In the second quarter of 2018 people in expensive, high-tax coastal markets including San Francisco, New York, Los Angeles and Washington, D.C. searched for homes in metros like Phoenix, Las Vegas and Miami, where taxes are lower and housing is more affordable, according to the latest Migration Report. The analysis is based on a sample of more than 1 million Redfin.com users who searched for homes across 80 metro areas from April to June.

Nationally, 24% of Redfin.com home searchers looked to move to another metro area in the second quarter, compared to 21% during the same period last year. According to Census survey data, housing-related reasons are the primary reason households relocate to another county, which in today’s market typically means affordability.

“With home prices reaching new heights in many metro areas, it’s no surprise people are continuing to move away from expensive metros in search of homeownership,” said Taylor Marr, Redfin senior economist. “Last year’s tax reform poured fuel on the fire. By capping mortgage interest and state and local tax deductions, there is an even greater incentive for home buyers to consider moving to a lower-tax state.”

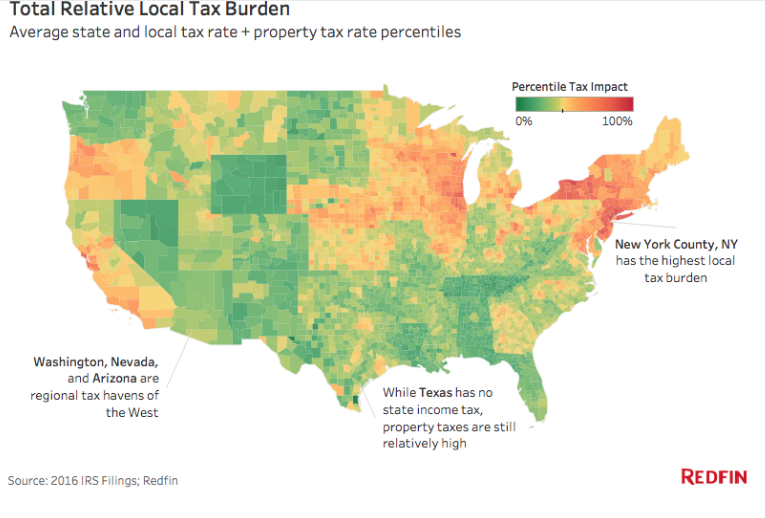

The average local tax burden—a relative measure of a county’s average sales, income, and property tax rates—was three-times lower in the top-10 migration destinations than in the 10 places people were most commonly leaving last quarter.

While taxes have long been part of the equation of where to live, tax reform passed in late 2017 has further heightened this consideration for home buyers. According to a Redfin-commissioned survey in May 2018, which included responses from 1,300 people who had bought a home in the past year:

- 8% of people said they shifted their search to a state with lower taxes due to the new tax law.

- 9% said they shifted their search to nearby cities with lower taxes.

- 10% said they bought a less expensive home because of the decreased benefits on high-priced homes.

- 10% bought a more expensive home because their after-tax income grew.

“Now that homeowners and prospective buyers have had some time to understand how the new tax laws are affecting their finances, we are starting to see an impact on migration trends,” said Marr.

San Francisco, New York, Los Angeles, Washington, D.C. and Chicago posted the highest net outflows in the second quarter. Net outflow is defined as the number of people looking to leave the metro minus the number of people looking to move to the metro. A net outflow means there are more people looking to leave than people looking to move in, while a net inflow means more people are looking to move in than leave. These metros have consistently ranked as the highest net outflow metro areas since Redfin began tracking quarterly migration in early 2017. These trends appear to be accelerating as the share of residents looking to leave is rising.

Of all Bay Area residents using Redfin, 22% were searching for homes in another metro, up from 19% during the same time period a year earlier. Of New Yorkers, 36% looked to leave compared to 35% last year. Of Los Angelenos, 16% looked to leave, compared to 15% last year.

Table: Top 10 Metros by Net Outflow of Users and Their Top Destinations | |||||||

Rank | Metro* | Net Outflow † | Net Outflow Last Year | Portion of Local Users Searching Elsewhere | Top Destination | Top Out-of-State Destination | |

1 | San Francisco, CA | 27,849 | 16745 | 22.1% | Sacramento, CA | Seattle, WA | |

2 | New York, NY | 23,559 | 15644 | 36.3% | Boston, MA | Boston, MA | |

3 | Los Angeles, CA | 13,370 | 13109 | 15.5% | San Diego, CA | Phoenix, AZ | |

4 | Washington, DC | 5,900 | 5499 | 10.0% | Philadelphia, PA | Philadelphia, PA | |

5 | Chicago, IL | 3,428 | 2366 | 9.1% | Phoenix, AZ | Phoenix, AZ | |

6 | Denver, CO | 3,007 | 338 | 22.6% | Colorado Springs, CO | Seattle, WA | |

7 | Milwaukee, WI | 787 | 226 | 39.1% | Chicago, IL | Chicago, IL | |

8 | Houston, TX | 336 | 317 | 25.2% | Austin, TX | Chicago, IL | |

9 | Eugene, OR | 288 | -201 | 44.3% | Portland, OR | Seattle, WA | |

10 | Detroit, MI | 263 | 309 | 21.9% | Chicago, IL | Chicago, IL | |

*Combined statistical areas with at least 500 users in Q2 2018 †Among the one million users sampled for this analysis only | |||||||

Denver: Reaching its Peak

Last quarter, we hypothesized that Denver had reached its peak in terms of migration, noting that the metro posted a net outflow of Redfin users for the first time. That trend continued in the second quarter. Of all Denverites using Redfin, 23% were searching for homes in another metro, up from 18% during the same time period a year earlier. Among the Denverites who were searching elsewhere, approximately 20% were looking at more affordable metros within the state: Colorado Springs and Fort Collins. The median list price in Colorado Springs and Fort Collins was $305,000 and $401,000 respectively, compared to Denver’s median list price of $406,000 in July.

Seattle: One to Watch

Seattle is an interesting case. In the first three quarters of 2017, Seattle drew new residents. In Q4 2017 and Q1 2018 that trend reversed and Seattle joined the list of metro areas with more people looking to leave than move in. In the second quarter, Seattle reversed course again with a net inflow of residents. The fact that Seattle residents don’t pay state income taxes may be one reason Seattle had a net inflow, despite its staggering home price growth, up 58% in the past five years. Another reason is the thriving tech sector, with Amazon, Google, Facebook and others continuing to grow and attract new hires to the region. We’ll continue following Seattle migration trends in future quarters to understand whether the metro is topping out on growth.

Moving In – Metros with the Highest Net Outflow of Redfin Users

The places attracting the most people are mostly sun-scorched metros with relatively affordable homes and lower tax burdens, including Phoenix, Las Vegas and Miami. Below are the 10 metros that are the most likely to receive big inflows of new residents in the coming year from expensive coastal markets. With these new residents, economic growth and rising home prices will likely follow.

Table: Top 10 Metros by Net Inflow of Users and Their Top Origins | ||||||

Rank | Metro* | Net Inflow † | Net Inflow Last Year | Portion of Searches from Users Outside the Metro | Top Origin | Top Out-of- State Origin |

1 | Phoenix, AZ | 6,349 | 3849 | 34.0% | Los Angeles, CA | Los Angeles, CA |

2 | Sacramento, CA | 6,208 | 4833 | 39.9% | San Francisco, CA | Seattle, WA |

3 | Atlanta, GA | 5,112 | 2767 | 26.7% | New York, NY | New York, NY |

4 | Las Vegas, NV | 3,786 | 3509 | 41.4% | Los Angeles, CA | Los Angeles, CA |

5 | Portland, OR | 3,614 | 1190 | 18.2% | San Francisco, CA | San Francisco, CA |

6 | Austin, TX | 3,212 | 1655 | 27.4% | San Francisco, CA | San Francisco, CA |

7 | Dallas, TX | 2,979 | 2036 | 22.3% | Los Angeles, CA | Los Angeles, CA |

8 | Miami, FL | 2,575 | 1746 | 24.2% | New York, NY | New York, NY |

9 | San Diego, CA | 2,537 | 5286 | 24.1% | Los Angeles, CA | Seattle, WA |

10 | Nashville, TN | 2,462 | 1364 | 33.6% | New York, NY | New York, NY |

*Combined statistical areas with at least 500 users in Q2 2018 †Negative values indicate a net outflow; among the one million users sampled for this analysis only |

As in the first quarter, Phoenix again had the highest net inflow in the analysis. Thirty-four% of home searchers in Phoenix in the second quarter were from elsewhere, up from 31% during the same period last year. The top origin of Phoenix migrants was Los Angeles (25% of inbound searches), followed by Seattle (14%), Chicago (8%), the Bay Area(8%) and New York (5%).

Phoenix is also much more affordable, with a median home list price of $275,000 in July, compared to $410,000 in Denver and $565,000 in Seattle.

Las Vegas, another low-tax haven, had the highest share of non-local searches. Forty-one% of the people searching for homes in Las Vegas were searching from outside the metro area. Nearly 40% of these inbound searches originated in Los Angeles, followed by the San Francisco Bay Area (12%), Portland, Oregon (8%), and Seattle(5%). The influx of new residents to the area is causing prices and competition to accelerate. Median home prices in Las Vegas rose by 11% in July year over year, marking 17 months in a row of double-digit price growth.

“Affordability definitely plays a role in home searchers considering Las Vegas as their new home city,” said Nicole Lazarski, a Redfin agent in Las Vegas. “Even though home prices are climbing fast, they have still not returned to their 2007 height. With a median sale price around $270,000 in July, plus Nevada’s low property taxes and lack of a state income tax, it’s a very attractive place for people looking to leave California and other expensive places.”

In Las Vegas, the typical homeowner pays $1,500 (0.8%) in property taxes and about 8% in local sales taxes, with no state income tax, whereas in Los Angeles, the respective amounts are $3,600 (0.8%) property taxes, about 9% sales tax rate, and 8% state income tax rate.

To read the full report, complete with more data, interactive charts and methodology, please visit: https://www.redfin.com/blog/2018/09/q2-2018-migration-report.html