KB Home, Los Angeles (NYSE:KBH) after market close Thursday reported a net loss of $71.3 million, or $.82 per diluted share for its fiscal first quarter ended Feb. 28, due to a charge to tax assets that were revalued under the Tax Cuts and Jobs Act. Wall Street was expecting a loss of $0.88 per share.

Excluding this charge, the company’s adjusted net income was $39.9 million, or $.40 per diluted share, compared to net income of $14.3 million, or $.15 per diluted share.

Among the operating metrics:

- Total revenues increased 6% to $871.6 million.

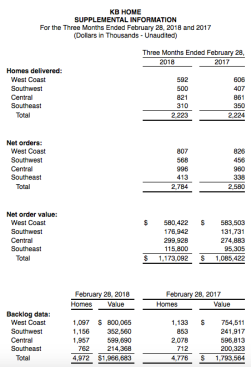

- Deliveries were flat at 2,223 homes.

- Average selling price rose 7% to $389,800.

- Home building operating income grew 74% to $44.0 million.

- Home building operating income margin increased 200 basis points to 5.1% from 3.1%. Excluding inventory-related charges of $5.0 million in the current quarter and $4.0 million in the year-earlier quarter, the homebuilding operating income margin also improved 200 basis points to 5.6%, from 3.6%.

- Housing gross profit margin expanded 150 basis points to 16.1%.

- Housing gross profit margin excluding inventory-related charges increased 160 basis points to 16.7%.

- Adjusted housing gross profit margin, a metric that excludes inventory-related charges and the amortization of previously capitalized interest, rose 150 basis points to 21.4%.

- Selling, general and administrative expenses as a percentage of housing revenues improved 50 basis points to 11.0%, a first quarter record low.

- All interest incurred was capitalized, resulting in no interest expense, compared to $6.3 million of interest expense, which included a $5.7 million charge for the early extinguishment of debt.

- Total pretax income increased 115% to $46.0 million.

- Net order value rose 8% to $1.17 billion on an 8% increase in net orders to 2,784. Three of the company’s four regions posted year-over-year increases in net order value.

- Company-wide, net orders per community averaged 4.2 per month, up 17% from 3.6 per month.

- Ending backlog value grew 10% to $1.97 billion, with all regions posting year-over-year increases. This was the Company’s highest first quarter backlog value in 11 years. The number of homes in backlog increased 4% to 4,972.

- The cancellation rate as a percentage of gross orders improved to 20% from 23%.

- Average community count decreased 7% to 222. Ending community count was down 9% to 219.

The company at quarter’s end had total liquidity of $1.02 billion, including cash and cash equivalents of $560.3 million. Net cash used in operating activities was $141.7 million for the quarter, compared to $77.0 million. There were no cash borrowings outstanding under the Company’s unsecured revolving credit facility.

Inventories increased 5% to $3.44 billion. Investments in land acquisition and development totaled $465.0 million for the quarter. Lots owned or controlled totaled 46,219, of which 79% were owned.

Notes payable increased slightly to $2.36 billion from $2.32 billion. The ratio of debt to capital was 56.0%, while the ratio of net debt to capital was 49.3%, within the Company’s 2019 target range under its Returns-Focused Growth Plan. Stockholders’ equity of $1.85 billion decreased by $73.6 million due to the one-time, non-cash TCJA-related charge.

“For the remainder of 2018, we plan to continue to execute on our Returns-Focused Growth Plan, and expect to benefit from favorable housing market dynamics,” said Jeffrey Mezger, chairman, president and chief executive officer. “In particular, we believe our long history of primarily serving first-time homebuyers, along with offering products designed to meet their needs, will enable us to continue to successfully attract millennials, which currently represent the nation’s largest and fastest growing demand segment. Moreover, we anticipate our housing gross profit margin will continue to strengthen throughout the year as we deliver more homes from newer, higher-margin communities, realize additional improvements from our community-specific action plans, and generate greater operating leverage. With good sales momentum across our business, and a considerable number of planned new openings on the horizon, we believe we are on track to end 2018 with a slightly higher community count and are well positioned operationally and strategically for the opportunities ahead.”