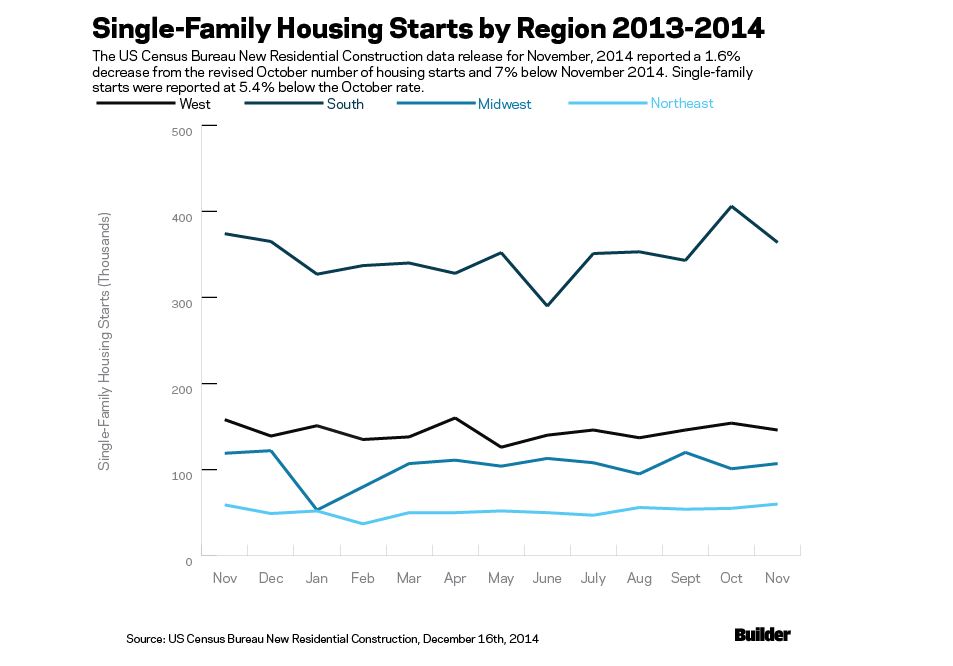

There was no evidence of a strong pickup in home construction in the final months of 2014. According to the Census Bureau data released this morning, housing starts in November were at a seasonally adjusted annual rate of 1,028,000. According to the Bureau, this is 1.6 percent (±8.1%) below the revised October estimate of 1,045,000 and is 7.0 percent (±10.2%) below the November 2013 rate of 1,105,000.

Single-family housing starts in November were at a rate of 677,000; this is 5.4 percent (±8.1%) below the revised October figure of 716,000. Lot shortages are holding back production in many markets, but demand is also to blame for the lackluster numbers.

Metrostudy’s outlook for 2015 is for a modest increase in single-family starts as well as a (smaller) increase in multifamily starts. Builders were aggressive in land and lot acquisition in the past three years, and Metrostudy’s data confirm that the number of new lots getting developed each quarter is rising rapidly, even in markets that were once over-lotted. This strongly suggests an increase in housing starts in 2015, just based upon builders’ intentions and lot supplies. As long as job growth continues to increase, new home demand will rise more rapidly as well.