syn·er·gy

ˈsinərjē/Submit

noun

the interaction or cooperation of two or more organizations, substances, or other agents to produce a combined effect greater than the sum of their separate effects.

A top three market share in an active new-home market matters.

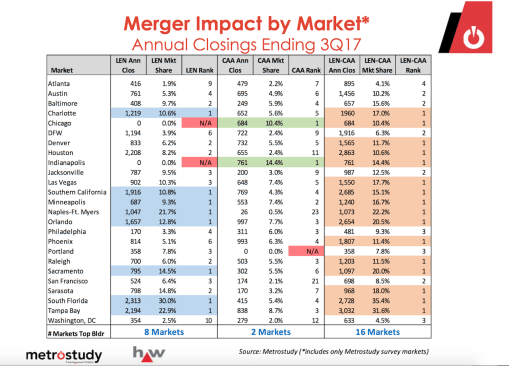

That’s one conclusion it’s impossible not to draw in the wake of the blockbuster deal the nation’s No. 2 and No. 5-ranked builders struck last week to merge CalAtlantic into Lennar, with 7% of U.S. new-home sales, and creating in one fell swoop a high-volume super power race for home building dominance with D.R. Horton.

Otherwise, how will Lennar manage–in keeping with its profitability track record–to generate $165 million in direct cost savings and $85 million in SG&A savings in the 24 months following what it expects will be a year-end closing on the deal?

First, let’s take a look at Metrostudy analysis of the effect of the Lennar-CalAtlantic combination, a deal whose per-lot cost would clock in–subtracting for debt–at about $138,000 per home site across the national portfolio, with a healthy concentration of California lots.

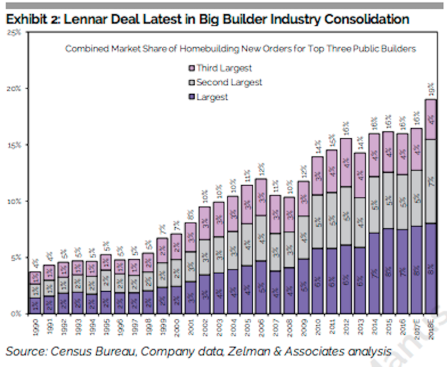

The Z Report, a twice-monthly compilation of analysis and insight into housing’s most important trends and events from Zelman & Associates, notes that beyond the posted sale price, Lennar’s acquisition of CalAtlantic–measured as a function of a last-12-month total of nearly 15,000 units with home building sales value of $6.7 billion–is the largest M&A deal in home building history to date, by far.

The Z Report (which you can sign up for a free trial of by clicking here), also zeroes in on the power of clout:

With permission from Zelman & Associates.

Based on our existing forecasts for Lennar, CalAtlantic Group and the national production new home sales market, we estimate that the combined unit market share of the new entity in 2018 will be approximately 8% … While homebuilding is certainly a unique industry with respect to mergers and acquisitions (M&A) given that the most valuable asset often lies in the land portfolio that has a finite life, we believe it is telling that the biggest builders in the country, with a legacy of M&A, have consistently accumulated market share over the last 300 years. In our opinion, establishing the requisite infrastructure to consistently replenish land becomes more complicated as entities grow. However, like most other industries, complication also brings scale to leverage refined processes, purchasing power and infrastructure costs, which we expect to be key to the success of the Lennar-CalAtlantic Group combination as well.”

Top ranking market share translates into an opportunity for deeper scale, a leveragable business competency that can lead to both stronger profitability on current inventory turns and stronger odds of being able to sustain those margins when new inventory comes into the lot pipeline.

A builder who gains deep scale in a market can ensure skilled trade companies that serve that market not just visibility and consistency in demand for their services. Rather, it’s an iron-clad deal that makes them money that will improve the likelihood of their loyalty, their speed in completing their tasks, and the quality of their work.

This is especially relevant right now, as some of the more “transient” trade workers–roofers, dry-wallers, and some of the finishing trades–are hearing the siren song of appeal of high-paying “insurance jobs” in Houston, South Florida and Puerto Rican communities hit hard by Hurricanes Harvey, Irma, and Maria.

What’s more, deep scale in a market and submarket improves geographical connectability and logistics among neighborhoods under construction, impacting how trucks are loaded and timed for distribution of materials to job sites, not to mention the volume savings on products and materials through national and regional sourcing and purchasing contracts.

Market share clout also allows Local Leaders opportunities to pencil deals differently than others with less presence in a market. The greater the operational concentration, the more flexibility a builder has to make internal rates of return on lot deals work, whereas a company that has scanter market share would apply hurdle rates with less wiggle-room.

This would suggest that developers and other land sellers in each of the operating arenas might find it advantageous to strengthen their ties to such a customer for the same reason building trade firms would.

Lennar CEO Stuart Miller addressed this point in a call with institutional investor clients and analysts last week, just after the $5.7 billion deal was announced. In answer to a question from Stephen Kim of Evercore ISI, Miller said:

The compatibility of these two companies and the strategic combination is all of the markets that we know, all of the product that we know, and have in our arsenal, and we have seen repeatedly over the years that where we have scale and concentration in local markets, we can garner efficiencies through a combination of the products that we’re familiar with and Everything’s Included operating strategy, we’re able to drive cost down or at least hold them at bay, and improve margins.

And this combination enables both sides of the equation to do that which we might not be able to do individually through concentrated scale at a local level. So that’s the beginning part and it’s through that concentrated scale at a local level that we drive the lion’s share of our synergies.

After all this, a question that might arise, at least among big-time investors in home builder is this: are there a quarter of a billion dollars of “synergies” out there for every 15,000 new-home orders, or $6.7 billion in home building revenues?

The answer’s probably yes, but that it would take companies at least as well-run as Lennar to capture them and turn them into topline growth.

Another–less evident–potential benefit emerges out of greater scale achieved through market share gains in concentrated geographical markets: manufacturing capability.

In the post-announcement call with investors and analysts, Ivy Zelman asked about “backward integration.” She asked specifically whether Lennar strategists foresee a scenario that takes them in the direction of an NVR-like investment in off-site manufacturing in plants whose automation allows them to secure overall deliveries more efficiently.

Lennar president Rick Beckwitt and chief operating officer Jon Jaffe each spoke positively about this scenario for Lennar:

Beckwitt:

It’s something that Jon and I have been spending a lot of time on over the last several months. There’s no question that the scale that we’ll have in some of our markets will make doing some of that lower level integration manufacturing assembly really, really pencil out and I think it’s too soon to get out in front of us. I think it’s a great question. You’re always thinking about the right thing, but I would say stay tuned at this point.

Jaffe: It definitely opens the door of the local scale to look at a market like Florida, Ivy, will me almost, you know, 15,000, deliveries in Florida. That definitely creates opportunity to explore where there are cost savings and efficiencies from doing that and we’re really excited because we’ve got strong leadership in that area. Paul Dodge who’s an industry veteran on this has on both sides of the equation, both the builder and the supplier, Kemp Gillis who’s been through both the Pulte-Centex combination and the Stan Pac-Ryland combination. We really have the resources to be able to, I think, apply the right kind of thinking to see where that make sense and take advantage of that opportunity.

Want an ideal opportunity to explore for yourself the synergies that can be achieved via local market share consolidation, and the potential ties to integrated offsite manufacturing as a part of the business model?

At Hive, Ivy Zelman will be there, offering insight into land strategies for this stretch of housing’s recovery cycle, as part of her Discovery session with Hive Dean James Chung, Reach Advisors’ principal and founder.

Their Hive session will focus on data insights to believe and bank on in a real estate investment environment where data is critical, abundant, and, yet deficient.

James and Ivy, along with Rancho Mission Viejo senior VP for community development Paul Johnson, Jeff Handlin, president of Oread Capital, and Issi Romem, BuildZoom chief economist, will explore data’s role and responsiblity in decision-making around business gains from concentrated scale. Space is limited and going fast, so register now for Hive by clicking here.