D.R. Horton, Inc. (NYSE:DHI) Thursday morning reported that net income attributable to D.R. Horton for its second fiscal quarter ended March 31, 2019 was $351.3 million, or $0.93 per diluted share, compared to $351.0 million, or $0.91 per diluted share, in the same quarter of fiscal 2018. Wall Street was expecting a gain of $0.86 per share.

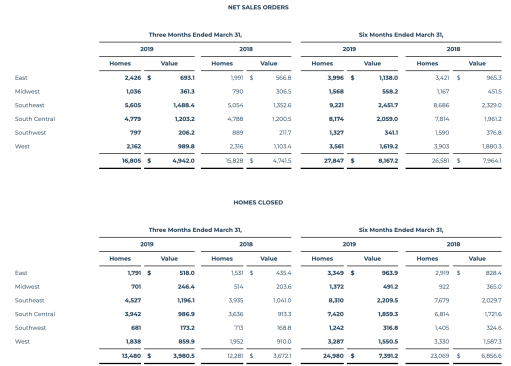

Home building revenue for the second quarter of fiscal 2019 increased 8% to $4.0 billion from $3.7 billion in the same quarter of fiscal 2018. Homes closed in the quarter increased 10% to 13,480 homes compared to 12,281 homes closed in the same quarter of fiscal 2018.

For the six months ended March 31, 2019, net income attributable to D.R. Horton increased 18% to $638.4 million, or $1.68 per diluted share, compared to $540.3 million, or $1.41 per diluted share, in the same period of fiscal 2018. Home building revenue for the first six months of fiscal 2019 increased 7% to $7.4 billion from $6.9 billion in the same period of fiscal 2018. Homes closed in the first six months of fiscal 2019 increased 8% to 24,980 homes compared to 23,069 homes closed in the same period of fiscal 2018.

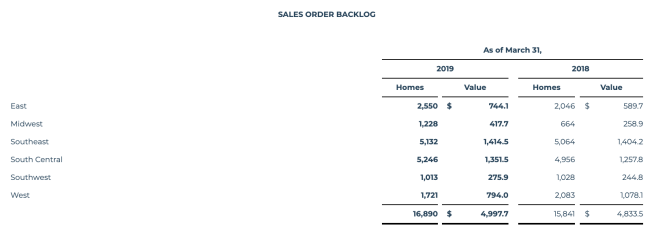

Net sales orders for the second quarter ended March 31, 2019 increased 6% to 16,805 homes and 4% in value to $4.9 billion compared to 15,828 homes and $4.7 billion in the same quarter of the prior year. Excluding the effects of recent acquisitions, the company’s second quarter net sales orders increased 3% from the prior year quarter. The company’s cancellation rate for the second quarter of fiscal 2019 was 19%, consistent with the prior year quarter. Net sales orders for the first six months of fiscal 2019 increased 5% to 27,847 homes and 3% in value to $8.2 billion compared to 26,581 homes and $8.0 billion in the same period of fiscal 2018.

The company had 32,100 homes in inventory excluding model homes at March 31, 2019, and its home building land and lot portfolio was 316,400 lots, of which 38% were owned and 62% were controlled through land purchase contracts.

The company ended the second quarter with $557.3 million of home building unrestricted cash and a home building debt to total capital ratio of 22.9%.

Donald R. Horton, chairman of the board, said, “The D.R. Horton team delivered solid results in our second quarter. Our consolidated revenues increased 9% to $4.1 billion, and our pre-tax profit margin was 11.2%. The spring selling season is going well, as our net sales orders increased 52% sequentially from the December quarter and 6% from the March quarter last year. These results reflect the strength of our experienced operational teams, industry-leading market share, broad geographic footprint and affordable product offerings across multiple brands.

“Our continued strategic focus is to consolidate market share while growing our revenues and profits, generating strong annual cash flows and returns and maintaining a flexible financial position. With 32,100 homes in inventory at the end of March and 316,400 lots owned and controlled, we are well-positioned for the remainder of fiscal 2019 and future years.”

During the second quarter of fiscal 2019, the company paid cash dividends of $55.9 million. Subsequent to quarter-end, the company declared a quarterly cash dividend of $0.15 per common share that is payable on May 28, 2019 to stockholders of record on May 13, 2019.

The Company repurchased 2.0 million shares of common stock for $75.6 million during the second quarter of fiscal 2019, for a total of 6.1 million shares of common stock for $216.2 million during the six months ended March 31, 2019. The Company’s remaining stock repurchase authorization at March 31, 2019 was $159.3 million.

Forestar Group Inc. (NYSE:FOR), a land holding subsidiary, sold 548 lots and generated $65.4 million of revenue compared to 304 lots and $22.6 million of revenue in the prior year period. For the six months ended March 31, 2019, Forestar sold 1,066 lots and generated $103.8 million of revenue compared to 559 lots and $53.5 million of revenue from the acquisition date through March 31, 2018. These results are included in the Company’s segment information following the consolidated financials.

Subsequent to quarter-end, Forestar issued $350 million principal amount of 8.0% senior notes. The notes are due April 15, 2024, with interest payable semi-annually. On its conference call today, D.R. Horton will provide an update on Forestar’s operations, capital structure and future growth plans.

DHI Communities, another wholly-owned D.R. Horton subsidiary, is a multi-family rental company that has four projects under active construction and two projects that are substantially complete at March 31, 2019. During the second quarter of fiscal 2019, DHI Communities sold its first multi-family rental project for $73.4 million and recorded a gain on the sale of $29.3 million which is included in the consolidated statements of operations for the three and six months ended March 31, 2019. At March 31, 2019 and September 30, 2018, the consolidated balance sheets included $170.2 million and $173.2 million, respectively, of assets related to DHI Communities.

Based on current market conditions and the company’s results for the first half of fiscal 2019, D.R. Horton is providing fiscal 2019 guidance as follows:

- Consolidated revenues between $16.7 billion and $17.0 billion

- Homes closed in the range of 55,000 homes to 56,000 homes

- Effective tax rate of approximately 24.5%

- Home building cash flow from operations of at least $1.0 billion

- Outstanding share count at September 30, 2019 down slightly from September 30, 2018