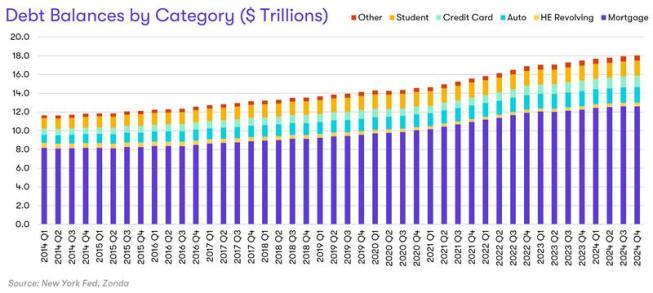

The latest consumer debt data from the Federal Reserve is ringing alarm bells. By the end of 2024, total household debt surpassed $18.0 trillion, marking a 0.5% increase QOQ and a 3.0% increase YOY.

While the higher nominal debt levels tend to grab headlines, it is always important to contextualize the increase. For example, after adjusting for inflation using the CPI (1982-1984 base year), real household debt stood at $5.7 trillion, showing relative stability both QOQ (-0.04%) and YOY (+0.02%).

Among all the debt categories analyzed—mortgages, auto loans, credit cards, student loans, other loans, and home equity lines of credit (HELOCs)—credit cards stood out with some alarming trends.

- Total credit card debt reached a record-high of $1.21 trillion. This was up 7.2% YOY and 30.6% from 2019. When we adjusted for inflation, total real credit card debt was $381.29 billion. This is a level we haven’t reached since Q2 2009 ($385.94 billion).

The full article is available to clients of Zonda’s National Outlook report. You can learn more and subscribe here: https://zondahome.com/products/data-intelligence/national-outlook/