Labor capacity constraints, as you’ve grown to recognize and manage for them, may take a dramatic turn right about now. Not for the better.

Demand trend models that count population growth, household formations, family formations, jobs and income growth, and eventually, an increase in prospective buyer pools in any given geography, may also take a new direction. For the worse.

Perhaps fall-off in demand will be slower to materialize, and start more subtly than the sudden diminution of available skilled workers for job sites.

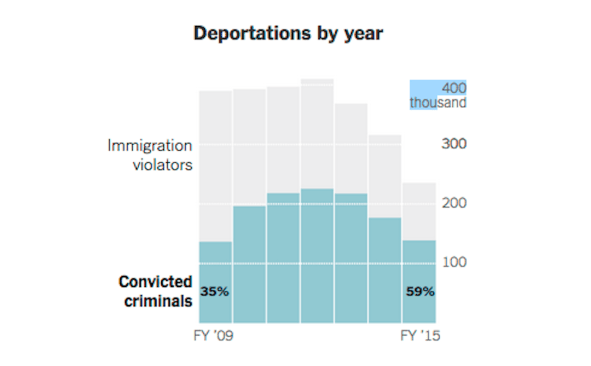

Here’s [paywall] Wall Street Journal analysis spotlighting two industries in the cross-hairs of a “crackdown” in immigrant labor, food and construction. Economics reporters Jacob Bunge, Heather Haddon, and Eric Morath write that U.S. companies are “girding for fallout” as immigration policy enforcement plays out.

Bunge, Haddon, Morath note that according to officially available data, about one in seven construction workers is an undocumented immigrant, and the National Association of Home Builders cites data that estimates 22% of the building industry’s workforce is foreign-born. Whether or not those figures jibe with what you know and see on your job sites may reflect how anxious you are about this issue or not, although we understand the effects of executive order and policy enforcement could take some time wending through to the job sites.

Still, the WSJ staffers write:

The agriculture and construction industries have relied on immigrants for decades to do tough, low-paying jobs U.S. citizens often avoid, from picking berries to slicing up hogs to erecting framing for houses. Many of these workers are undocumented.

“Business is business, and whether it’s the farming industry or the construction industry, we already have a resource issue,” said Bill Wilhelm, president of R.D. Olson Construction in Irvine, Calif., which specializes in hotel construction. “You already have a shortage of documented individuals. So if you have fewer and fewer undocumented, at the end of the day it’s going to have an impact on projects.”

Foreign-born workers make up about three-quarters of the roughly 1.1 million workers on U.S. farms, and nearly half aren’t legally authorized to work, according to the U.S. Department of Agriculture. In the construction industry, 13% of workers in 2014 were undocumented, according to data from the Pew Research Center.

Paring down from the gross statistics to actual real-world workers, although it may take some of the sting out of the headline risk, still doesn’t count for the potential impacts to construction cycles, scheduling, productivity, costs, and delivery of homes to waiting customers.

And then there’s the other side of the immigrant coin, which also materially impacts the well-being and wherewithal of many builders: immigrant customers.

Bloomberg reporter Prashant Gopal looks at how a “crackdown could sink U.S. home prices,” by choking off a stream of international in-migrants entering into the food-chain of housing demand, culminating often with homeownership and community-making. Gopal writes:

Fueling housing demand, immigrants replace baby boomers retiring from the labor force, according to University of Washington economist Jacob Vigdor.

By his reckoning, the country’s 40 million immigrants add $3.7 trillion to total housing wealth. In Houston’s home county, the newcomers boosted the value of the typical home by $25,000 during the decade ended in 2010. Between 2015 and 2065, according to a Pew Research projection, future immigrants and their descendants will account for 88 percent of the U.S. population increase, or 103 million people.

Add to all this talk of a $1 trillion infrastructure program to build and rebuild highways, bridges, (dams?), and other critical systems.

That could spur growth, jobs, incomes, consumer spending, etc.

Where will the workers come from?

Who will build? And then, who will buy? Especially in places like the following, where the share of undocumented workers is highest.

The NAHB states its immigration reform position here. It’s no time to sit back and be passive about this issue. Is a temporary guest worker program a viable option at this point? The discussion is consequential–both on the supply side of your businesses and the demand among present and future home buyer prospects. Don’t let it simply happen to you unless you’re content with any outcome.