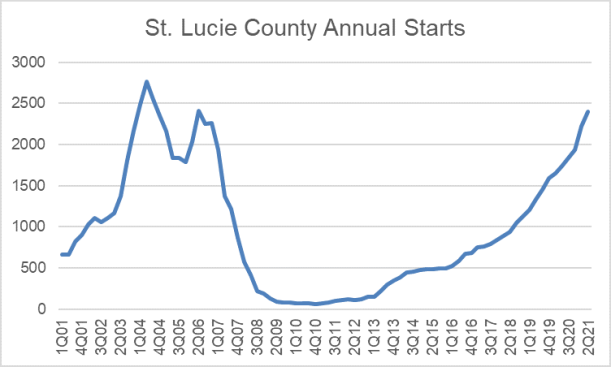

In 2010, St. Lucie County was one of several “ground zero” housing markets in Florida, crushed by over speculation and falling prices that occurred during the worst of the Great Recession. The heady days of 2004 were long gone, with the annual starts pace falling from 2,763 that year to just 62 annual starts by the fourth quarter of 2010. Talk about a housing meltdown.

After a long crawl back, the market has accelerated over the past four years, and the current annual starts pace is back to 2,404 units—not quite matching the previous peak, but getting pretty close.

Courtesy Zonda

So, what’s fueling the surge in housing activity? This time, instead of reckless speculation, the current activity level relies on much more sustainable fundamentals.

Neustar’s demographic forecast for the next five years is robust, with household growth estimated at 18% and population growth at 19%. This computes to almost 25,000 new households and an increase in population of 68,000, which bodes well for the housing market. The current population stands at just over 350,000, and 26% of those are age 65 or older. In fact, the active adult buyer is the largest consumer group at 33% of all households, followed by renters (18%), entry-level (18%), and family life (12%).

St. Lucie’s job market has recovered well from the COVID-related job losses of 2020. Employment peaked at 159,200 in November 2019, fell to 138,000 in April 2020, but has since rebounded to 157,000 in July 2021. This represents an employment level that is 99% of the previous peak. Some of the notable employment categories include employment and health, professional services, trade, transportation and utilities, leisure and hospitality, and construction. Note that the employment data for the St. Lucie MSA includes Martin County.

The Great Migration of 2020 certainly helped boost St. Lucie’s recent growth spurt, but it’s interesting to note that migration comes from two directions—the Northeast and South Florida, primarily Palm Beach and Broward counties. Our northern migrants come to South Florida for many of the same reasons as before—warmer weather, lower cost of living, and retirement. Folks from further south than St. Lucie County move up to escape the higher housing costs and congestion of that area.

There are three distinct submarkets in St. Lucie County. The original scattered lot community of Port St. Lucie, which began development in the 1960s, now has a population of 205,000. Over the past 12 months, approximately 1,400 new-home closings were recorded in the city. Most were single-family detached homes, and this submarket enjoys some of the best affordability in the county, although it lacks the infrastructure and amenities found in typical master-planned communities.

West St. Lucie, located generally to the west of the Florida Turnpike, is the most active submarket in the county. Over the past 12 months, 2,404 starts and 2,114 closings were observed. These are primarily master-planned communities located in and around Tradition and PGA Village. This submarket also boasts the most future lots, at 56,278, and is one reason why builders have left the land-constrained counties to the south to set up shop here.

East St. Lucie, located generally to the east of the Florida Turnpike and including the city of Fort Pierce, has seen some recent growth. Annual starts have grown from 220 in 2017 to 640 today. Land is a bit less expensive here, and the location near Hutchison Island and the beaches is a plus.

Twenty or so years ago, most of the new housing was located in the Port St. Lucie submarket. It offered little more than commodity housing priced below $250,000, with many resales priced at or below $150,000. The mega master-planned community of Tradition changed all that in the early 2000s, and although it suffered badly during the Great Recession, the area has rebounded strongly to become the center of new housing activity today. Now, prices range from the $200s to over $700,000, an upper price point that would have been unheard of as recently as 10 years ago. The new communities serve all types of consumer profiles, from families to active adult. These new communities also bring a plethora of amenities that simply didn’t exist two decades ago.

Most of the product is single-family detached, but townhomes are now a small part of the mix. The condominium market has not returned in St. Lucie County, in fact, it’s been about 15 years since one has been built.

All of this synergy has gotten the attention of new-home buyers, who have energized the St. Lucie County market so that it is now larger than the new-home market in Broward County, which has almost six times the population. Of course, Broward County is severely land constrained, which underpins the migration pattern from Broward to St. Lucie as home buyers look for both variety and affordability.

GL Homes, a Florida-only builder, has been a student of the St. Lucie market for several years. In 2018, GL Homes opened its 55-plus Riverland master-planned community, just outside of Tradition. Up to 12,000 homes are expected to be built by GL here. Ryan Courson, division president of GL Homes at Riverland, sees St. Lucie County as the future for South Florida home builders.

“We’ve taken the success in Palm Beach County of our Valencia branded 55-plus neighborhoods and brought the concept to Riverland at St. Lucie,” Courson says. “We have the same elements here as our Palm Beach Valencia communities, with abundant amenities and product offerings, at half the price. And that’s a compelling value proposition.”