In March, we published an article highlighting inflation trends in metropolitan areas across the United States. At that time, inflation on a 12-month basis was coming down off its June 2022 national peak of 9.1% but, at 5%, was still elevated.

Today, inflation at the national level has moderated further to 3.1%, per the Bureau of Labor Statistics. This is still above the Federal Reserve’s target for price stability of 2%, but it has come down substantially since last year.

The cooling of inflation is due to fiscal stimulus wearing off, consumers working through their excess savings, diminished global supply chain issues, and policy changes. The Federal Reserve’s rate hikes that started in March 2022, for example, have had an impact on credit availability and are dampening demand to an extent.

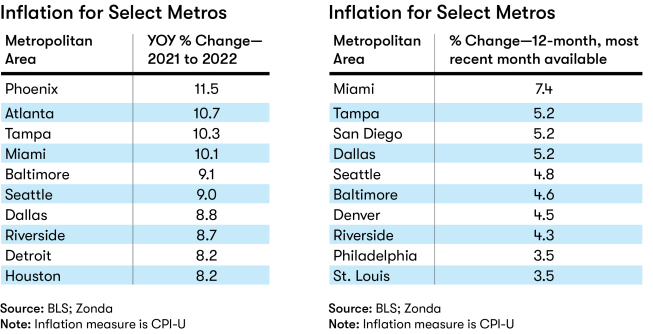

The inflation rate, however, varies widely by market. Below are the 10 metro areas with the highest inflation. The table on the left shows the ranking from 2021 to 2022, and the table on the right shows the most recent data.

Some takeaways:

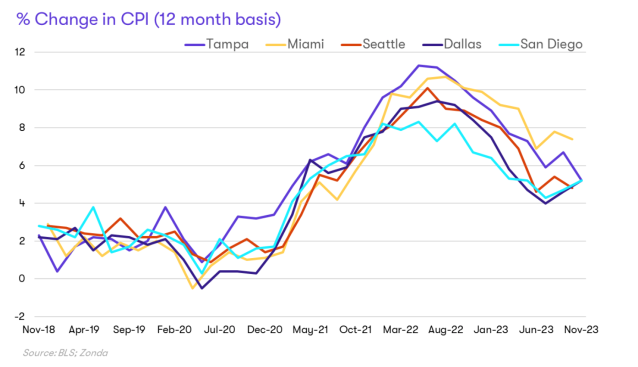

Coastal markets top the list. Popular coastal relocation and lifestyle markets top the list with Miami; Tampa, Florida; and San Diego exhibiting the most price growth year over year.

Miami, the No. 1 metro, is a sought-after location due to its weather, lifestyle, and labor market. In fact, Miami has a robust job market for higher earning occupations, and this trend has only increased since the pandemic. Migration plays a strong role in the local economy as well, driven by those moving in from outside the country. Miami has had more international migration in than out since 2000.

These strengths also bring challenges. Miami’s growth has led to more congestion and greater competition for resources. Related, Miami is seeing huge demand for housing, which is playing into the inflation equation. The demand for housing also increases the need for energy, such as air conditioning, due to Miami’s warm climate. Taken together, the demand pressures in Miami have contributed to higher costs of living.

Six markets were on the highest inflation list last year as well. Tampa; Miami; Seattle; Dallas; Baltimore; and Riverside, California, were all repeats from the highest inflation markets list last year. Phoenix, Atlanta, Detroit, and Houston dropped off the list, while San Diego, Denver, Philadelphia, and St. Louis joined it.

Huge improvement in Phoenix and Atlanta. The top two markets with the most inflation last year were Phoenix and Atlanta with 11.5% and 10.7%, respectively. The latest data shows both metros now have a 2.9% inflation rate, below the national average.

Inflation is notably down from the peak. If you look at the top five markets with the most inflation, you’ll find that levels have improved from the peak seen in early 2022. Each of the markets, though, are still a way off from returning to the figures seen pre-pandemic.

As global supply chains normalize and the Federal Reserve rate hikes continue to take hold, we should expect inflation to continue its moderation.