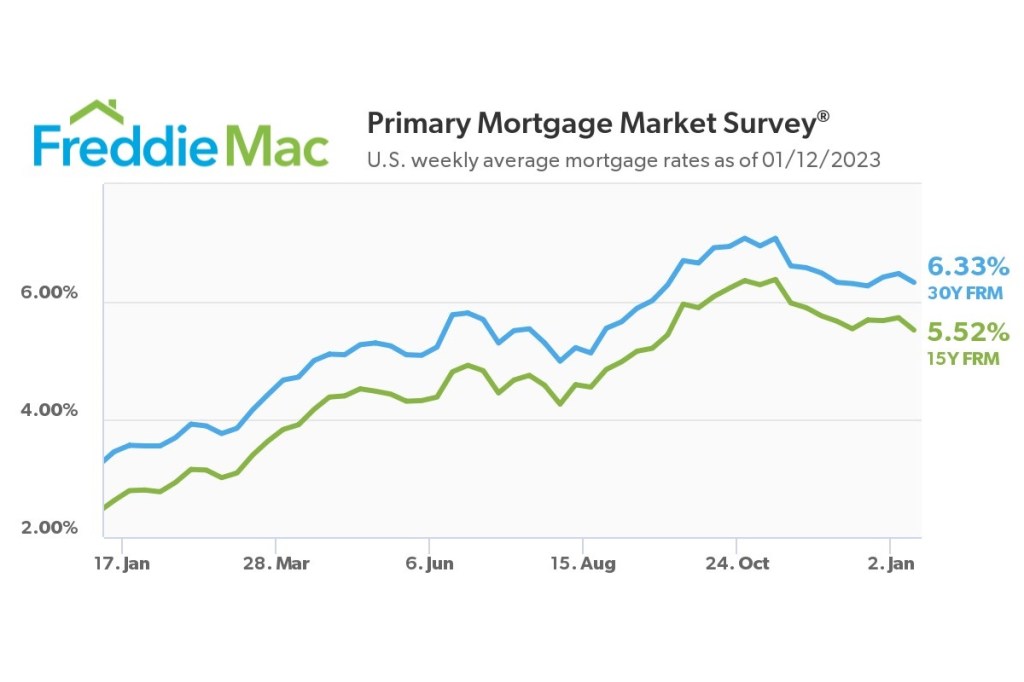

The results of Freddie Mac’s Primary Mortgage Market Survey shows the 30-year fixed-rate mortgage averaged 6.33% for the week of Jan. 12, down from the prior week when it averaged 6.48%. A year ago at this time, the rate averaged 3.45%.

“While mortgage rates have resumed their decline, the market remains hypersensitive to rate movements, with purchase demand experiencing large swings relative to small changes in rates,” says Sam Khater, Freddie Mac’s chief economist. “Over the last few weeks latent demand has been on display with buyers jumping in and out of the market as rates move.”

The 15-year fixed-rate mortgage averaged 5.52%, down from the prior week when it averaged 5.73%. A year ago at this time, the rate averaged 2.62%.

Mortgage applications for the week ending Jan. 6 increased 1.2% from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey. The seasonally adjusted Purchase Index decreased 1% from one week earlier, while the unadjusted Purchase Index increased 47% compared with the previous week and was 44% lower than the same week one year ago.

“Mortgage rates declined last week as markets reacted to data showing a weakening economy and slowing wage growth,” says Joel Kan, MBA’s vice president and deputy chief economist. “Purchase applications continued to be hampered by broader weakness in the housing market and declined slightly over the week, with the index slipping to its lowest level since 2014.”