Atlanta’s housing market continues to actively slow down as mortgage rates hold near recent highs.

The decline in existing-home sales is accelerating with December’s tally off by more than one-third compared with a year ago. New-home sales are slowing at an even faster rate as cancellations remain elevated.

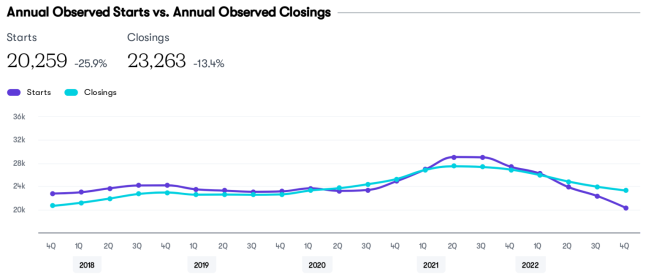

Builders have responded aggressively and starts activity has fallen below pre-pandemic levels and dipped below total closings. Despite the downturn, the metro area remains resilient and fundamentally sound.

The need for more housing has not changed, and Zonda expects Atlanta to weather the storm and recover quickly as mortgage rates improve.

Strengths

While builders are seeing a precipitous drop in demand and have cut back on new construction, they remain busy as they work through significant backlogs. Even though a recession is anticipated, the metro area is benefiting from steady population and job growth.

Weaknesses

Atlanta is the nation’s fourth-largest new-home market by permit volume. As the Fed increases interest rates, construction of new homes has tumbled. As a result, direct and indirect impacts are expected to be wide-ranging as layoffs in construction tick higher.

Source: Zonda

Supply

Quarterly housing starts decreased 37.1% from a year ago, while the number of available vacant developed lots sits at 42,995 down 1.4% from Q4 last year. In terms of supply/demand balance, the market area is 1.54% under supplied.

Sales

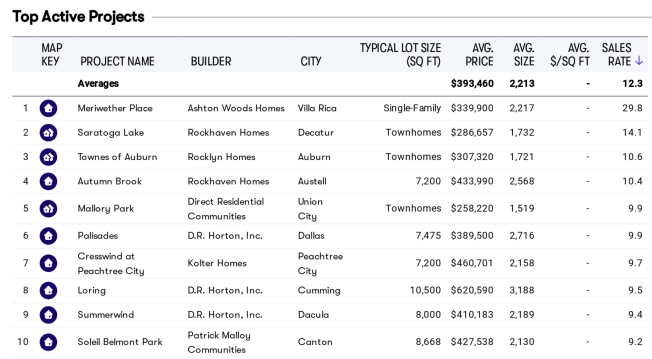

New-home sales in the Atlanta-Sandy Springs-Alpharetta metropolitan area decreased 38.2% year over year to an annualized rate of 13,101 units in February. Over the past 12 months, 3,882 of sales were attached units and 9,219 were detached. Existing-home closings for the 12-month period ending in January posted a year-over-year decline of 30.3% to an annualized rate of 116,249 unites. Of those, 15,435 were attached units and 90,486 detached.

Prices

The average list price for a new detached home in the region increased 8.7% from 2022 to $474,390 in February, while the average list price for a new attached home increased 3.7% over the same period to $451,442. Homes priced over $550,000 experienced the most closing activity over the past year. The new-home affordability ratio for a detached home reached 29.2% in January.

Source: Zonda

Economy

Total non-farm employment in the metropolitan statistical area increased 4.45 from the same period last year to 3,023,800 payrolls in December 2022. There were approximately 8,000 more jobs in December 202 compared to the previous month. The local unemployment rate remained flat at 2.9% in December compared to 2.9% in the previous month. December 2022’s jobless rate is lower than it was the same time a year earlier when it stood at 3.3%. Zonda forecasts the region’s unemployment rate will finish 2023 at 2.8%.

Community

The current population for the Atlanta-Sandy Springs-Alpharetto metropolitan area is approximately 6,298,930. Population in the area is projected to increase by 1.2% in 2023. There are roughly 2,347,150 households in the region, which is up 1.2% year over year. Incomes increased 7.8% from the previous year to $87,739.

Did you know you can access free housing data with Zonda’s Market Snapshots? Reports include new-home supply and valuation, resale listings, jobs, market forecasts, and more. Get your complimentary market snapshot for your local CBSA today.