The standard starter home is disappearing. On behalf of Bank of America, Braun Research recently surveyed 1,000 adults in the U.S. who want to buy a home in the future, and it turns out they’re not willing to settle for something that’s not quite right.

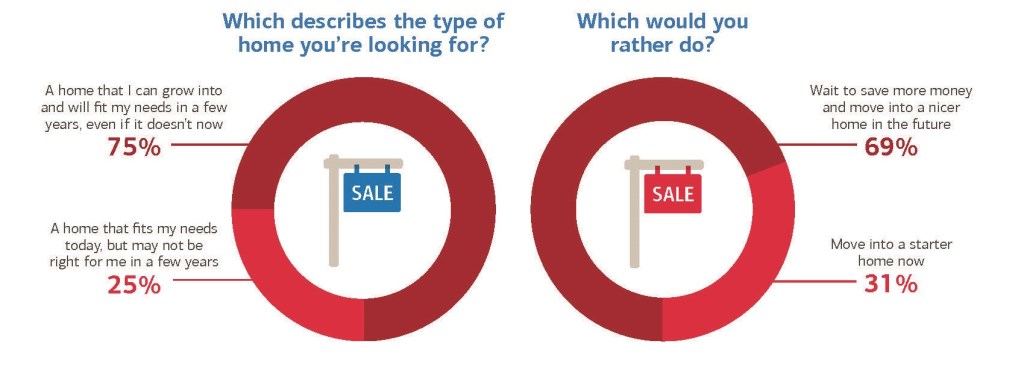

According to the survey, first-time buyers today want a home they can grow into (75%) and would rather wait to save more money for a nicer house in the future (69%). When asked why they haven’t purchased a home yet, 56% of respondents said they didn’t think they could afford a home or the type of home they want – only 34% said it’s because they’re still paying off debt.

They’re also not willing to budge on what they want. Only 17% of first-time buyers said they’d sacrifice location and only 36% said they’d sacrifice features in their dream home, proving they’d rather get what they want instead of lowering their budget.

In terms of what they want in a dream home, more than half of first-time buyers reported wanted a home in the suburbs, with only 26% claiming they wanted a home in an urban location. Similarly, 75% said they wanted a single family home. Only 11% wanted a town home and a small 6% said they wanted a condo.

Though they’re not willing to budge on what they want, they’re still concerned about their budget. Cost was the biggest factor in considering a home, 82% of respondents saying they considered it. The three other biggest factors were neighborhood (71%), floor plan (60%), and square footage (47%).

Buying a home is also an emotional experience for these first-time buyers, with 76% saying they’re motivated by emotional factors. When asked about their reasons to purchase a home, 52% said they wanted a place to call their own and 43% said it’s something they’ve always wanted to do. Just 37% said it’s because their rent would be better put towards a mortgage.

First-time buyers also said they associated home ownership with security (60%), responsibility (58%), and happiness (57%). For specifically millennial first-time buyers, home ownership meant adulthood and success.

It turns out first-time buyers today are focused on getting what they want, though they remain conscious about their budgets, and are excited about what buying a home will mean.