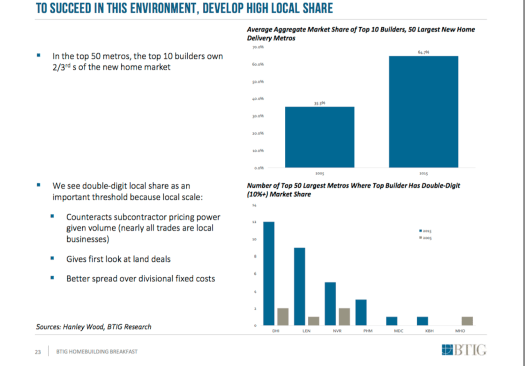

A motivation or source of urgency that makes a lot of sense to us when it comes to the public builders is a notion BTIG analyst Carl Reichardt refers to as deep local share, where a builder penetrates a faster-growing market with comparably outsized volume of units in order to gain profit margin advantage.

The greater the market share, Reichardt reasons, the more effect the builder can be at leveraging volume for better labor capacity access and pricing, getting a “first-look” off market at land deals, and an opportunity to absorb divisional overheads through more volume in a true “more for less” model.

So, we’ll go out on a limb and suggest that, although Japanese and Chinese organizations and Clayton Homes remain as formidable players in home building’s m&a arena this year, big public builders will likely account for 60% of the deal activity in 2017. Opportunities to gain “deep local share”–where a big builder can add not only a land asset with immediate new community potential, but a human asset with an ecosystem of relationships with trades, land sellers, real estate agent friends, and trusting current owners as table stakes in the deal.

Stay tuned as m&a fever plays out and lifts home building consolidation up one more notch or two before we’re done.