The federal funds rate, the interbank lending rate set by the Federal Reserve, has increased from 5.25% to 5.5%, the highest level in 22 years. The Fed’s intention in recent increases of the federal funds rate is to slow growth by raising the cost of borrowing to help reduce inflation back down to its target of 2%.

In addition to rate increases, banks can tighten credit standards to slow growth. Tighter credit standards combined with a higher cost of borrowing can cause consumers to pull back on spending for goods and services.

Given this backdrop, the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) has become a top economic indicator to watch. The SLOOS captures changes to demand for and access to credit via the responses from 66 domestic banks and 19 U.S. branches and agencies of foreign banks. The most recent report, released in July, showed that access to credit is tightening across the economy.

The SLOOS also asked banks about their plans for future lending. Respondents reported plans to continue tightening for the balance of 2023, assuming the economy follows the consensus forecast. According to the survey, “the most cited reasons for expecting to tighten lending standards were a less favorable or more uncertain economic outlook, an expected deterioration in collateral values, and an expected deterioration in credit quality of commercial real estate (CRE) and other loans.”

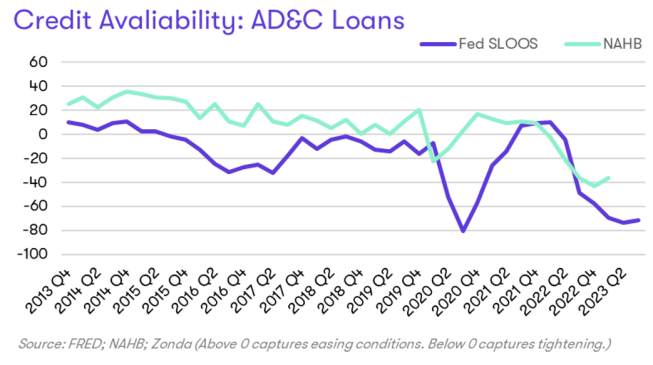

When considering the home building industry, the SLOOS tracks commercial and industrial (C&I) loans over time. We corroborate these trends with data from the NAHB on acquisition, development, and construction (AD&C) loans. Both the NAHB and the SLOOS data point to tighter lending standards in the construction industry.

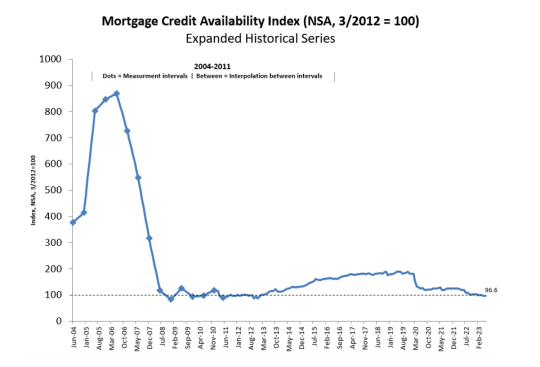

While residential construction lending is not covered in the survey, residential loan access for consumers is covered. The July data shows lending standards tightened for all types of residential real estate loans, especially for jumbo loans and home equity lines of credit. This aligns with the Mortgage Credit Availability Index from the Mortgage Bankers Association, which shows credit availability is close to the lowest level since 2013.

Courtesy Mortgage Bankers Association

Tighter lending standards for consumer loans started following the Great Recession and have gotten even more restrictive since. However, it’s important to note these standards haven’t necessarily slowed housing growth; rather, they’ve helped ensure today’s home buyers are creditworthy and have contributed to rebuilding confidence in the long-term stability of the industry.

Credit tightening that becomes too restrictive is one of the risks of the “long and variable lags” of the Fed’s policy changes. If banks freeze up, the soft-landing hopes could turn into a hard-landing reality. A modest tightening of credit, though, is good for the economy as banks exercise more risk management and the excess spending in the economy cools.