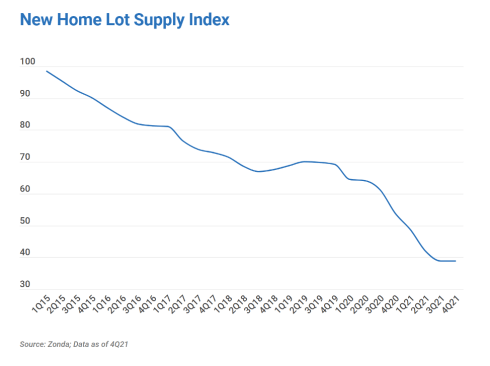

Zonda’s New Home Lot Supply Index (LSI) fell 27.8% on a year-over-year basis to a reading of 38.9 in the fourth quarter of 2021. The index was essentially flat from the third quarter, with supply increasing by 0.1%.

The index, a residential real estate indicator based on the number of single-family vacant developed lots and the rates those lots are absorbed, indicates lot supply has tightened year over year across the U.S. A reading of 100 for the LSI represents “perfect equilibrium,” while a reading of 75 or below equals “significantly undersupplied.”

“Constrained lot inventory remains part of the challenge when trying to get more homes built,” says Zonda chief economist Ali Wolf. “The New Home Lot Supply Index captures today’s shortage, but look for more lots throughout 2022. Total upcoming activity, a gauge of lots expected to become vacant developed over the next year, is up 26% compared to last year.”

Lot supply trended below the levels of 2020’s fourth quarter in nearly every top market. However, according to Zonda, lots going through development suggest vacant developed lots should increase over the next 12 months.

Los Angeles-Orange County; Miami; and Riverside-San Bernardino, California, lead the markets where land supply tightened the most in the fourth quarter on a year-over-year basis. In addition, Los Angeles-Orange County; Miami; and Nashville, Tennessee, have the tightest lot supply among major markets. Zonda reports that builders have had to look farther out in these markets to meet demand, with the areas that once were flush with affordable supply becoming extremely competitive for developed lots.

According to Zonda, the LSI increased quarter over quarter in 12 of its select 30 markets, with San Diego and Boise, Idaho, growing the most, both up 27%.

“The efforts to develop lots are being hamstrung by the same factors influencing home building: a lack of workers, the supply chain challenges, and government delays,” says Wolf. “Over time, the time and money invested in the residential real estate market will result in a lot more homes coming to the market. What the industry needs to track is where prices and interest rates will be by then and what it means for consumer demand.”