The housing market is facing stiff headwinds as mortgage rates hold close to recent highs and demand for homes slumps. For now, prices are still higher than year-ago levels but as homes take longer to sell, the market will force greater concessions.

New-home construction activity took off at the start of 2021 and the gap between new-home starts and closings widened until the third quarter of 2022. But with new-home sales slumping and cancellations ticking higher, builders are increasingly cautious and inventory levels are starting to stabilize. As macroeconomic concerns weigh on builders, we expect 2023 production will continue to contract.

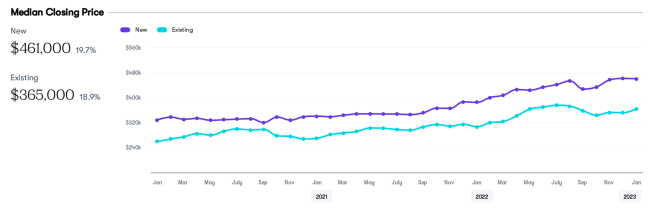

Prices

The average list price for a new detached home in the Dallas-Fort Worth-Arlington metropolitan statistical area increased 12.8% from 2022 to $517,133 in February while the average list price for a new attached home decreased 5.5% over the same period to $462,867. Homes priced over $550,000 experienced the most closing activity over the past year. The new-home affordability ratio for a detached home reached 28.7% in January.

Strengths

The local economy has been adding jobs at a rapid pace. Dallas bounced back from the pandemic in just over a year and job growth has been averaging more than 7% in recent months, while the unemployment rate hovers below 4%.

Weaknesses

As demand for new homes contracts, build-to-rent single-family homes have grown in market share and account for roughly 8% of new construction. Housing affordability continues to be an issue so rentals will help fill a significant gap in the housing supply.

Supply

In the fourth quarter of 2022, quarterly housing starts decreased 14.2% from a year ago, while the number of available vacant developed lots was up 18.2% compared with the same quarter a year prior. In terms of supply-demand balance, the market area is 1.81% undersupplied.

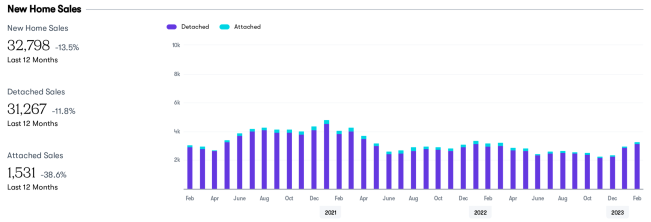

Sales

New-home sales in the Dallas-Fort Worth-Arlington MSA decreased 13.5% year over year to an annualized rate of 32,798 units in February. Over the past 12 months, 1,531 of sales were attached units and 31,267 were detached. Existing home closings for the 12-month period ending in January posted a year-over-year decline of 26.6% to an annualized rate of 119,177 units. Of those, 5,446 were attached units and 94,223 detached.

Economy

Total nonfarm employment in the Dallas-Fort Worth-Arlington area increased 5.9% from the same period last year to 4,201,800 payrolls in December 2022. There were approximately 8,500 more jobs in December 2022 compared with the previous month. The local unemployment rate decreased to 3.5% in December compared with 3.6% in the previous month.

Community

The current population for the Dallas-Fort Worth-Arlington MSA is approximately 8,041,730 people. Population in the area is projected to increase by 1.5% in 2023. There are approximately 2,982,97 households in the region, which is up 1.4% year over year.

Did you know you can access free housing data with Zonda’s Market Snapshots? Reports include new-home supply and valuation, resale listings, jobs, market forecasts, and more. Get your complimentary market snapshot for your local CBSA today.