If you haven’t blocked your Outlook calendar for about an hour today (Tuesday, Jan. 17, 2017), promptly at 2 pm Eastern, (11 am PST), there’s still time.

In that timeslot, Ivy Zelman and her Zelman & Associates team will dive in with a just-refreshed housing Outlook on 2017, via a conference call set up exclusively for members of The Z Report (including “trial subscribers”).

Register for the call by clicking on this link.

The incredibly timely presentation will cover key themes for the housing market and related sectors for 2017, including an outlook for important macro drivers such as housing starts, mortgage rates, home sales, home pricing, mortgage originations, housing policy, home improvement spending and more. Slides will be viewable on-line when the conference call begins.

The question of the moment is about mojo. By all rights, 2017 should be another in a series of sequentially improving 12-month periods, fueled by the fundamentals of underserved demand, constrained supply, and relative affordability–in the grand scheme of things.

The thing about relative affordability–whether you measure it by historical relationships to relative costs of renting, or to household income benchmarks, or in the context of pricing’s former highs and lows–is that it’s relative. Part of what relative means is that it’s in the minds of the beholder–in this case, the potential buyer.

A growing source of worry among builders is that interest rate drift upward might mess with the mojo.

As the Zelman team ponders in its latest edition of The Z Report, “Will January Bring a Cliff?” The analysis notes:

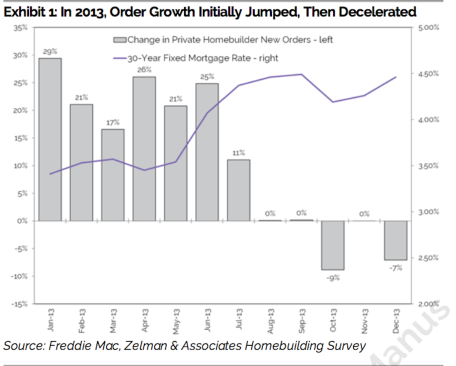

While our survey results suggest that higher rates have been a non-event thus far, we are concerned that the strength relates to a pull forward of activity as witnessed in 2013 when rates last increased near this magnitude. Specifically, the 10-year Treasury rate increased 46 basis points in May 2013 and climbed another 36 basis points in June 2013, leaving the month-end rate 70 basis points higher than the training one-year average.

In May 2013, our private homebuilder survey revealed a 21% year-over-year new order growth, which accelerated to 25% in June, but demand then softened to 11% growth in July and 0% in August as the market fully adjusted to the impact of higher rights.

Hence, the Bernanke “Taper Tantrum” snuffed a good chunk of the mojo out of 2013, and made it a barely passable year in housing’s recovery, rather than the sparkly one everybody thought would be the case throughout the first half of 2013.

Net, net, the Zelman team concludes, “we expect some softness in order growth rates to emerge, beginning in January, as the consumer likely takes a pause with the effective price increase caused by the higher cost of financing.”

Relative affordability, you see, becomes relatively less affordable and relatively more unaffordable.

Still, affordability now, before, and later, are all in a continuum. As interest rates head higher, it may not matter if prospective buyers decide that they’d better get in on homeownership before it gets even less manageable.

The Z Report is a bi-weekly publication offering unique analysis and insights into the housing market and related sectors. The Z Report is rooted in proprietary research and opinions and void of advertisements, focusing exclusively on rich content for investors, executives and business leaders overlapping sectors tied to the housing market, including apartment rentals, banking, building products, homebuilding, home improvement, land development, mortgage finance, real estate services, single-family rentals and title insurance. Register for The Z Report here.