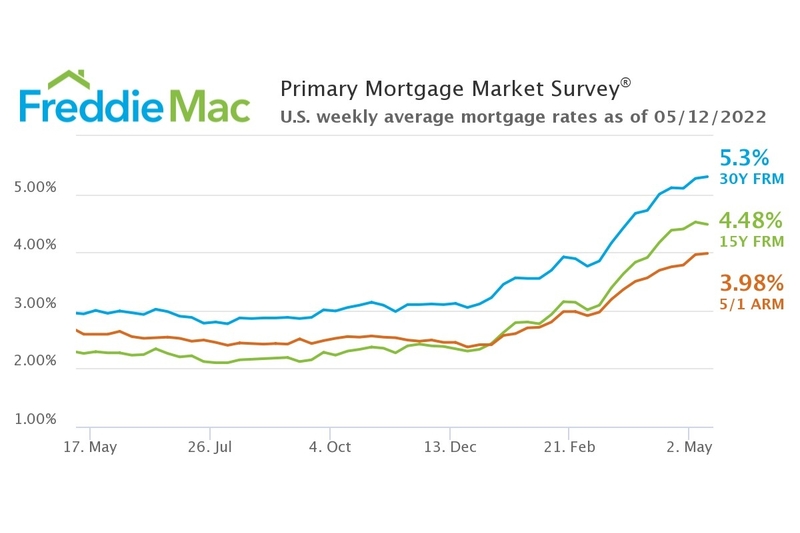

The 30-year fixed-rate mortgage (FRM) averaged 5.30% for the week of May 12, up from last week when it averaged 5.27%, according to Freddie Mac’s weekly Primary Mortgage Market Survey. A year ago at this time, the 30-year FRM averaged 2.94%, reported Freddie Mac.

“Home buyers continue to show resilience even though rising mortgage rates are causing monthly payments to increase by about one-third as compared to a year ago,” says Sam Khater, Freddie Mac’s chief economist. “Several factors are contributing to this dynamic, including the large wave of first-time home buyers looking to realize the dream of homeownership. In the months ahead, we expect monetary policy and inflation to discourage many consumers, weakening purchase demand and decelerating home price growth.”

According to Freddie Mac, the 15-year fixed-rate mortgage averaged 4.48% for the week of May 12, down from 4.52% the previous week. A year ago, the 15-year FRM averaged 2.26%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.98% for the week of May 12, up from 3.96% a week ago. A year ago, the 5-year ARM averaged 2.59%, according to Freddie Mac.

According to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey, mortgage applications increased 2% from one week earlier for the week ending May 6.

“The increase in mortgage applications last week was driven by a strong gain in application activity for conventional and government purchase loans, even as mortgage rates rose to their highest level since 2009,” says Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Despite a slow start to this year’s spring home buying season, prospective buyers are showing some resiliency to higher rates. Purchase activity has now increased for two straight weeks. More borrowers continue to utilize ARMs to combat higher rates. The share of ARMs increased 11% of overall loans and to 19% by dollar volume.”

Kan says the rise in mortgage rates continues to impact the refinance market, with activity 70% below a year ago. The refinance share of mortgage activity decreased 32.4% of total applications from 33.9% the previous week, according to the MBA. The ARM share of activity increased to 10.8% of total applications.