Comstock Holding Companies, Inc., Washington D.C. (NASDAQ:CHCI), late Thursday reported a net loss attributable to common stockholders of $(1.5) million, or $(0.45) per diluted share for the three months ended September 30, 2017, compared to net loss attributable to common stockholders of $(1.1) million, or $(0.34) per diluted share for the three months ended September 30, 2016. The company is not followed by analysts.

Total revenue was $13.8 million, including $13.1 million from 24 home deliveries during the three months ended September 30, 2017, as compared to $13.1 million, including $12.9 million from 33 home deliveries during the three months ended September 30, 2016.

Average settlement price was $545,000 for the three months ended September 30, 2017 as compared to an average settlement price of $390,000 for the three months ended September 30, 2016.

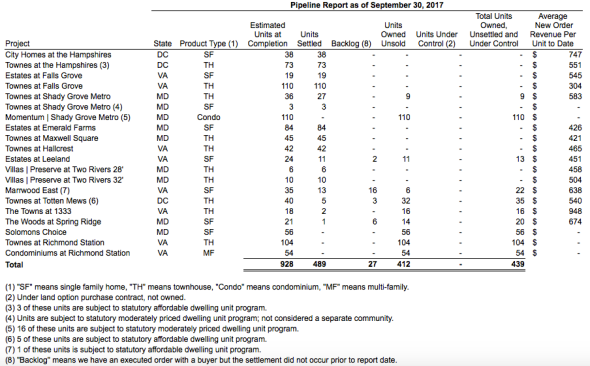

Backlog at September 30, 2017 of 27 units valued at $16.4 million, compared to 35 units valued at $16.4 million at September 30, 2016.

On July 17, 2017, the company acquired all the business assets of Monridge Environmental, LLC through a newly formed entity, JK Environmental Services, which is a wholly owned subsidiary of CDS Capital Management, L.C., a subsidiary of Comstock. The total purchase price was $2.3 million.

Chairman and CEO Christopher Clemente commented, “As previously disclosed, Comstock secured additional capital of $5.0 million subsequent to the close of the 3rd quarter. During the 3rd quarter, Comstock took the first step in a concerted effort to expand our footprint and generate new sources of revenue in the real estate services market by acquiring Monridge Environmental, LLC in a transaction that we believe will be accretive and provide a platform for additional expansion of the fee-for-service business model of our wholly owned subsidiary, Comstock Real Estate Services, LLC. Coupled with additional services that will include commercial mortgage brokerage, asset management, and related services, we believe that these new initiatives provide the Company additional means of utilizing our public company platform to generate new opportunities to enhance shareholder value.”

Comstock currently has 6 communities open for sale in Virginia, Maryland, and Washington, D.C., including townhomes and single-family homes priced from the high $300s to the $900s.

In addition to the open communities, Comstock has two additional communities in various stages of planning and development. The communities, located in Virginia, include townhomes to be priced from the low and mid-$300s.