Ninety-nine percent of counties in the nation will start 2022 with higher Federal Housing Administration (FHA) loan limits than 2021. Home price appreciation moved to record highs in 2021 as the housing market continued to boom through the pandemic. Rising FHA loan limits are particularly important in a rising home price environment as they help some Americans secure a mortgage by offering buyers lower down payment and credit score options.

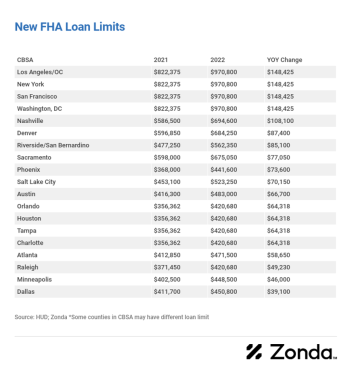

- The FHA sets a ceiling and floor each year for the loan limits based on median home prices. The new ceiling of $970,800 is 18% higher than the $822,375 from last year. Loans in metros like Los Angeles, New York, and San Francisco are subject to the revised ceiling. The new floor of $420,680 is seen in hot housing markets like Las Vegas; Raleigh, North Carolina; and Tampa, Florida. Over 87% of all counties received the minimum limit;

- Among major markets, the new loan limits increased the most in counties in Boise, Idaho, and Phoenix, up 24% and 20%, respectively. Other notable increases include select counties in Montana, Utah, and Tennessee. In some markets, though, the dramatic increase still lags the runup in prices seen over the last year; and

- After a muted increase of just 2.8% last year, Austin, Texas, one of the hottest housing markets in the country, rose 16% from $416,300 to $483,000. This change, however, is still less than the national 18% increase to the floor and ceiling limits.

“Home builders and existing homeowners have benefited tremendously from the hot housing market, but those looking to buy a home have found the process challenging,” says Tim Sullivan, senior managing principal at Zonda. “These higher FHA loan limits capture how the market has evolved and serve as a place to help folks with a slightly tarnished credit score or small down payment get on the homeownership ladder.”

The impact on the new-home market varies by metro, but most will see a net benefit.

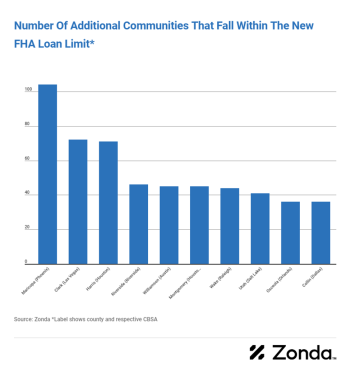

- New-home communities in Maricopa County in Phoenix are the biggest winners under the new 2022 criteria, with over 100 additionally active communities that list a minimum price under the updated $441,600 limit. Maricopa was the biggest winner in 2020 and 2021 as well;

- Looking on a CBSA level, Houston gained the most volume of new-home communities that now fall within the new limits, Harris and Montgomery counties alone added 116 more active projects listed under their new $420,680 limit; and

- Among major metros, Las Vegas gained the most on a percentage basis, increasing its under FHA count by 130%. Other major metros with large percent gains were Phoenix; Riverside/San Bernardino, California; Orlando, Florida; and Charlotte, North Carolina.

The change in the FHA floor and ceiling loan limits match the 18% increase in conforming loans announced by the Federal Housing Finance Agency (FHFA) earlier this week. The FHFA established the national conforming limit at $647,200, the FHA is required to set the floor at 65% of the conforming limit whereas the ceiling is set at 150% of the FHFA’s figure.