From Seth Godin, human beings are good with “now,” and terrible at the future when it comes down to buying value. Here’s how he phrases it:

“We move up all the imagined benefits and costs of something in the future and experience them now. That’s why it’s hard to stick to a diet (because celery tastes bad today, and we can’t easily experience feeling healthy in ten years). That’s why we make such dumb financial decisions (because it’s so tempting to believe magical stories about tomorrow).

“If you want people to be smarter or more active or more generous about their future, you’ll need to figure out how to make the transaction about how it feels right now.”

Hence, as he says, “It’s almost impossible to sell the future.” In a sense, the assertion gets support from another master observer of how humans behave and decide, Daniel Kahneman, in Thinking Fast and Slow, where he says, “Nothing in life is as important as you think it is when you are thinking of it.”

How Godin’s assertion plays out in the world of selling new homes, or in the world of new home builders selling local community planners and officials on new-home neighborhoods and projects is fascinating.

This matters in connection with a “critical path” issue in builders building affordably-priced housing.

If local, county, state, and other officials were “good at the future” and proficient at understanding the benefits of value in the future, then resistance–in the form of fees, delays, compliance to design guidelines, etc.–to development where it’s needed and to the extent that it’s needed would be less.

Look at the data, for instance on geographic mobility and in-migration in the United States. Here, the U.S. Census tells us that the 11.2% of Americans who moved from one residence to another in the year from 2015 to 2016 was the lowest percentage of mobility on record.

Moving the lens in further and deconstructing movers into their respective “housing tenure” segments, Census data reveals that a startling piece of this trend focuses on people currently renting. Census analyst David Ihrke notes:

Renters experienced a greater decline in their mover rate compared to owners. Renters began with a mover rate of 35.2 percent in 1988. By 2016, this rate had fallen by over 10 percentage points, down to 22.9 percent. This represents a 35.0 percent decrease in the mover rate for renters between 1988 and 2016.

Now, what does this have to do with local officials “buying the future,” vs. not? How is this connected with the issue of builders building affordably-priced homes and neighborhoods?

Richard Florida, CityLab demography guru, helps shed some light on these questions here. He writes:

Zoning laws, construction caps, and subdivision regulations limit the supply of housing in the most innovative and productive cities, ultimately driving up prices and making it unaffordable for people to move there.

The economists Chang-Tai Hsieh of University of Chicago and Enrico Moretti of the University of California at Berkeley estimate that these restrictions have cost the U.S. economy between $1.6 trillion and $2 trillion in lost productivity and output. These cities and metros are also the best opportunities for low-income families and their children to move up the economic ladder.

Florida’s comments here spring from taking a look at new research from Yale Law School researcher David Schleicher, whose “Stuck in Place: Law and the Economic Consequences of Residential Stability,” spotlights ways policies may be inhibiting mobility and economic growth as we speak. Schleicher writes first that policies that block geographic mobility and migration between states stifle national economic growth, and second:

“…That governments, mostly at the state and local levels, have created a huge number of legal barriers to inter-state mobility.”

Here, researchers at the Cleveland Fed note a strong correlation between mobility–as observed in boom towns related to oil extraction–and financial well-being. Their conclusion:

Geographic mobility could have quantifiable benefits for consumer financial health.3 However, it is important to recognize that many individuals could have limited opportunity to relocate when local economic activity declines. Some family or personal circumstances can make relocation infeasible. Yet when the opportunity for relocation is plausible, there are tangible economic benefits that policymakers can consider when concerned with consumer financial health.

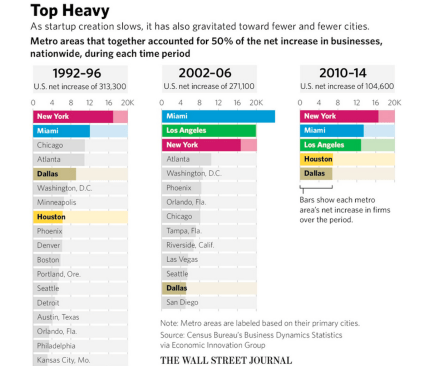

What’s more, we can see the impact of these inertial forces on one of our nation’s critical economic lifestreams, both practical and symbolic: entrepreneurialism. Wall Street Journal staff writer Janet Adamy writes that business start-ups are not only way down, they’re hyper-concentrated in five markets that are prohibitive to move to:

For most of America’s history, workers simply uprooted and moved to where the jobs were sprouting up, but the high cost of housing in economically booming areas, and the advanced skills they demand, is now hampering that.

Now, getting back to the issue of how good or bad we are with the future.

Just as home builders need to consider Godin’s assertion when it comes to selling homes to people–which is in many ways, selling them a future they will value, the strategy and skill-sets of builders and developers these days must also include selling localities on a future they’ll value in new neighborhoods of the present.

People need to be persuaded that having new homes and new, affordably-priced communities “in their backyard,” is not exclusively a value for the future, but a benefit for the present. To do that, Godin’s perspective on effective ways to message this may be helpful.