The Las Vegas Valley housing market continues to exhibit an amazing resilience through the start of 2021. Similar to cities around the country, Las Vegas has maintained a strong and growing housing market since the start of the pandemic. Unlike most other markets around the country, a large majority of the employment base in the Las Vegas Valley is heavily reliant on the hospitality industry, which has been slower in its recovery than other segments of the economy. Despite this, the Valley’s housing market has grown through the pandemic—and, in some cases, thrived—and additional positive news has emerged in recent weeks showing the Valley’s economy should continue to rebound.

The Las Vegas Convention and Visitors Authority (LVCVA) and Informa Markets put out a press release on March 18, announcing the World of Concrete in June, the first large convention since the pandemic hit. A number of other conventions were also announced. For perspective, over the past five years Las Vegas averaged roughly 6.3 million convention attendees per year, according to LVCVA. This comes on the back of Gov. Steve Sisolak announcing that casinos and restaurants can now open to 50% capacity, adding fuel to the hospitality recovery. Unemployment, which hit a high of 34% at the start of the pandemic, has declined to 9.9% in January, per the state of Nevada, and should continue to drop with this news. The positive signs for the Valley’s economy continue to gain momentum.

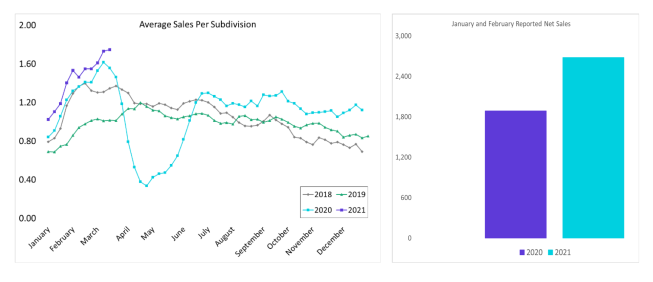

Residential real estate traversed the pandemic at a torrid pace with a continued influx of new residents into the Las Vegas Valley. Zonda’s database of supply and demand metrics shows Las Vegas’ four-week average sales per subdivision hit rock bottom in April 2020 before an immediate bounce over the following two months. Since then, the market has eclipsed the 2018 and 2019 sales rates for the draw of the year with a widening delta. As illustrated below, 2021 has thus far exceeded expectations by a healthy margin. The start of 2021 has seen net sales outpace 2020 by over 40% with the early March numbers trending toward strong new-home sales.

Courtesy Zonda

Despite the good news, worries remain within the industry. While rising land prices, higher material costs, increasing interest rates, and the resulting diminished affordability (and potential appraisal issues), rightfully so, have gotten most of the press about issues arising on the horizon, there are some other measures that bear watching for the Las Vegas area.

The Las Vegas Valley’s mining and construction sector has not come close to its peak of employment, reached in June 2006 (about 112,500 jobs), with only 62,500 similar jobs in January—a delta of 50,000 jobs. Unlike other major industry sectors in the Valley, which experienced a peak in employment numbers from 2018 to 2019, this sector has never recovered its employment from the Great Recession, nor even come close to peak employment. Its most recent peak from 2010 to 2020 was roughly 72,800 jobs (October 2019). Labor constraints have contributed to increased building timelines and tight housing supply.

Increased land prices are cutting into profit margins. Limited buildable, private residential land inside the Bureau of Land Management boundaries will keep housing supply constrained. According to Zonda’s latest quarterly data, there is less than 10 months of detached vacant developed lots in the Las Vegas Valley, inhibiting supply. Zonda’s Lot Supply Index, developed by chief economist Ali Wolf’s team, indicates Las Vegas has one of the lowest, and declining, index values among the markets tracked. The limited supply of land could cause more lot gaps to emerge, creating further potential issues. Builders have sought to counter with an increase in attached production, which has boosted lot deliveries per Zonda data by 89% in the past year and will provide strong potential housing options into the future. The limited supply for land will continue to weigh down Las Vegas Valley housing production.

Despite these hurdles, the Las Vegas Valley residential real estate market has shown amazing resilience and is poised to have a strong 2021. Check back in the coming months to see how the market progresses through the year.