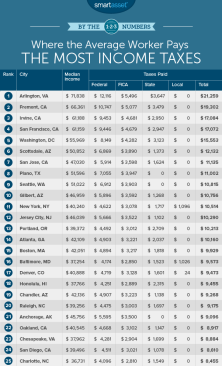

SmartAsset is out with a study based on its paycheck calculator, which it used to estimate how much the average worker pays in income taxes in the 100 largest cities in the country. Interestingly, California and Washington D.C., where big government reigns, lead everywhere else.

Findings:

● The more you earn the more you pay – As a general rule, the more money you earn, the more you pay in income taxes. However, there are exceptions to this rule. Workers in Plano, Texas, for example, pay the eighth-highest income taxes but have the sixth-highest average income. One factor contributing to this is the fact that Plano residents don’t pay state or local income taxes. In fact, the average worker in New York, New York pays only $500 less in income taxes than the average Plano worker despite earning $11,300 less.

● California and the D.C. metro area lead the way – All of the top five cities where the average worker pays the most in taxes are located in the D.C. metro area or in California. Workers in these cities take home big paychecks, on average, and pay fairly high state taxes. An Arlington, Virginia worker earning the median income, for example, would pay just over $21,200 in income taxes. While the average worker in Fremont, California would pay just under $19,300.

● New Yorkers have it tough – Despite only having the 20th-highest median income in the study, the average New York worker pays the 11th-most in income taxes. The main reason New York ranks so high is due to local New York City taxes, which account for an extra $1,100 in income taxes for the average worker. Without those taxes, New York would rank 18th for total income taxes paid.

● Local taxes hurt – New York isn’t the only city charging its residents a local income tax. In total, 17 cities in the study levy local income taxes. Workers in Philadelphia, New York and Baltimore pay the most in the study. Workers in those cities earning the median wage can expect to see $1,286, $1,096 and $1,026 in local income taxes withheld annually from their paychecks, respectively. And that’s on top of their state and federal income taxes.