One month’s data a trend doesn’t make.

Okay, two months. Still, circumstances and conditions–especially affecting sentiment about when a potential home buyer might consider it the right moment to move–made December 2017 and January 2018 an apples to oranges comparison.

In that light, let’s take a moment, unpack the latest Census Bureau report on new home sales for January, breathe, and then get back to work on what should be a very solid continuation of recovery for home building and residential development this year.

Two facts in the latest report–and one related financial and economic data point not in it–seize immediate attention, and the algorithm of a compelling narrative kicks into gear.

The two facts in the report are these.

- New home sales clocked in at an annual rate of 593,000, which was lower in sequence than the prior month, lower than year-earlier January rates, and below expectations.

- Median selling prices of $323,000, meanwhile, were 2.5% more than January 2017.

The related fact, not in the report, was a rise in mortgage interest rates.

CNBC correspondent Diana Olick, bless her heart (as they say in some places when they’re about to hurl criticism at somebody), wants, above all, to be first to call a housing trend, even if it’s at the risk of not quite pronouncing itself as a trend.

And why not? Big, dramatic, one-time changes impacting individuals’ tax deductibility–mortgage interest deduction caps and restrictions on state and local tax and property tax deductibility– combined with long-anticipated, inevitable increases in mortgage interest rates tied to Central Banks tightening of monetary policy could amount to a housing “singularity” event. Perhaps.

Or not.

Job formations, wage increases, and household and family formation trends have, likewise, been gaining momentum.

Could the positives equalize the negatives in home buying, and new home buying trends in America in 2018? Absolutely.

The positives could more than equalize the negatives, and Diana Olick will no doubt be the first one to report that new home sales have suddenly regained once-lost momentum–defying both interest rate increases and tax reform consequences–if and when it becomes appropriate to do so as the Spring selling season takes shape.

Not having Gilda Radner around to say, “never mind!” in instances like that is one of our society’s harsher realities.

At any rate, let’s cut to the chase on the issues here. Are builders jittery about the impact of rising interest rates and the possible negative effects of tax law changes on the incentives for Americans to become homeowners?

Yes.

Is January’s data on new home sales telltale of a tipping point in the recovery, reflecting, as Diana Olick says:

Homebuyers increasingly can’t afford what they want. Higher mortgage rates, combined with the loss of homeowner tax breaks in some of the nation’s most expensive markets, are taking away buying power.

In sense, the way to understand CNBC’s Olick’s reporting and its value is that she’s like a sportswriter doing game coverage, which uses a technique called “running copy,” a constantly updated narrative produced during the course of a contest so that it can be finished only moments after it’s done.

Economists mostly see fundamentals and tailwind conditions that support a constructive view of the new home economy in 2018, asserting that December and January–for different reasons–add up to “noise” rather than the signal. Wall Street Journal staffer Sharon Nunn’s analysis captures this sensibility here (“U.S. New-Home Sales Drop Again, but Economists Don’t See Housing-Market Downswing“).

“If the drop in January were related primarily to economic factors, it is likely that all regions would have experienced declines,” Nationwide chief economist David Berson said.

Instead, the declines were concentrated in the Northeast and South. Winter weather, particularly in Southern states, might have kept prospective buyers from the search, some economists said.

And Calculated Risk blogger Bill McBride recapped the view of knowledgeable housing observers this way:

I wouldn’t read too much into one month of sales, especially in January. January is usually one of the weakest months of the year for new home sales, on a not seasonally adjusted (NSA) basis – and poor weather this year might have impacted sales a little more than usual. I’d like to see data for February and March before blaming higher interest rates, or a negative impact from the new tax law, as the cause of slower sales.

That said, here are six reasons not to hit the panic button, and six reminders of what you, no doubt, already know and are doing, but may be worth mentioning anyway.

- The revision. Commerce Department data that the Census Bureau uses to report new home sales are prone to error and revision, and the last several initial reports have been upwardly revised.

- The weather. Early-season cycles tend to start in the South, so when there’s bad weather there in January, it can show up materially in the numbers for that region.

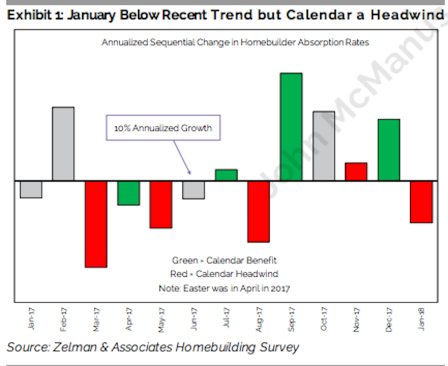

- Counting days. The Z Report, Zelman & Associates’ twice-monthly roll-up of housing’s critical themes, issues, and opportunity areas, notes that a fair-and-balanced analysis of key selling days reveals that January’s pace held its own. The report (which you can try for free by clicking here) notes:

A disproportionate share of new home orders is signed on the weekend when buyers are more available. On average, over time, January and December typically have the same number of weekend days, but this January had two fewer weekend days than December. The timing of the holidays complicates how impactful these days could have been, but we feel confident stating that sequential trends would have stood at or above the high-end of the 24-31% range for January from 2012-17.

- The Super Bowl. The Eagles flew on Feb. 4, which means big-time selling, and a number of new home communities featuring lower-priced, entry-level offerings from more builders, kicked it up several notches that first week in February. That’s when both pace and price (heading lower, reflecting the entry-level push), should start to push into the monthly data.

- Taxes: As individuals get their spiffy new tax returns resulting from elevated alternative minimum tax deductions, and consider their improved income prospects in a tighter jobs economy, the impact of the Trump economic stimulus program will start to play out.

- Mix shift: Again, Spring 2018 is the moment builders make a concerted, multi-market push with product, operations, marketing, and sales to the lower-price tier customer segments that, up to this point have been the focus of a relatively small number of builders. The delta of attainability, and the switches and levers of price and pace, really only come into play starting over the next couple of months.

- Rate direction consistency: For almost the whole duration of the housing recovery since the Great Recession ended, home buyers to a very important extent have been rewarded by taking a “wait-and-see” stance, particularly on interest rates. Whenever they’ve tailed upward, they’ve come back down within a few months, especially over the past couple of years as the drumbeat about imminent higher rates has been pounding. Now, however, rates appear to be on a relatively steady–if slow–upward trajectory. Once buyers understand the “this-time-it’s-for-real” nature of the Fed’s direction on the cost of money and its impact on housing finance, they’ll likely move off the sidelines at the first opportunity, before the impact on monthly payments gets onerous.

So, moving into what has to be one of the critical moments of truth of the current recovery, and one that will go far to revealing just how much juice this recovery cycle may have left in it, here are a few points offered in the spirit of managing what you can vs. fretting about what you may not be able to control.

- Customers. First, always, forever, and entirely. They put you in business. They’ll keep you in business if they trust in the value you’re giving them.

- Your team. Expect a lot. Serve their need to find a way to excel. Set a vision and illuminate a path forward, and hang out with them for your own enjoyment.

- Time. It’s where you probably have the biggest opportunity area to generate more value, capture more waste, and make your business more resilient to all external circumstances.

- Data. It works best when you apply human brilliance, rigor, and honesty to its revelations, rather than seeing it as a way to do work you don’t want to do.

- Small stuff. The smartest builders we know sweat the small stuff without losing sight of the big picture. It’s called caring. It’s called precision. It’s called what makes you different, which is what customers call your ability to offer value.

- Learn. Which is the bigger risk, do you think, among you and your associates, forgetting knowledge of how you did things in the past that proved through the years to work? Or failing to learn what you don’t know yet about what will prove through the coming years to work? Wise people say, today is yesterday’s tomorrow.

- Partner. This is one of the most important notions of the moment. Who should you include in your trusted circle? Why? How can collaborating get you where you can’t get alone? Where are the most important partnerships that will help you navigate the impacts and implications of rising interest rates, of the collateral effects of new tax burdens on would-be buyers in high-cost regions? Partner to a degree that makes you almost uncomfortable, and the result will be a more resilient, more nimble, more opportunistic organization.

Take one more look at January new home sales numbers, check your own plans with your folks, and go back to work today, and hopefully, enjoy what you’re doing.