An engineer contemplating punctuation is a dangerous thing. Trust me.

We are better off with Greek symbols, like Alpha, or superscripts, like squared or cubed, than we are with periods, exclamation points, or question marks.

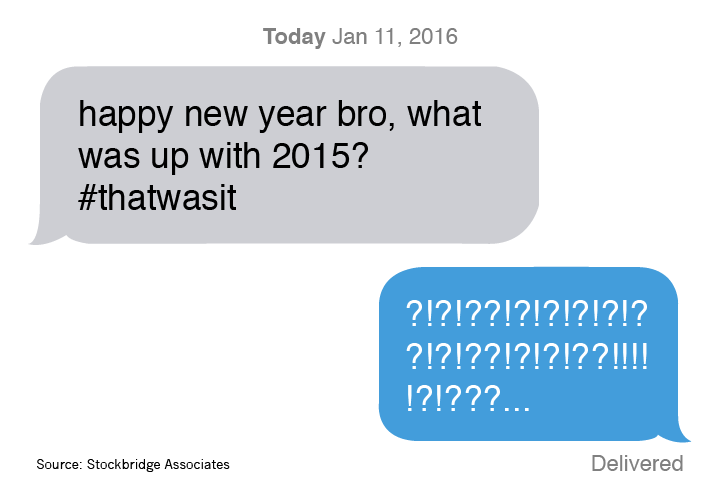

As I was thinking about the end of 2015 and the start of 2016, punctuation came into play as I was fiddling with a headline and my own confusion as to where we are in the residential housing business at this juncture.

At first, I contemplated the declarative phrase “That was it.” with the certainty enabled by a period as punctuation.

It was a sign of resignation. We had reached the logical zenith of this housing cycle and we had only the downhill slide ahead of us. After all, statistically we are well past the median point of housing recoveries.

Speaking with many builders this fall, other than those in California, many saw a pronounced slow down in sales in the late summer and early fall. With sales sliding, incentives were growing again and margins were taking a hit to keep even the meager volumes they were seeing.

These are the signs of the beginnings of a downturn, for sure. Strategically, home builders should be pulling in their land acquisition horns and beginning to pare down the overhead, remembering the lessons from the not-too-distant past.

Standby for heavy rolls!

Then I took a look at some of the housing start data (at least through November).

My back of the envelope guess for December being thrown in, it looks like we should finish 2015 with 1,142,000 housing starts: 742,000 single family and 400,000 multifamily. Single-family starts would be up 14.5% from 2014 and total starts would be up 13.8%. Additionally, the proportion of single family starts would, for the first time in nearly six years, be improving year over year: up to 65% from 64.6% last year, but still down from the 70%+ level before the recession.

In this instance of hope, my headline became “That was it!” and adopted the joyously triumphant exclamation point as its punch in the air. We were past the darkest hours and light (at least for single family builders) lay ahead. The slow, but sure, convalescence of the single family industry was upon us.

However, as I read through the macroeconomic situation that included an apparently slowing China, a strengthening dollar, statistical full employment with no apparent near-term improvement of wages in the US, shaky consumer confidence, despite great gas prices, and a gnawing feeling that the US way of life was more vulnerable than ever, I got confused again.

Once again the headline shifted to “That was it?” with all of the disappointment and incredulity that the twisty-turn question mark could invoke.

Somehow, maybe we have seen the best that this recovery could offer, tepid though it was. The return to the “average” of 1.6 million housing starts or the peak of 2.0 million that all had anticipated and geared-up for is still an illusion on the horizon: the “wait ‘til next year” promise that Chicago Cubs fans get every October.

Perhaps all of the changes that were made to make the housing and mortgage markets safer for consumers have in-fact made the for-sale housing industry permanently smaller, supply even tighter, and affordability (or lack of it) a topic from Portland, Maine to Portland, Oregon.

Maybe living with the folks well into middle age, not owning homes as part of the American dream, and renting for life are part of the new normal that we just ought to accept under these new sets of operating rules.

I still am not sure what the correct and appropriate punctuation for the headline should be. I am still confused with both positive and negative data that reinforces each position.

What I do know is that, despite all of these challenges, overwhelmingly US residents want to own their own homes. I still firmly believe that there will be new mechanisms that will enable this to happen in ways that are not fully apparent to us right now.

I believe that entrepreneurial juices will win in the end and there will be new business models that are developed that make it possible.

So, perhaps I should adopt a wholly new punctuation of hope, maybe the hash tag (#) of Twitterdom, to reflect the belief that, although we may be in confusing times right now, I believe that new approaches by a new generation to our issues will prevail and the true headline for 2016 should read: That was it#

Here is hoping that we all can look back a year from now on a 2016 that positively surprises all of us.