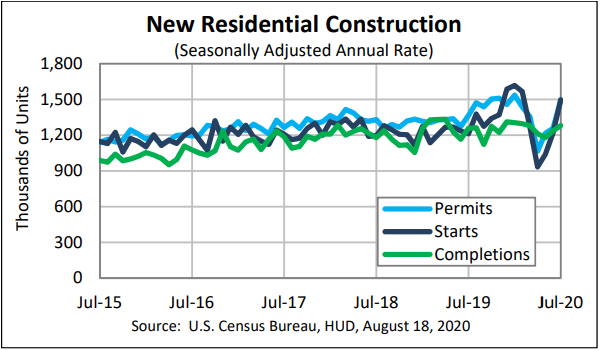

Privately owned housing starts in May were at a seasonally adjusted annual rate of 1,572,000, which is 3.6% above the revised April estimate of 1,517,000 and 50.3% above the May 2020 rate of 1,046,000, according to the latest new residential construction statistics from the U.S. Census Bureau and the Department of Housing and Urban Development.

Single‐family housing starts last month were at a rate of 1,098,000, or 4.2% above the revised April figure of 1,054,000. The May rate for units in buildings with five units or more was 465,000.

“Today’s new residential construction report from the Census Bureau showed housing starts rebounding modestly in May following April’s large 12.1% decline,” says Doug Duncan, chief economist at Fannie Mae. “Both single-family and multifamily starts contributed to the month’s headline gain.”

Housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,681,000, which is 3% below the revised April rate of 1,733,000 but 34.9% above the May 2020 rate of 1,246,000. Single‐family authorizations last month were at a rate of 1,130,000, or 1.6% below the revised April figure of 1,148,000. Authorizations of units in buildings with five units or more were at a rate of 494,000.

“The number of single-family homes authorized, but not started increased to 142,000 units,” says Odeta Kushi, deputy chief economist at First American. “While this is a modest increase compared with last month, this is 52.7% higher than a year ago. This is one indication of how building material cost increases and delays slow home building.”

May’s housing completions were at a seasonally adjusted annual rate of 1,368,000, which is 4.1% below the revised April estimate of 1,426,000 but 16.1% above the May 2020 rate of 1,178,000. Single‐family housing completions last month were at a rate of 978,000, or 2.6% below the revised April rate of 1,004,000. The May rate for units in buildings with five units or more was 387,000.

“With brisk house price appreciation and a continued lack of existing home sale listings, demand for new construction remains robust,” continues Duncan. “However, home builders continue to face supply constraints, namely shortages of building materials, labor, and buildable lots.”