Hovnanian Enterprises, Inc. (NYSE: HOV), Matawan, N.J., reported a net loss of $1.0 million, or $0.01 per common share, in the third quarter of fiscal 2018 ended July 31. The loss compared with a net loss of $337.2 million, or $2.28 per common share, including a $294.0 increase in the valuation allowance for deferred tax assets, during the same quarter a year ago.

Analysts polled by Dow Jones were expecting a loss of $0.06 per share. Shares of HOV were up 4.8% at $1.62 in mid-morning trading.

For the nine months ended July 31, 2018, the net loss was $41.7 million, or $0.28 per common share, compared with a net loss of $344.0 million, or $2.33 per common share, including a $294.0 increase in the valuation allowance for our deferred tax assets, in the first nine months of fiscal 2017.

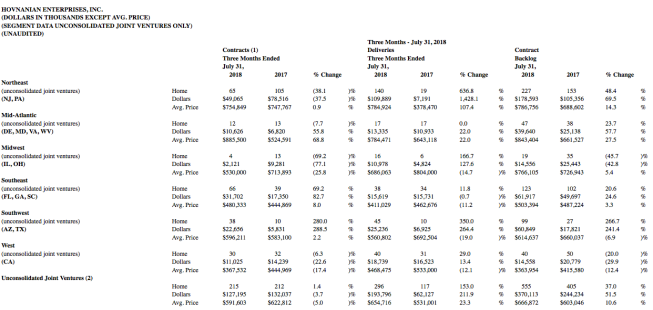

Contracts per community, including unconsolidated joint ventures, increased 9.8% to 10.1 contracts per community for the quarter ended July 31, 2018 compared with 9.2 contracts per community, including unconsolidated joint ventures, in last year’s third quarter. Consolidated contracts per community increased 6.4% to 10.0 contracts per community for the third quarter of fiscal 2018 compared with 9.4 contracts per community in the third quarter of fiscal 2017.

As of the end of the third quarter of fiscal 2018, community count, including unconsolidated joint ventures, was 143 communities, a 14.4% year-over-year decrease from 167 communities at July 31, 2017. Consolidated community count decreased 12.8% to 123 communities as of July 31, 2018 from 141 communities at the end of the prior year’s third quarter.

The number of contracts, including unconsolidated joint ventures, for the third quarter ended July 31, 2018, decreased 5.3% to 1,451 homes from 1,533 homes for the same quarter last year. The number of consolidated contracts decreased 6.4% to 1,236 homes, during the third quarter of fiscal 2018, compared with 1,321 homes during the third quarter of 2017.

During the first nine months of fiscal 2018, the number of contracts, including unconsolidated joint ventures, was 4,407 homes, a decrease of 4.0% from 4,593 homes during the first nine months of fiscal 2017. The number of consolidated contracts decreased 10.2% to 3,667 homes, during the nine month period ended July 31, 2018, compared with 4,084 homes in the same period of the previous year.

The dollar value of contract backlog, including unconsolidated joint ventures, as of July 31, 2018, was $1.32 billion, an increase of 2.1% compared with $1.29 billion as of July 31, 2017. The dollar value of consolidated contract backlog, as of July 31, 2018, decreased 9.4% to $946.5 million compared with $1.04 billion as of July 31, 2017.

For the quarter ended July 31, 2018, deliveries, including unconsolidated joint ventures, decreased 2.0% to 1,438 homes compared with 1,467 homes during the third quarter of fiscal 2017. Consolidated deliveries were 1,142 homes for the third quarter of fiscal 2018, a 15.4% decrease compared with 1,350 homes during the same quarter a year ago.

For the nine months ended July 31, 2018, deliveries, including unconsolidated joint ventures, decreased 8.3% to 4,002 homes compared with 4,362 homes in the first nine months of the prior year. Consolidated deliveries were 3,382 homes in the first nine months of fiscal 2018, a 15.4% decrease compared with 3,998 homes in the same period in fiscal 2017.

The contract cancellation rate, including unconsolidated joint ventures, was 19% in the third quarter of fiscal 2018 compared with 20% during the third quarter of fiscal 2017. The consolidated contract cancellation rate was 19% for both the three months ended July 31, 2018 and the three months ended July 31, 2017.

Total revenues decreased to $456.7 million in the third quarter of fiscal 2018, compared with $592.0 million in the third quarter of fiscal 2017. For the nine months ended July 31, 2018, total revenues decreased to $1.38 billion compared with $1.73 billion in the first nine months of the prior year.

While total revenues decreased $135.3 million, home building revenues for unconsolidated joint ventures increased $131.9 million to $194.5 million for the third quarter ended July 31, 2018, compared with $62.6 million in last year’s third quarter. During the first nine months of fiscal 2018, home building revenues for unconsolidated joint ventures increased to $350.0 million compared with $214.1 million in the same period of the previous year.

Home building gross margin percentage, after cost of sales interest expense and land charges, was 15.4% for the third quarter of fiscal 2018 compared with 12.8% in the prior year’s third quarter. For the nine months ended July 31, 2018, home building gross margin percentage, after cost of sales interest expense and land charges, improved to 14.6% compared with 12.9% in the first nine months of last year.

Home building gross margin percentage, before cost of sales interest expense and land charges, improved 160 basis points to 18.4% for the third quarter of fiscal 2018 compared with 16.8% in the same quarter one year ago. During the first nine months of fiscal 2018, home building gross margin percentage, before cost of sales interest expense and land charges, improved 120 basis points to 18.0% compared with 16.8% in the same period of the previous year.

For the third quarter of 2018, total SG&A decreased by $7.3 million, or 11.9%, year over year. Total SG&A was $53.9 million, or 11.8% of total revenues, in the third quarter of fiscal 2018 compared with $61.2 million, or 10.3% of total revenues, in the third quarter of fiscal 2017. For the nine months ended July 31, 2018, total SG&A decreased by $4.8 million, or 2.6%, year over year. For the first nine months of fiscal 2018, total SG&A was $178.0 million, or 12.9% of total revenues, compared with $182.8 million, or 10.6% of total revenues, in the first nine months of the prior fiscal year.

Interest incurred (some of which was expensed and some of which was capitalized) was $40.4 million for the third quarter of fiscal 2018 compared with $39.1 million in the same quarter one year ago. For the nine months ended July 31, 2018, interest incurred (some of which was expensed and some of which was capitalized) was $121.6 million compared with $116.9 million during the same nine-month period last year.

Total interest expense was $38.3 million in the third quarter of fiscal 2018 compared with $42.9 million in the third quarter of fiscal 2017. Total interest expense was $125.2 million for the first nine months of fiscal 2018 compared with $126.5 million for the first nine months of fiscal 2017.

Income before income taxes for the quarter ended July 31, 2018 was $0.1 million compared with a loss before income taxes of $50.2 million during the third quarter of fiscal 2017. For the first nine months of fiscal 2018, the loss before income taxes was $40.0 million compared with loss of $57.5 million during the first nine months of fiscal 2017.

Income before income taxes excluding land-related charges, joint venture write-downs and loss on extinguishment of debt, was $4.4 million during the third quarter of fiscal 2018 compared with a loss of $3.7 million in the third quarter of fiscal 2017. For the first nine months of fiscal 2018, the loss before income taxes, excluding land-related charges, joint venture write-downs and loss on extinguishment of debt, was $30.4 million compared with $13.4 million during the first nine months of fiscal 2017.

The valuation allowance was $659.9 million as of July 31, 2018. The valuation allowance is a non-cash reserve against the Company’s tax assets for GAAP purposes. For tax purposes, the tax deductions associated with the tax assets may be carried forward for 20 years from the date the deductions were incurred.

Total liquidity at the end of the third quarter of fiscal 2018 was $242.1 million.

In the third quarter of fiscal 2018, approximately 5,800 lots were put under option or acquired in 56 communities, including unconsolidated joint ventures.

As of July 31, 2018, consolidated lots controlled increased sequentially by 16.7% to 30,974 from 26,537 lots at April 30, 2018, and increased 19.9% year over year from 25,834 lots at July 31, 2017. The consolidated land position, as of July 31, 2018, was 30,974 lots, consisting of 18,416 lots under option and 12,558 owned lots.

“We are pleased to report another quarter with year-over-year improvements in contracts per community, a significant increase in gross margin percentage and increases in pretax profits for our third quarter of fiscal 2018,” stated Ara K. Hovnanian, chairman and CEO. “Our total consolidated lots controlled at the end of the third quarter expanded 20% year over year and 17% sequentially. As we move forward, we remain laser focused on further growing our land position, which should ultimately lead to increases in our community count.”

“Assuming no adverse changes in current market conditions, we continue to expect solid profitability during the fourth quarter of fiscal 2018. Similar to what we have experienced in past cycles, our planned community count growth should lead to improved operating results and sustainable levels of profitability.”